Why you shouldn't forget Government Bonds

The Government and State-Government bond market is one that seldom gets me excited. I have tended to pop it in the ‘no risk, no return’ bucket. In fact, when we were going through a zero-interest rate policy, it would be more accurate to say that I saw them as ‘high risk, no return’. The risk was not credit risk but duration risk. Perhaps duration risk is seen as more palatable; however, there are investors who bought long dated fixed rate Government and State-Government bonds that are now sitting on significant capital losses, suffering the sort of declines that you would not expect to see within the defensive portion of your portfolio.

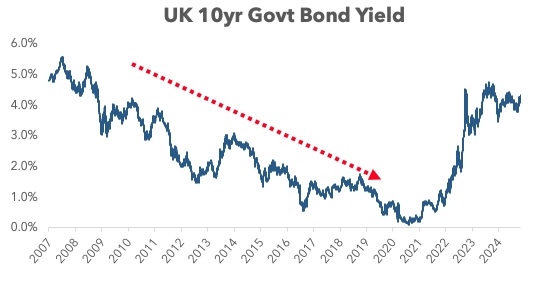

Looking back there have been a couple of periods where I should have been getting more excited about this part of the market. Just prior to the GFC, when I was working in the UK, Government bond yields were around 5%. If only I had the foresight to buy Government bonds at that time. Yields consistently fell, meaning that capital values consistently rose, from April 2007 until July 2020 when yields almost hit zero.

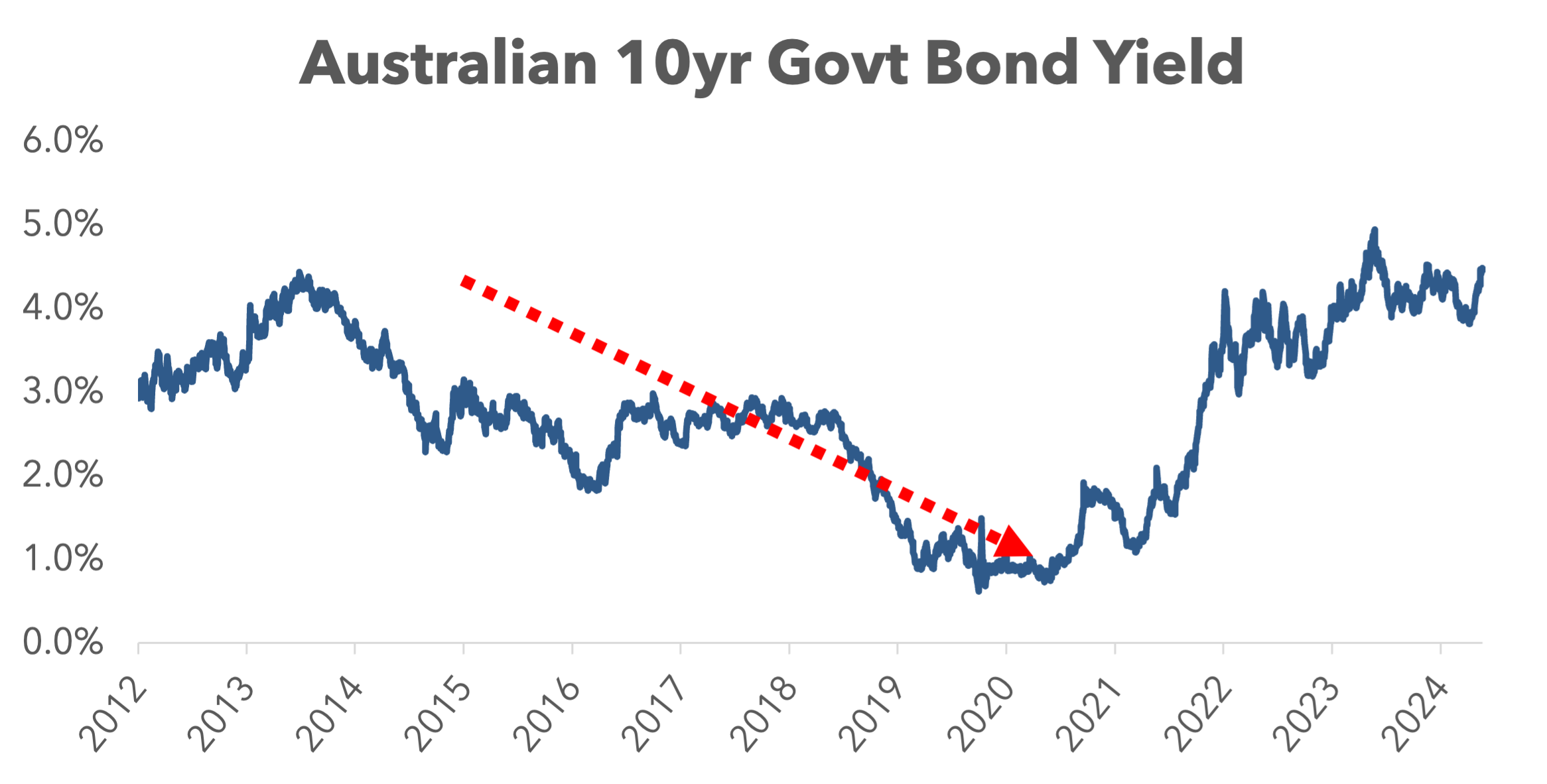

Then, shortly after moving to Australia in 2013 the 10-year yield here was >4% and proceeded to fall below 1% in 2020. Once again, this fall in yields ensured that Government bonds provided outsized returns for the risk taken.

We now know and can see clearly from the charts above that yields have moved sharply higher once again. Australian yields are now back up above the levels when I should have been paying more attention in the past! I don’t see us heading back to a zero-interest rate world. However, I can see yields falling as the RBA starts to move into its easing cycle. Once again, falling yields should be supportive of strong performance in these bonds.

After learning these lessons from the past, I see two distinct ways to play this opportunity in Government and State-Government bonds at present. One will suit income seekers, and the other will appeal to investors looking to achieve capital growth. Let’s discuss the case for each.

Income Seeking Opportunity

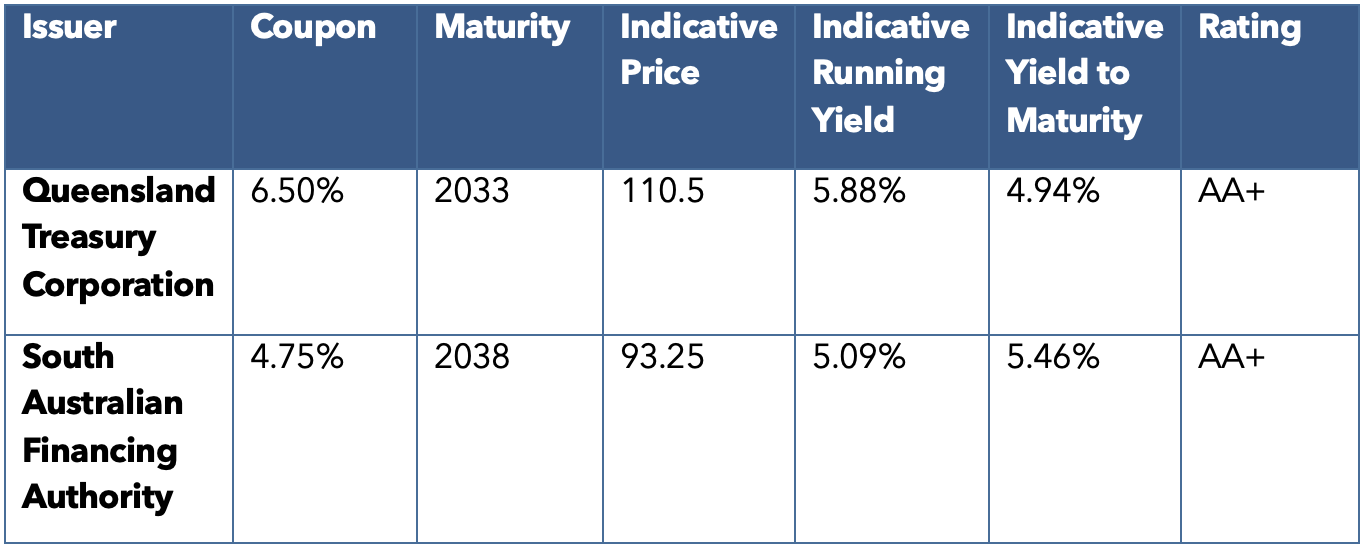

There are a number of higher coupon bonds in this space. These bonds allow investors to lock in a running yield* of 5%+ over the long term. This might not seem like it is too much better than term deposit returns at the moment, however throughout the cycle it is a very attractive income to lock in from such a quality asset.

Note the maturity for Queensland Treasury Corporation (QTC) is 2033 and 2038 for South Australian Financing Authority (SAFA) – so we are talking about locking in longer term income here. QTC is a clear winner on the income generating front, with a running yield of 5.88%, however, it is also trading at a much higher price. A price of 110.5 may feel like a hefty premium to achieve this income however this bond was trading in the low 160s when yields bottomed out in 2020!

Capital Growth Opportunity

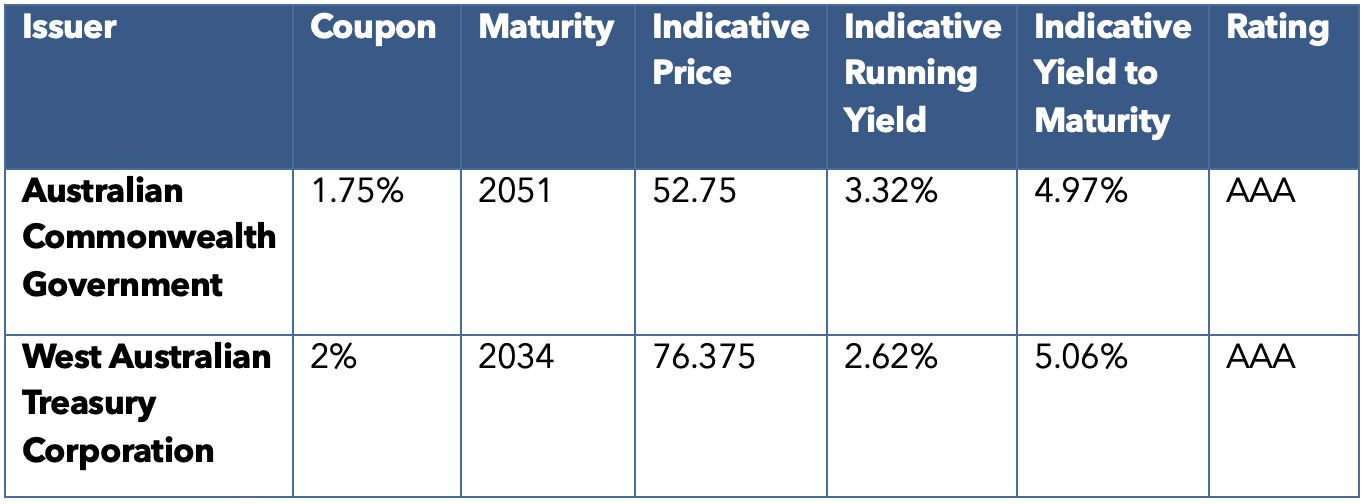

There are many bonds that were issued during the Covid years that have very low coupons. The capital value of these bonds has been savagely hit by the jump in yields however this creates an opportunity for investors looking for deeply discounted assets. Often bonds trading at such discounts are in some level of financial distress however in this case we are talking about the highest quality, AAA-rated, assets. For patient investors who are not heavily reliant on income, these look highly attractive. Yes, the maturities are a long time away but, once again, when the RBA starts cutting, I would not be surprised to see a meaningful recovery in some of these capital values. It is not necessarily a case of having to wait until maturity to get par (100).

As at 18 November 2024

The fact that you can pick up an Australian Commonwealth Government bond at almost 50 cents in the dollar is quite extraordinary. At risk of stating the completely obvious - a $100k nominal parcel of that bond would cost just over $52k.

These are just four of the bonds in this space and there are many others to choose from. However, these clearly show the available opportunity, whether you are an investor seeking income, or one looking to achieve capital growth. While past performance is not an indicator of future performance, the risk/reward of these investments are appealing for an allocation from investors that accept a lower interest or cash rate will play out over time.

After missing out on these opportunities in the past, this time around, I am hoping to get investors set in positions that look to be offering very compelling returns for the risk.

*Running yield is the annual income return that you will receive on a bond. It does not take any capital movement into account.

5 topics

Darryl is a fixed income specialist who has spent almost 25 years working in the financial markets. After graduating from university in New Zealand Darryl worked in Auckland at UDC Finance, an asset financing subsidiary of ANZ, as a credit...

Expertise

Darryl is a fixed income specialist who has spent almost 25 years working in the financial markets. After graduating from university in New Zealand Darryl worked in Auckland at UDC Finance, an asset financing subsidiary of ANZ, as a credit...