Why this year's tech wreck has changed the game and two stocks for the new world order

The mantra of many in the tech industry is “move fast and break things” – the motto famously coined by Facebook (now Meta) founder Mark Zuckerberg. Recent history has shown us that the US tech sector is still living up to that mantra - but perhaps not in the manner originally intended.

As per a recent article in the Harvard Business Review, the mantra intends to “inform internal design and management processes, but it aptly captures how entrepreneurs regard disruption: more is always better.” In other words, let’s move fast, disrupt things along the way, and not worry if we make a few mistakes (or upset a few regulators).

But with the recent collapse in share prices of some of the world’s biggest tech companies and the mass firings that have ensued, the words are is taking on a darker meaning. ‘Moving fast’ is manifesting as huge numbers of employees being shown the door, and ‘breaking things’ is capital destruction and shareholder and employee pain.

For those who aren't up to speed with the rap sheet of US tech companies, here is the list of clangers since the start of the year.

- Meta (NASDAQ: META) fell 24.5% on the day it released results in late October

- Snap (NASDAQ: SNAP) fell 25% on the day it released its results

- Amazon (NASDAQ: AMZN) fell 13% on weak fourth-quarter guidance

- Alphabet (NASDAQ: GOOGL) was down 9.1% on the day it released its latest results

- Microsoft (NASDAQ: MSFT) was down 7.7% on the release of its results

- In late August, Snap announced plans to lay off some 20% of its more than 6,400 global employees

- Meta announced significant layoffs in September, firing as much as 10% of its workforce. The company has since laid off 11,000 workers, or 13%

- Elon Musk decided to cut almost 50% of the personnel from Twitter

- Amazon has cut 10,000 workers, although that is less than 1% of the company’s 1.5 million workers worldwide

- Lyft (NASDAQ: LYFT) cut 13% of its workforce, some 700 people

- Stripe cut 14% of its workforce, some 1100 people

- Robinhood (NASDAQ: HOOD) has cut 23% of its employees so far this year

With so much negativity in the space, it’s fair to say that the once high-flying tech sector has collectively nosedived. But what happens next? Can these tech names return to their former glory, or are their prior nosebleed valuations and share prices consigned to the ‘free-money’ era in which they flourished?

For what it is worth, I reached out to Sam Ruiz from T.Rowe Price for his thoughts on the recent rout and where tech is headed next.

.png)

The washout we had to have?

Given the carnage we’ve seen in tech this year, the question begs whether this washout was inevitable and necessary. Ruiz notes that, in hindsight, monetary and fiscal policy went too far.

“As interest rates fell towards zero, we effectively lost price discovery and valuation discipline went out the window. What we’re seeing now in Tech (and the rest of the market) is a stronger focus on real cash flow, not a dream of how huge a company could be in time,” says Ruiz.

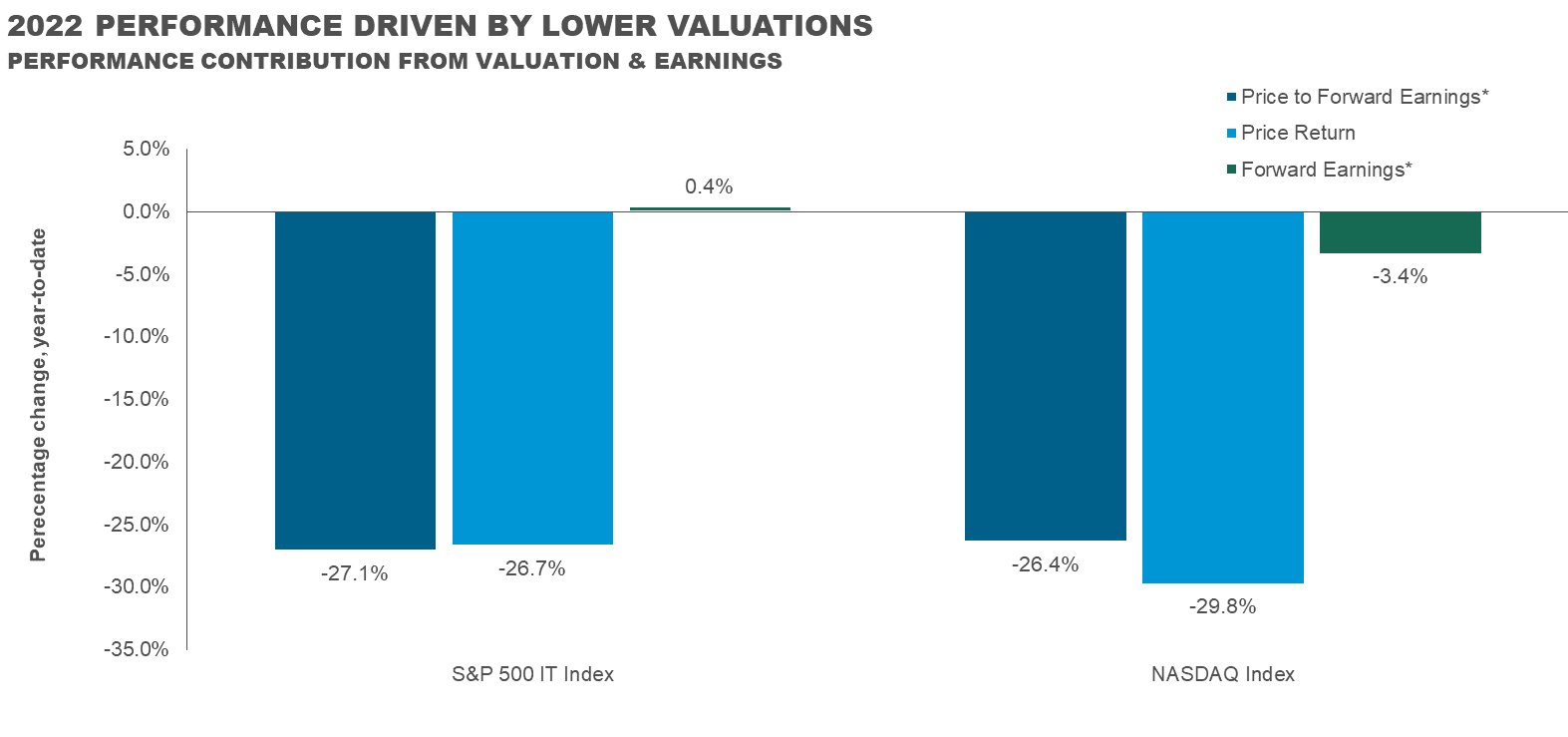

Covid was another factor that saw US tech valuations depart from reality, notes Ruiz, who points out that “At one point in early 2020, we saw 10 years of eCommerce penetration growth in just 10 weeks, but what we’ve painfully learned is that most of this “extra demand” was temporary and we’re seeing most of this “COVID demand” normalise back towards pre-COVID levels.” Ruiz adds that “it’s not a surprise, therefore, to see valuations revert lower and the sell-off has, in fact, been entirely driven by valuation, not earnings (Fig 1).”

Source: T. Rowe Price, FactSet. As of 31 Dec 21 - 31 Oct 22. Past performance is not a reliable indicator of future performance. *Uses next 12 months data for earnings.

In calling the death knell for thematic investing (for now at least), Ruiz explains that now the focus is on “which companies make money, have a real competitive advantage, are allocating capital sensibly (not chasing pipedream growth at the cost of shareholders) and can sustain margins through an economic deceleration.”

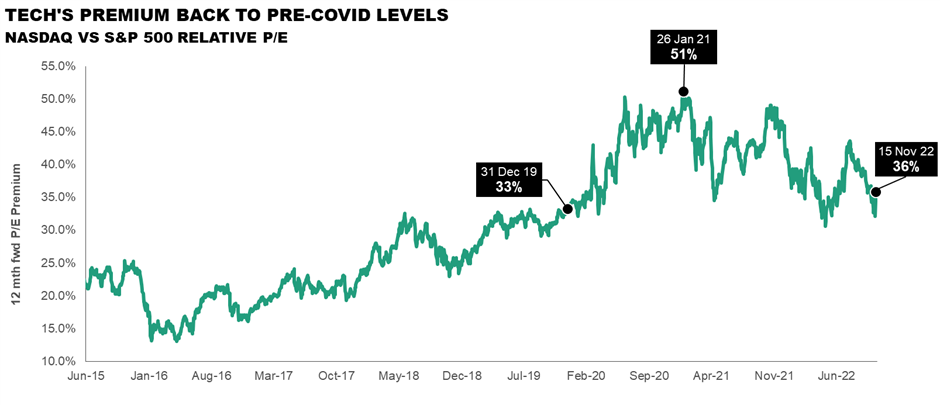

In that vein, Ruiz adds that it is subsequently no surprise that we have seen multiples for US tech stocks compress aggressively – “for context, the P/E premium of the NASDAQ vs S&P 500 expanded from 33% to 50% between 31 Dec 19 – 31 Dec 21 and we’ve now retraced that almost entirely (Fig 2)”.

While painful to watch, Ruiz comments that these share price declines are bringing the market back to more sensible levels and improving forward-looking prospective returns.

“We’re also witnessing the beginning of the reaction the economy needed to have; the increase in Tech layoffs (discussed in the intro) is potentially an early sign of inflation’s cure: injecting newly unemployed workers into an economy suffering from an undersupply of labour. Seeing unemployment move higher, while uncomfortable, is necessary for the Fed to pivot from their hawkish stance,” says Ruiz.

What happens next?

Given the overarching macro conditions, which are punctuated by high inflation, higher interest rates, and slowing economic growth, I put it to Ruiz that things could potentially get worse before they get better for tech.

In response, Ruiz notes that predicting short-term moves in tech, one of the traditionally fastest-growing sectors, will remain challenging as the market remains fixated on inflation and central bank policy. He goes on to comment:

“Unless we see inflation brake (this month’s US print was more a “crack”) and central banks revert to the liquidity playbook, this is a market where investors, in our view, should be searching for well-capitalised businesses situated in strong end markets with resilient fundamentals.”

Even more profoundly – and in direct answer to one of the key questions in the introduction about whether US tech stocks can return to their former glory – Ruiz had the following to say:

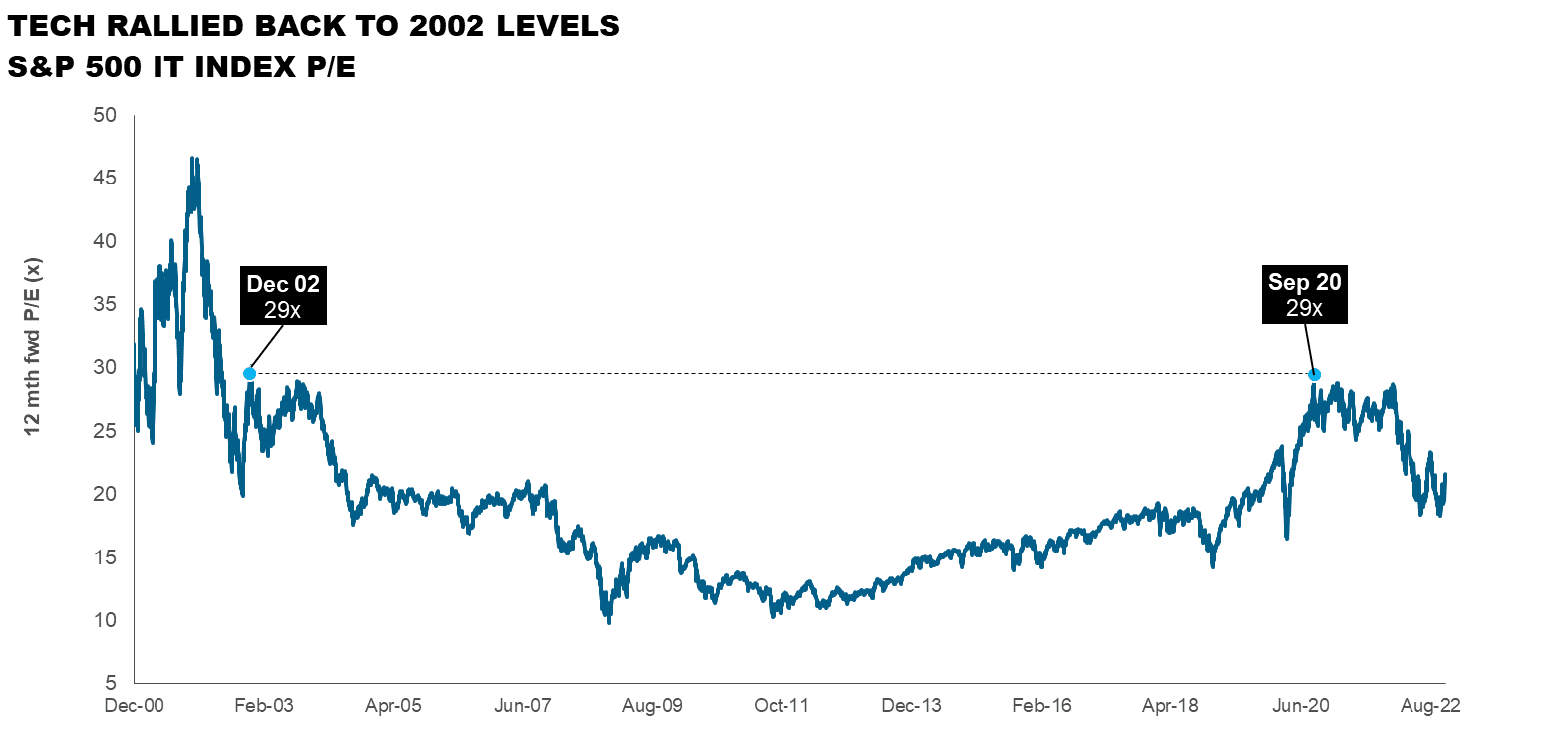

“As central banks drain the enormous COVID era liquidity from the system, it’s unlikely we see a sustained valuation re-rating back to 2021 levels. Underscoring how unique this period was, the S&P 500 IT index’s forward P/E traded to 29x at its COVID peak, a level it hadn’t come close to since the tech wreck aftermath in 2003 (Fig 3).

What is the opportunity for investors?

On this, Ruiz is very clear, saying that investors should ask themselves which businesses can maintain outsized profitable growth and how much we should pay for these businesses as the economy moves in the wrong direction.

Ruiz notes that historically, investors have fared well by blindly buying the collective mix of tech giants, whose collective size dominated various indices.

As of 31 Dec 21, the MSCI USA Index’s seven largest companies were tech equivalents, collectively representing 25.5% of that index.

Those days are over, however, and from this point, their performance is likely to diverge. "In our view, it is important to assess these companies individually on:

- Valuation;

- How effectively they are investing in growth initiatives;

- The levers they could pull to create value;

- The extent to which they are returning capital to investors; and

- The sensitivity to an economic slowdown and ability/willingness to protect margins via cost-cutting”.

Noting a host of problems at major players like Alphabet, Meta and Amazon, Ruiz suggests that “the opportunity in the near-term, therefore, may be further down the market cap spectrum and require investors to look more broadly than just the US’s largest tech companies, or the US at all.”

He highlights that with a fast-changing opportunity set, T.Rowe Price is looking globally and are interested in companies where they can find a true moat surrounding their business and evidence of likely resilience in a weakening macro environment.

Ruiz highlights Dutch company ASML (NASDAQ: ASML) as one such example, noting that it is the world’s sole supplier of equipment required to manufacture leading-edge semiconductors.

“Despite the recent rally, the company remains reasonably valued with a two-year view and maintains a solid backlog of customer demand,” says Ruiz.

Ruiz further adds that T.Rowe Price is interested in companies with proven growth but where the market has overreacted and led to a mispricing of the future opportunity.

He highlights Nu Holdings (NYSE: NU) in Brazil – which the team views as one of the world’s leading Fintechs - as one such stock, believing this year’s selloff provides investors with an attractive entry point to a LATAM banking market disruptor.

“The company has grown its customer base to more than 70 million since launching in 2013 and has the ability to grow revenues more than 50% p.a. in the foreseeable future, fast-tracking their profitability ramp and experiencing greater than expected operating leverage,” says Ruiz.

The final word

Wrapping things up succinctly, Ruiz comments that “investors need to be cautious and selective in the near-term, but also acknowledge there is a season for everything.

"Long term, we believe some of the powerful trends that have driven outsized growth remain intact and should continue to present solid medium to long-term opportunities.”

Ruiz adds that e-commerce, cloud computing, electric vehicles, machine learning, and quantum computing, are some of the powerful trends that T. Rowe Price expect to continue over the next decade and should not be dismissed.

Ultimately, and as always, “investors should carefully consider their investment horizon, increase their focus on valuation and be mindful of the likely volatility as we navigate choppier economic waters over the months ahead. There will still be opportunities, but the “free kicks” from cheap money are gone (for now).”

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

5 topics

9 stocks mentioned