Why you should be wary if bond rates rise

Falling bond rates have helped propel the prices of long-duration assets – like shares, housing and gold – as well as speculative "assets" like cryptocurrency. But, if rates start to rise in a meaningful way, the price of these assets could tumble. Now could be a good time to re-assess your portfolio.

“If you invest in stocks, you should keep an eye on the bond market. If you invest in real estate, you should keep an eye on the bond market. If you invest in bonds or bond ETFs, you definitely should keep an eye on the bond market.” Investopedia

If you have been reading our posts and articles attentively, you will have picked up a discussion about the influence bond interest rates have on the price of long-duration assets. It’s a fundamental observation that might prove more useful to investors than predicting when rising bond rates could begin having a deleterious effect on equities.

In essence, we pointed out the greatest beneficiaries of declining bond interest rates were businesses with earnings way out on the horizon – those companies that are profitless today but are forecast to earn a lot in the future. These companies see the greatest positive impact on their theoretical values from declining bond rates.

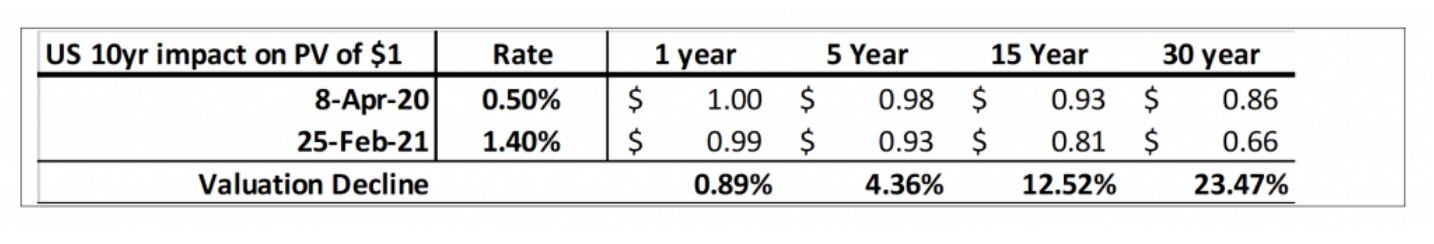

Table 1. Impact of rise in US bond rates on Present value (PV) of future earnings

Of course, the reverse is also true. When rates start to rise, intrinsic values start to fall. As Table 1., demonstrates the rise in bond rates from 0.5% to 1.4%, if applied as a discount rate, results in a decline of 23.5% of the present value of a dollar earned in 30 years.

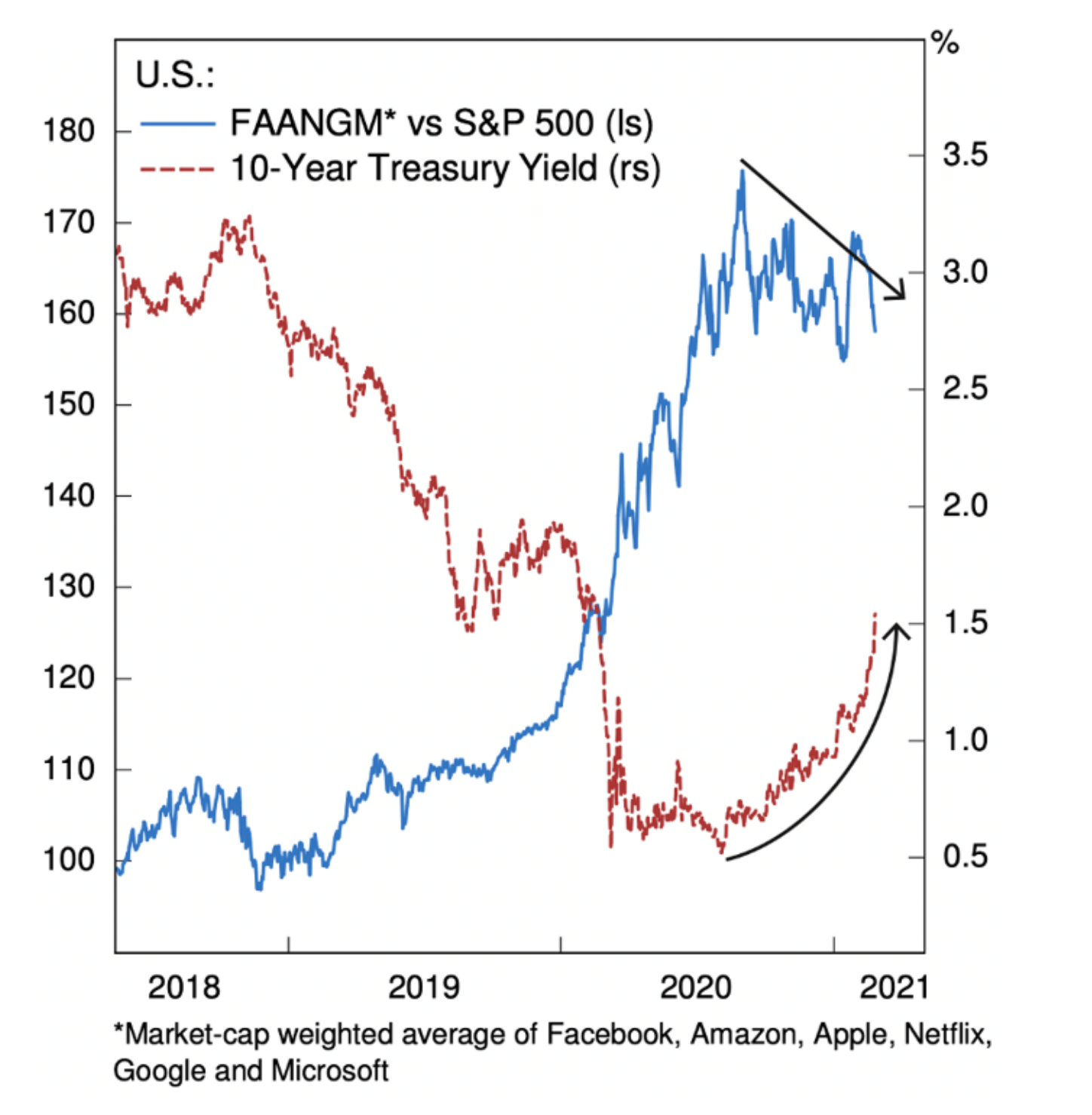

Since 25 February, when Table 1. was constructed, US 10-year Treasury bond yields briefly traded above 1.6%. This is more than triple the 0.51% that Treasury bonds traded at a year ago. Consequently, stocks were under pressure and those hit hardest were the same stocks that benefited most when rates were declining (Figure 1.).

Figure 1. The real world: Rising Bond Yields impact long-duration growth stocks

Source: Alpine Macro

The rise in bond yields to date primarily reflects a shift in inflationary expectations as well as a rise in real bond yields.

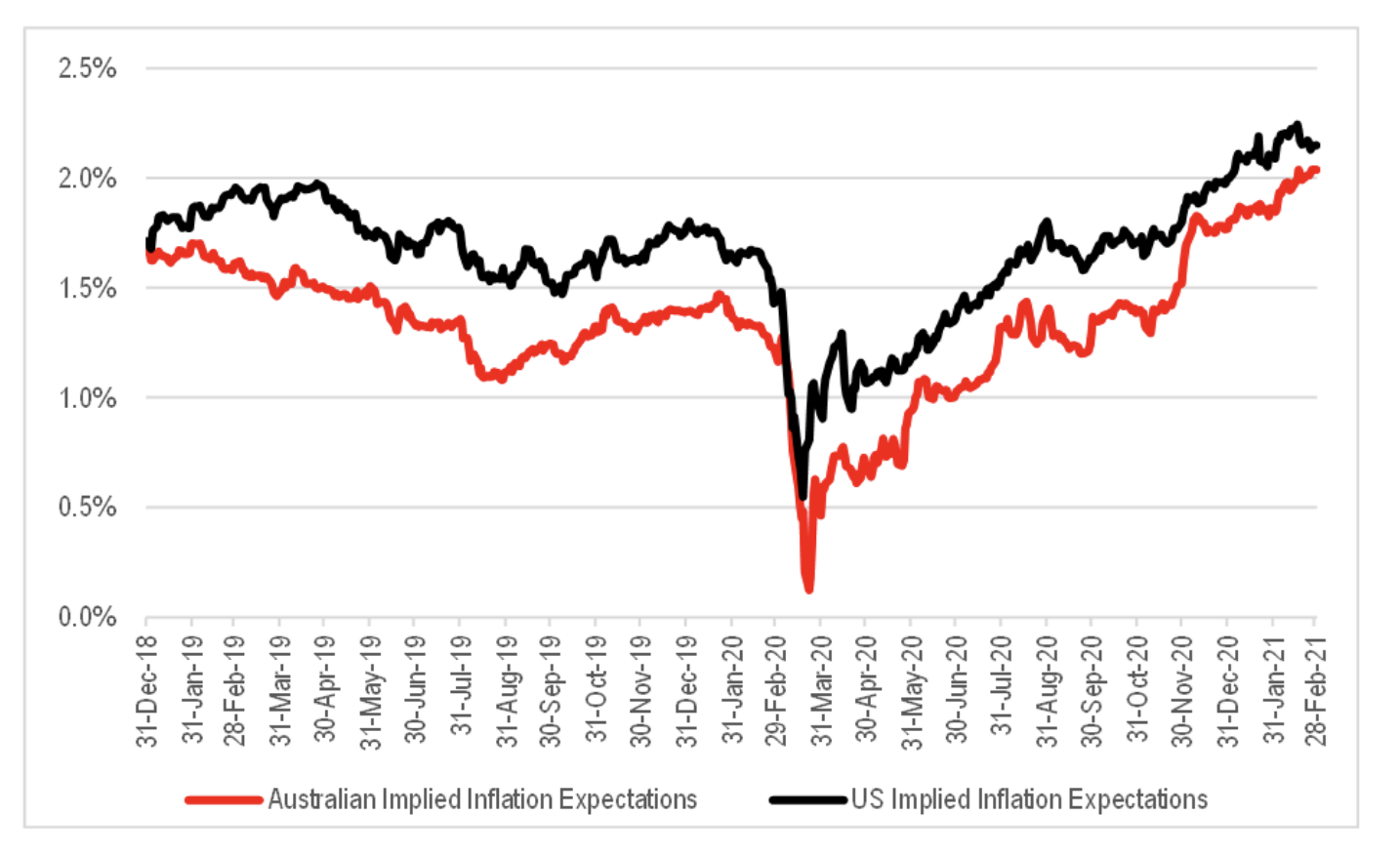

Figure 2 plots the difference between inflation-linked bond yields and nominal bond yields for both Australia and the US markets, providing an indication of the market’s implied inflation expectations over the subsequent 10 years. As Figure 2 illustrates, inflation expectations today, now exceed the expectations prior to the pandemic in both Australia and the US.

Figure 2: Implied Australian & US Inflation Expectations: 10-year bond yields – inflation-indexed bond yields

Source: Bloomberg

While increasing inflation expectations appear to be driving the overall increase in bond yields, a rise in real yields is also occurring.

Factors driving bond rates higher

There’s a potential positive to this combination of factors driving bond rates higher. Rising real yields are common coming out of a recession. This is because inflation is still low and rising bond rates reflect confidence in the economic recovery. Consequently, the gap between the bond rate and inflation (real yields) widens. Inflation typically lags economic growth and so the early phase of rising bond yields, coming out of a recession, means the economy is growing, which is usually positive for revenues and an optimistic signpost for markets.

Concerns over inflation however are also a component of the latest spike in bond yields with investors beginning to worry US President Biden’s US$1.9 trillion fiscal package will spur runaway inflation. Should inflation rise, the impact on long-duration stocks – companies not earning anything now, and the impact on companies unable to pass on the price increases, will be negative.

It’s a complicated picture. On the one hand, rising real yields is positive, on the other, expectations of inflation are negative. As vaccines roll out globally, economies will return to normal so shifting expectations towards reflation makes perfect sense. Whether it is associated with inflation however is a bet that markets are making. But markets don’t always get it right. For example, the yield curve, which is an aggregate market forecast of where interest rates will be in the future, gets its predictions about 100% wrong. In other words, just because markets anticipate inflation, doesn’t mean inflation will emerge.

Optimism about accelerating economic growth

History provides a reasonable guide as to what to expect for equities after a recession and amid rising bond yields. Typically, the early stage of rising bond yields reflects optimism about accelerating economic growth and improving business conditions. This is positive for equity markets generally. During the initial period of recovery both bond yields and equity markets can rise in tandem.

As the recovery from a recession matures, continued increases in bond rates prove counter-productive, kerbing economic growth. The yield curve begins to flatten spelling trouble for equities, and presumably long-duration growth assets and cyclical assets such as commodity-related assets and commodities themselves.

Investors really need to know when the rising bond rates move from being encouraging to being depressing. Unfortunately, History offers no set period of time at which the impact of rising bonds switches from being supportive to being deconstructive. A more useful guide may be to watch the slope of the yield curve. A flattening yield curve has been a useful warnings signal.

But today, waiting for a flattening of the curve could be problematic because central banks promising to keep short rates at zero means a flattening of the yield curve looks unlikely.

One interesting concept proposed by the team at Alpine Macro looks back at history by examining the pace of bond rate rises.

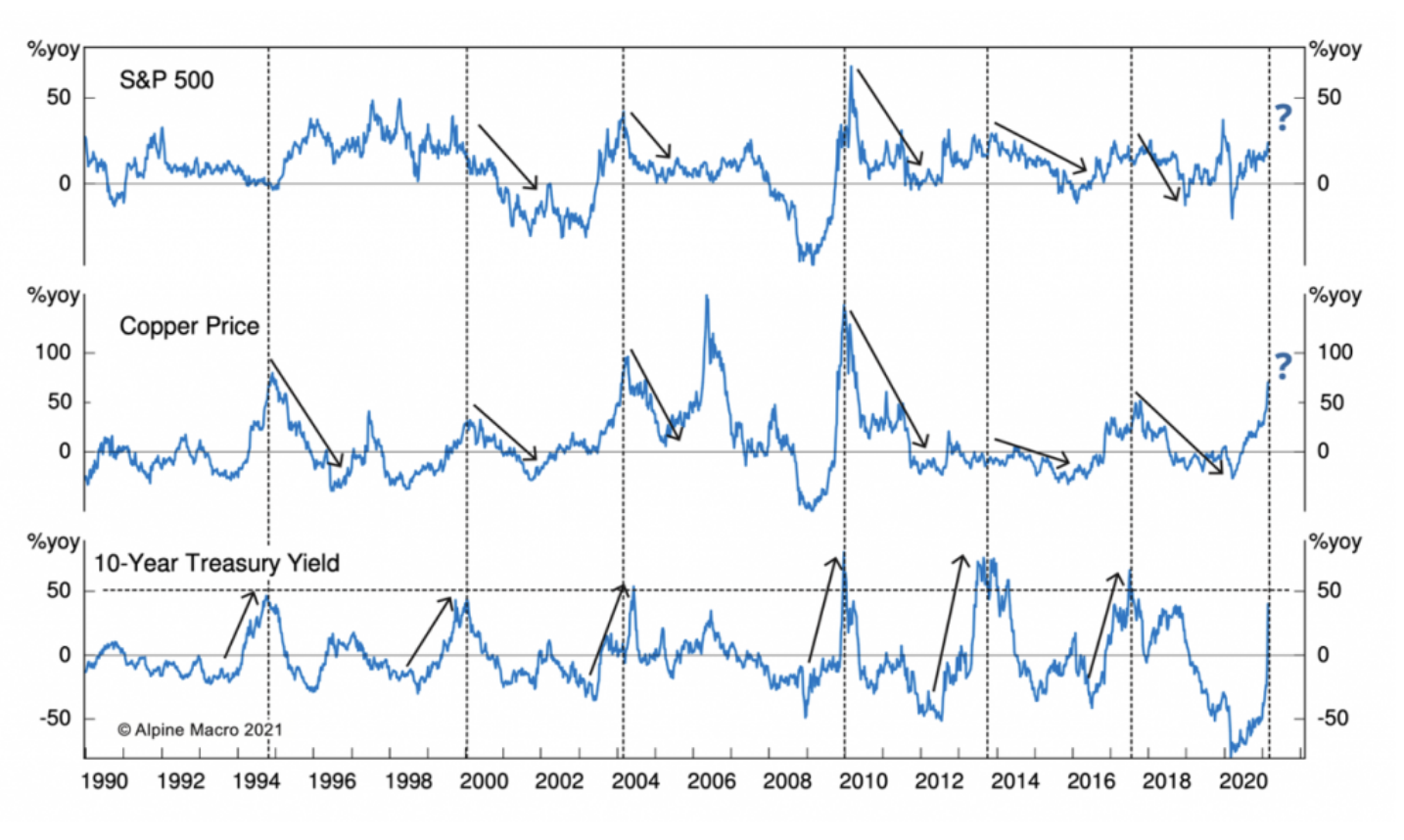

Figure 3. Bond Yields, Stock Prices And Copper Prices

Source: Alpine Macro

As Figure 3 reveals, whenever 10-year Treasury yields rose by 50% or more within one year, this was often, but not always, succeeded by deteriorating equity market performance. Using this historical observation as a guide, the recent near tripling of bond yields might trigger an equity correction.

The relationship however cannot be counted as reliable as there aren’t enough observations and there are periods where a spike in bond yields, such as into 1994, was not followed by poor stock market performance.

Alpine Macro goes a step further, plotting the copper price against bond yields. A more than 50% jump in bond yields tends to push down copper prices. Copper prices are an oft-used gauge of economic growth. And historically, falling copper prices amid rising bond yields may suggest the higher borrowing costs are adversely impacting economic growth.

But today, copper prices are not retreating. This suggests the higher bond yields are not overly restrictive.

A reliable warning signal

It would be very helpful to be able to find in history a reliable warning signal for equity investors. Perhaps the best advice is to remember that while history may not repeat, it does indeed rhyme. Rising bond yields, hyper-extended Cape Shiller PEs and waves of speculative fervour are enough to scare Jeremy Grantham sufficiently to predict a crash before May. He might be right.

For what it’s worth, investors should simply look at each individual company in their portfolio and ask whether those companies are reasonably expected to generate strong growth in the next five years. That growth will of course be dependent on economic and monetary conditions. Investors should also ask how much of that growth is already factored into prices. Of and also keep in mind the impact on present values from rising bond rates. This is inescapable. Nothing, it seems, can replace a rational and continuous assessment of the fundamentals.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics