Will 2024 be an attractive vintage for private equity?

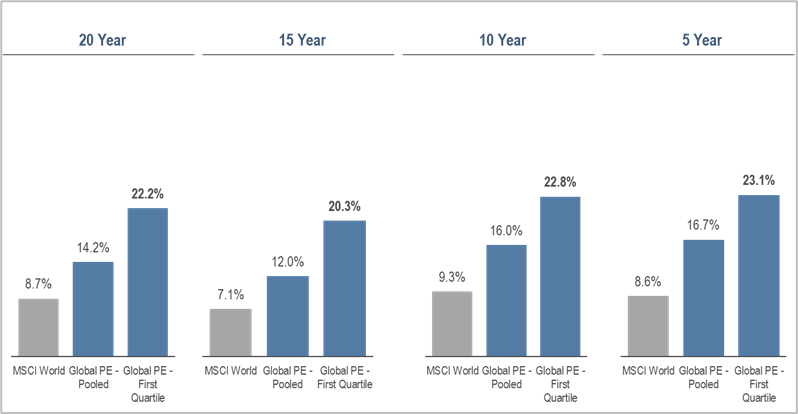

The past few years, including 2023, have been a roller coaster for investors in public markets, filled with unprecedented waves of shocks, including a pandemic, monetary stimuli, high inflation, and quick increases in interest rates to levels not seen in more than a decade. However, if we look at the private equity asset class, the ride has been less bumpy in comparison, exemplifying once again some of the main virtues of private equity across cycles: attractive performance, outperforming public markets over long periods of time and lower volatility (see Figure 1).

Figure 1.

LONG-TERM PERFORMANCE OF GLOBAL PRIVATE EQUITY VS PUBLIC MARKETS

This is why at Neuberger Berman we continue to advocate for a stable allocation to private equity, with 2024 potentially resulting in an attractive vintage as historically years of market uncertainty and volatility have resulted in very good private equity returns (e.g. 2009, 2010, and 2020).

2024: An attractive vintage?

While private equity has seen less turmoil than the public side of the equation, in 2024, we expect to see the same headwinds to the asset class as in 2023, including a challenging fundraising environment, tight debt markets and limited liquidity opportunities for private equity fund investors.

This desire for liquidity in a difficult IPO and M&A environment is creating an opportunity for well-capitalized co-investors, secondary fund players and capital solution providers to provide much-needed capital for fund managers.

Liquidity a key focus in 2024

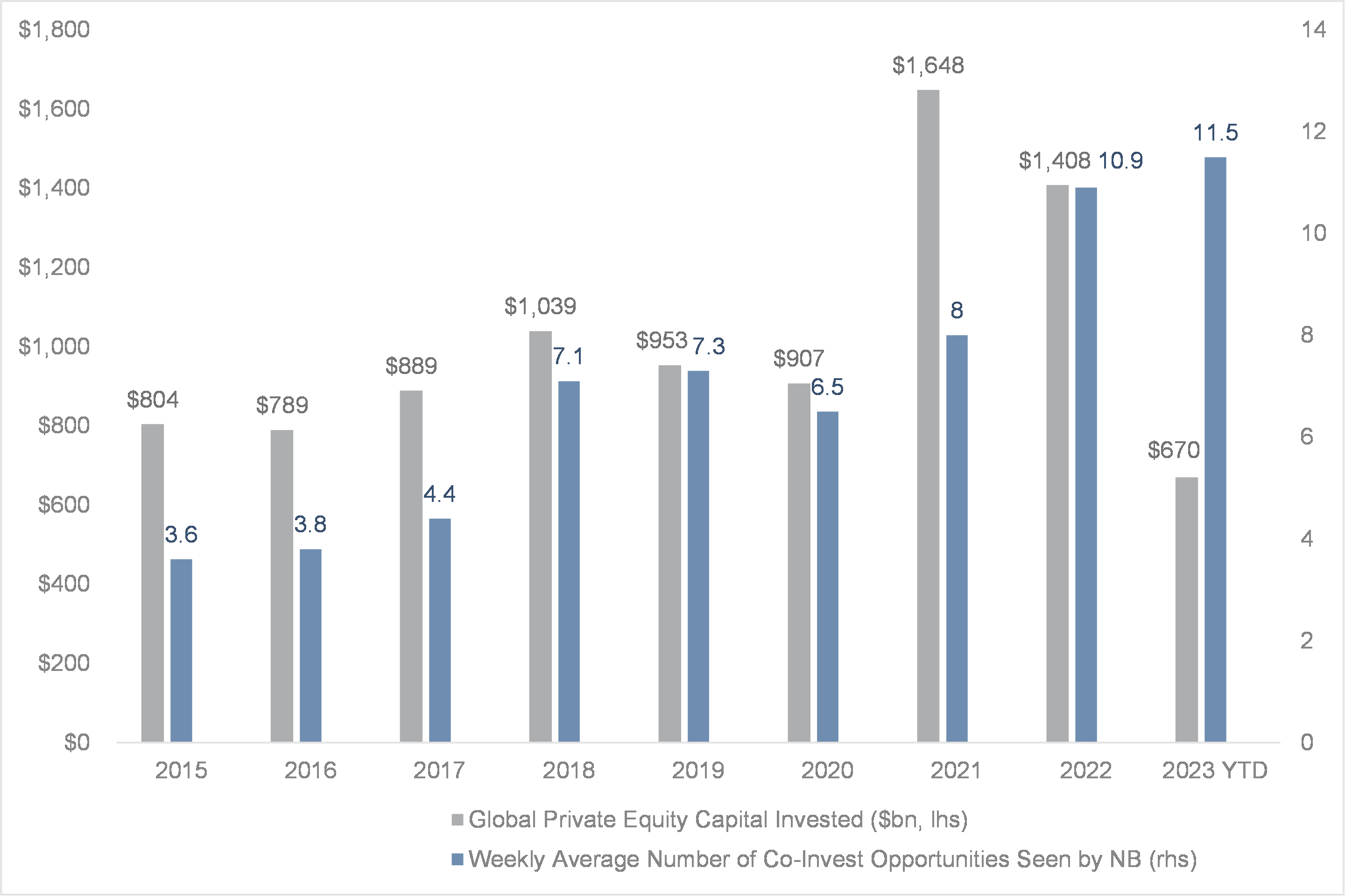

With access to capital as the main priority, co-investment platforms such as ours have developed into an important source of equity capital for general partners (GPs) to get their transactions done; particularly important is having dedicated co-investment capital available to GPs irrespective of market cycles or dislocations to opportunistically fill voids in this marketplace.

The numbers on our platform speak for themselves. Despite a fall in the volume of private equity transactions of c.30% this year, our investment practice has seen a new all-time-high number of opportunities per week, almost 12 (see Figure 2).

Figure 2.

A SHARP INCREASE IN CO-INVEST OPPORTUNITIES IN 2022 AND 2023, DESPITE A STEEP FALL IN PRIVATE EQUITY TRANSACTIONS

As previously mentioned, with the traditional exit options for private equity owned companies tightening and limited partners (LPs) suffering increased duration and reduced net inflows, or worse yet, net outflows, from their private equity portfolios, LPs and GPs are also increasingly turning to the secondary markets to generate much-needed liquidity. The secondary market is one of the few options for liquidity, which is in greater demand than at any other time in recent years. But given that capital formation generally hasn’t kept pace with deal supply, it has created an attractive supply and demand imbalance that we believe could persist for a period of time.

Aside from providing liquidity, private equity firms are also utilizing this capital as an injection into their companies to foster growth, complete add-on acquisitions, or raise a continuation vehicle to maximize the value of assets.

High level of dry powder to drive activity

Although the pace of private equity fundraising overall has seen a slowdown compared to the previous year, going into 2024 we believe the record-high dry powder reserves suggest potential for significant PE activity as values slowly recover and conditions improve. However, an inefficient capital distribution despite this abundant dry powder means many areas are still lacking funding which is where specialist capital solutions providers can also play a role in the upcoming year.

As we have seen at Neuberger Berman, the ability to provide capital in the form of preferred or structured equity when debt limits have been reached and equity dilution is not an option has been another way to seize opportunities amidst this challenging environment.

What are the risks?

In our view, the biggest risks for private equity investors in 2024 are;

- first, a potential negative surprise on the inflation side that reverses, yet again, the expectations of lower interest rates and tightening capital markets;

- second, in a world where private equity managers can´t benefit from cheap financing or multiple expansion at the time of selling their investments, the risk is selecting managers without the adequate toolkit to boost growth and drive operational efficiencies to achieve returns;

- and third, the level of risk in investments could be misleading due to exceptional growth in the past years likely being cyclical or artificially high due one-off situations (e.g., Covid aid) or recent price increases rather than considering it to be secular.

Why should investors consider private equity above all others in 2024?

We see 2024 as a year where our co-investment, secondaries and capital solutions practices will continue screening opportunities and deploy capital globally, at record levels in companies that provide business critical solutions across industries, including software and technology, healthcare, business services, industrials and unique consumer businesses. All of our practices, in private companies alongside solid private equity managers, will do so away from the daily volatility of public markets and the risk of redemptions and repricing due to interest rate expectations.

Additionally, we believe in this environment there will be greater reliance on a manager’s ability to utilize skill-based value-creation levers. Pulling these levers requires significant skills and resources that, in our view, not all private equity managers possess, which means there will be a performance dispersion that tends to favour higher-quality companies with well-defined strategic and operational improvement plans versus relying on financial engineering tactics and leverage to generate returns.

From an investor point of view, we believe this to be an attractive time to be involved within the co-investment, secondaries and capital solutions space as a liquidity provider to private equity managers seeking to preserve fund value in the current market environment.

2 topics