Why value investing will roar back in the 2020s

Value has traditionally outperformed Growth

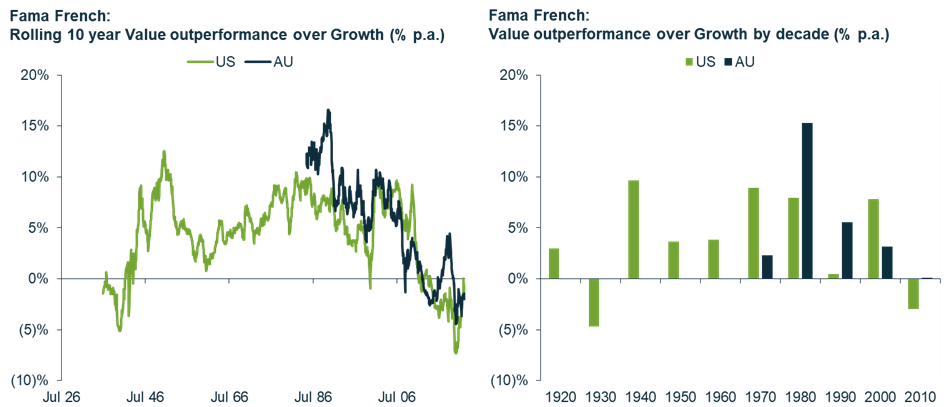

Back in the 1990s, Eugene Fama and Kenneth French’s research highlighted the higher expected returns available over time for stocks with low market value relative to their book value of equity, small market capitalisation and higher beta(1). While Value-style investing had been around for many more decades (think Graham, Buffet), Fama and French were the first to systematically test Value and Growth returns across a large set of stocks(2).

Their results demonstrated that Value investing can be expected to produce superior long run returns relative to the Growth style.

Updated data through October 2022 demonstrates that Value-style stocks have outperformed Growth stocks in eight out of the last 10 decades, and in 82% of rolling 10-year average periods.

This observation of superior Value returns has now also been demonstrated in other markets including Australia(3).

Value’s poor last decade was an outlier

However, as we all know, the decade since the global financial crisis (GFC) has proven to be one of the most difficult ever periods for Value investing, recording the worst rolling 10-year results which extended into the start of the 2020s during COVID.

It is hard to determine all the reasons as to why the 2010s were such a tough decade for Value investing, but it is easy to point one - the extraordinary monetary policies employed over the decade that drove US Bond yields to 100+ year lows. Value stocks have historically shown a strong outperformance correlation with upward movements in bond yields, and yields are finally on their way back up.

The current inflationary conditions now point to a return to the “old normal” for bond yields, and a tailwind for the Value style.

Value stocks are now as cheap as ever

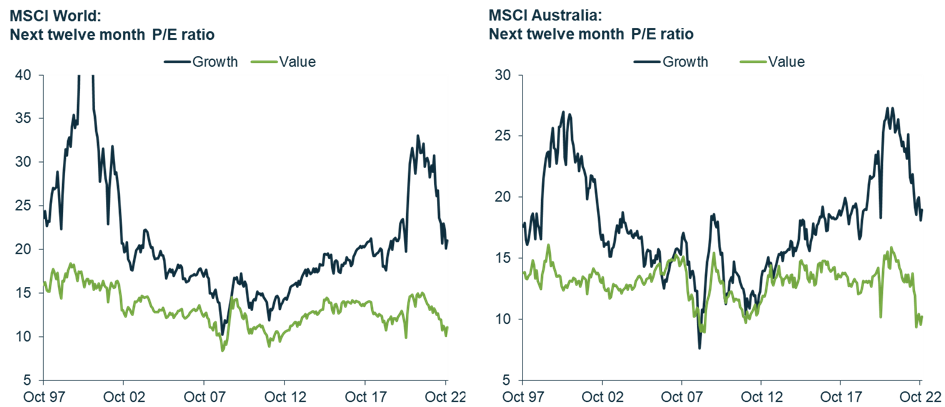

The impacts of the market’s penchant for Growth over the last decade have been stark on stock valuations.

Growth stocks are far more expensive and Value stocks are far cheaper today than they have been over most modern periods.

The chart below shows this based on forward Price to Earnings (P/E) ratios(4) but a similar observation can be made looking at market to book, dividend yield and our own proprietary Martin Currie Australia valuations.

As these extremes will inevitably unwind, the Valuation starting point for excess returns to Value investing is strong for the next decade.

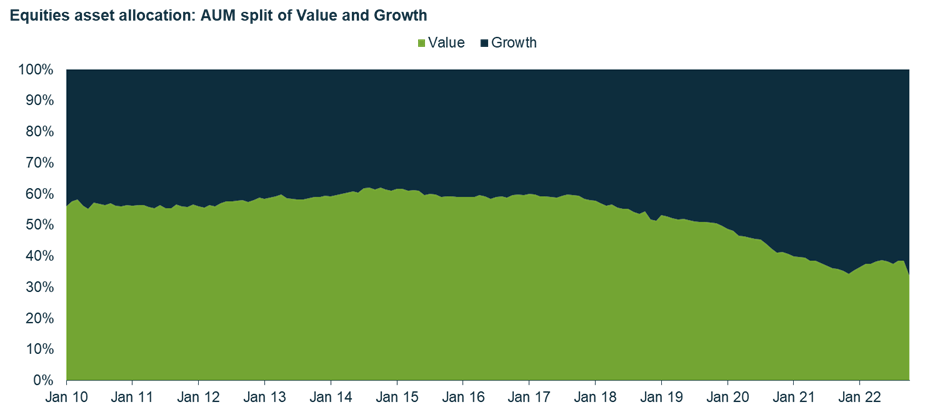

Investors are at risk of being left behind as value reawakens

The other effect of Growth’s outperformance has been on investor positioning. Whilst the asset allocation to typical Growth managers was similar to Value through 2017, the poor performance of Value in the 2010s has resulted in investors culling their weights to Value managers(5). In recent times there have been questions of value investing death and distancing from style tags as an explanation of performance.

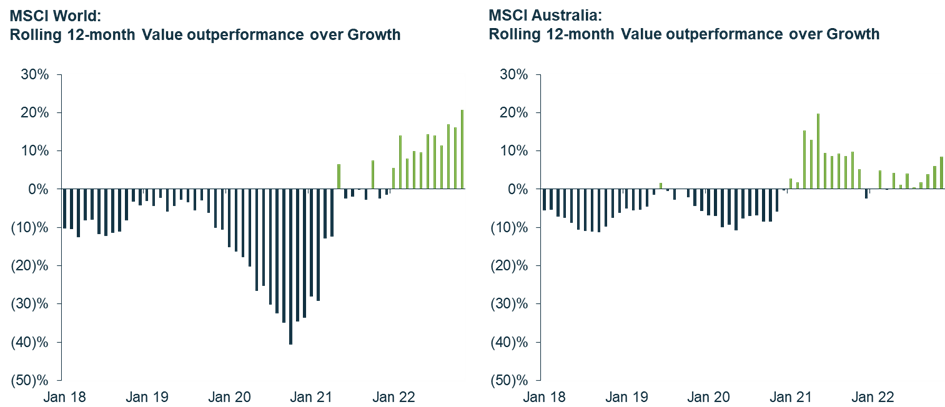

But Value is far from dead. We are now seeing renewed Value-style performance globally and in Australia, be that from cyclicality or a return to the long-term outperformance patterns shown by Fama French’s research(6).

Recent strong returns for value will pressure those investors who had moved to underweight Value strategies to reassess their asset allocations, redirecting flows back toward Value managers.

Value is set to prosper in the new roaring ‘20s

In summary, the current conditions are strong for Value-style strategies to produce superior long-term returns this decade:

- Value stocks have typically outperformed growth stocks by 5% p.a. over the last 90 years;

- The exceptional monetary conditions and zero rate policies have concluded, and we are now seeing the return of inflation and central bank tightening;

- Growth stocks are expensive and Value stocks are cheap relative to history;

- Investors are under-allocated to Value strategies as they have responded to the unusual returns of the 2010s.

Positioned for the Value Opportunity

Martin Currie Australia’s Select Opportunities Fund provides investors with a diversified exposure to our highest conviction stock ideas with Valuation potential, while aiming to control risks through our focus on Quality & Direction analysis.

Our stock selection, driven by our proprietary fundamental analysis process, is positioned to benefit from the continuation of the market’s rotation from Growth to Value.

2 topics

1 fund mentioned