Will 2025 be a goldilocks year for investors?

The full-time whistle (or horn, if you're a hockey fan like me) is about to be blown on a market year that confounded all the consensus expectations. Luckily, it was for all the best reasons.

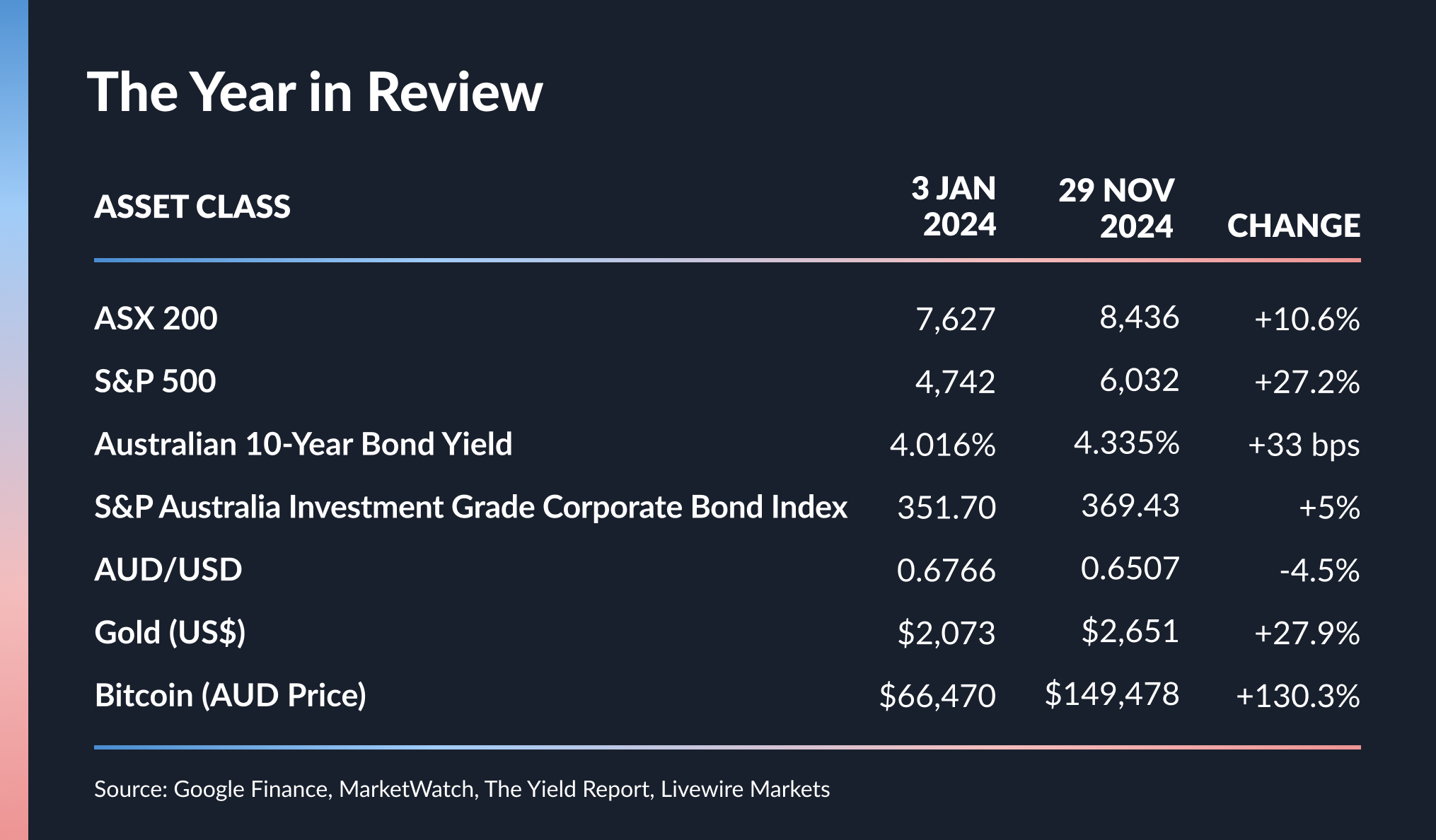

As the below table shows, the S&P 500 has climbed 27% and has recorded 57 all-time highs this year (as of time of writing.) Corporate bonds have held up despite weaker earnings while gold has reset its own all-time high repeatedly thanks to immense central bank buying. Even Bitcoin has just cracked US$100,000 per unit.

So, will 2024 go down as the last inning of a two-year long bull market run for investors?

Not if you believe AMP Deputy Chief Economist and Signal or Noise's very own Diana Mousina. Mousina offered that next year will likely be a year of "Goldilocks" returns for investors.

"Central banks will be in a slow interest rate cutting cycle, but that's not a bad scenario for share markets," she said.

"But in general, a Goldilocks environment shouldn't be too bad at all for a diversified portfolio."

To find out if the rest of the panel will share Mousina's views and what their own predictions are for markets next year, we are delighted to be bringing you the last Signal or Noise episode of the season. Joining me and Mousina are a show returnee and a show newbie:

- Stephen Miller, Investment Strategy Advisor at GSFM and Investment Committee Member at QIC

- Simon Clark, Equities Strategist at Morgan Stanley Wealth Management

In this final episode of the year, we'll also discuss what Donald Trump's re-election is a signal for, whether the Chinese government has finally issued enough stimulus to entice investors back into that market. Plus, stick around to the end as each panellist shares with us their chart of the year!

Other ways to listen:

Note: This episode was taped on Wednesday 4 December 2024. You can watch the show, listen to the podcast, or read our edited summary below. This article only contains general financial advice, which has been prepared without taking into account your objectives, financial situation or needs and because of this, you should, before acting on the general advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs.

EDITED SUMMARY

Topic 1: What was Donald Trump's re-election a SIGNAL for?

Diana: Trump's re-election was a signal for US equities in the short-term but in the long-term, his political victory may actually turn into noise. Next year, Diana forewarns that we will see more volatility in markets due to the re-introduction of tariffs (and whatever retaliation from other nations we may see.)

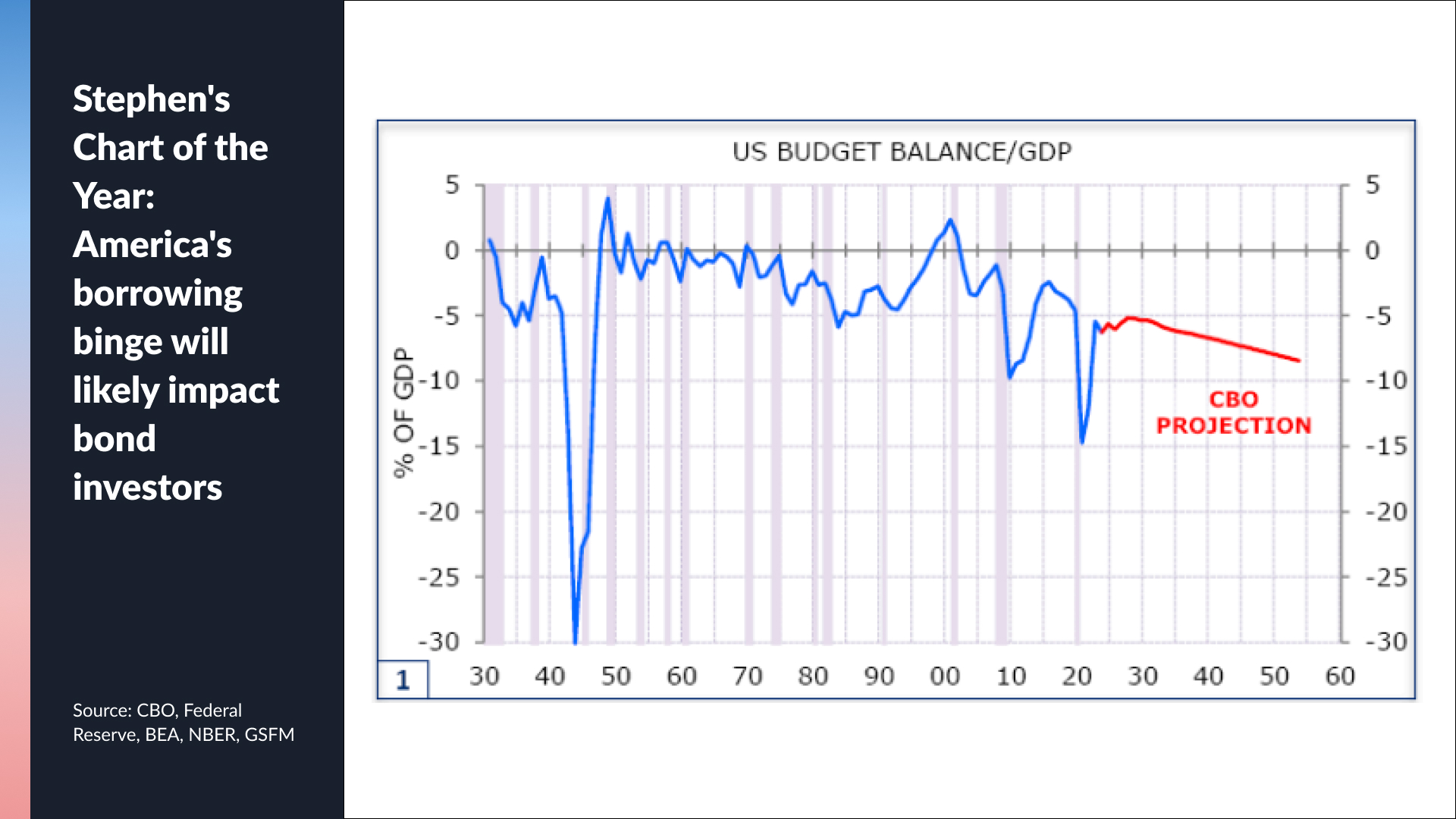

Stephen: The themes of de-regulation, especially in the financial sector, will be great news for Bitcoin investors especially (not least symbolised by Bitcoin's price cracking the $100,000 mark soon after this taping was finished.) But Stephen also thinks Trump's re-election is a signal for gold investors given he believes extra tax cuts and fiscal spending will lead to sharply higher bond yields in 2025.

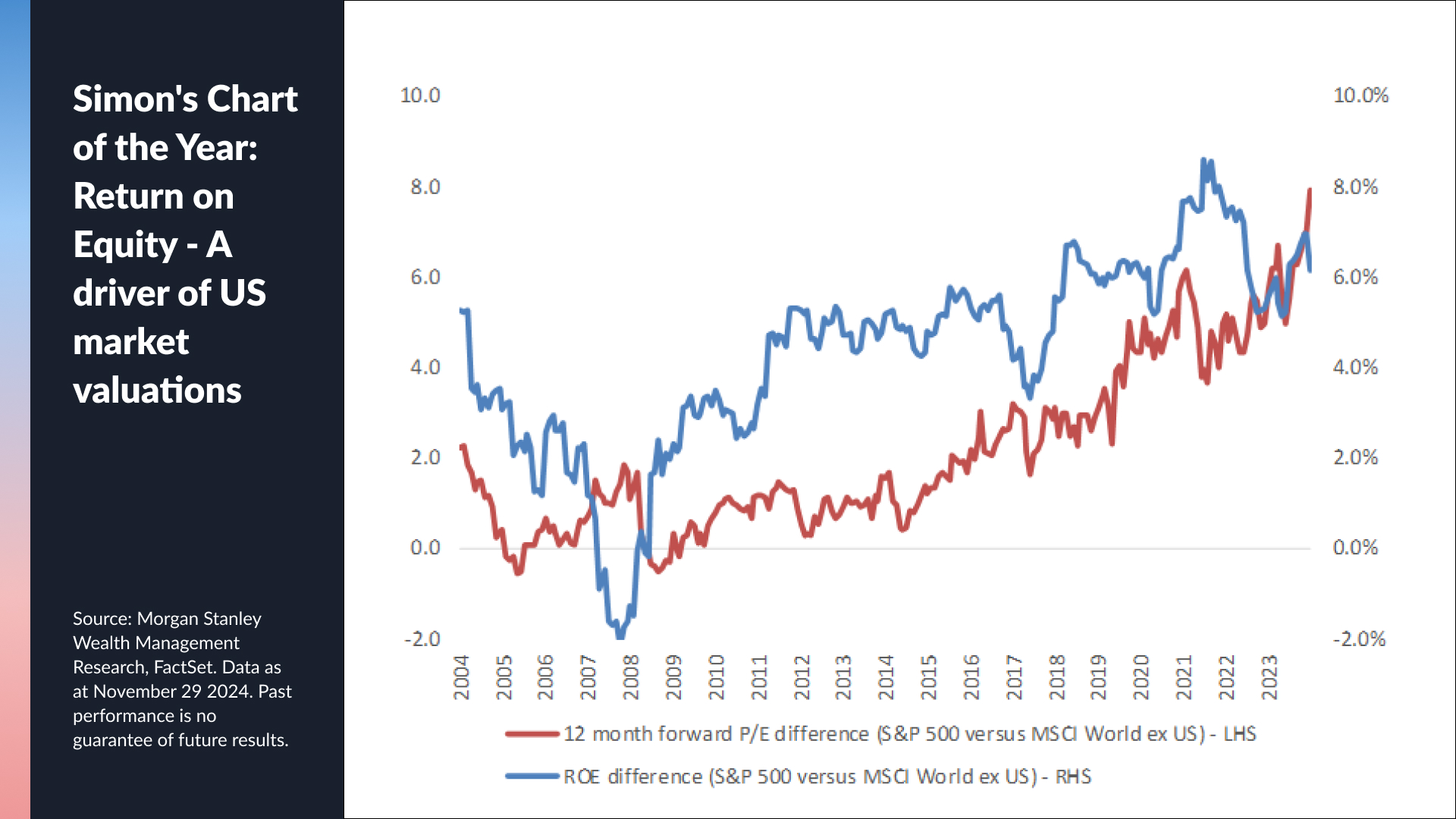

Simon: Extending the de-regulation theme further, Simon views Trump's re-election as a boon for US financial and bank stocks. It also helps that such names as JPMorgan (NYSE: JPM) and Bank of America (NYSE: BAC) are trading on 13-14x earnings, far less than the mega-cap tech names and certainly on far less than what CBA is trading at! For a noise call, Simon nominated consumer discretionary stocks, particularly those with heavy exposure to the Chinese consumer.

Topic 2: Has the Chinese government provided enough stimulus to rescue its ailing economy?

Stephen: NOISE - Stephen believes the Chinese government is "pushing on a string" and that far more money will need to be thrown at the structural issues facing that economy (which is ailing consumer confidence and consumer demand.) In fact, Stephen believes the SIGNAL is emanating from the foreign investor withdrawal statistics.

Simon: NOISE - Morgan Stanley's estimates suggest the Chinese government needs to be issuing RMB10 trillion over the next couple of years to re-stimulate that economy. But they may issue as little as RMB3 trillion. It is this view that also helps inform Morgan Stanley's underweight rating for Chinese stocks.

Diana: NOISE - The basic problem, as Diana puts it, consumer spending is too soft because property investment is down 20% year-over-year and people save in China through the housing market. When house prices tick up, consumer spending will tick up as well. More stimulus, when fed through to consumer spending, will spark a rally in Chinese assets again but not before then.

The Big Call

Simon: Airlines are the new luxury good - and are a way to play the resilience of the affluent consumer and the ongoing rise in household wealth. Some of the team's favourite picks in this area are Delta Airlines (NYSE: DAL), Qantas (ASX: QAN), and even French hotel operator Accor (EPA: AC).

Diana: SIGNAL - The outlook for consumers is likely to be more optimistic over the next 12 months than it has been over the last two years. This is in large part due to increased wage growth and a low unemployment rate.

Stephen: SIGNAL (with a caveat) - If Steve's family experience is anything to go by, this is a blaring signal. But his big issue is how much a global trade war could impact economic activity - and naturally, a hard hit to economic activity will impact consumer spending at all levels.

Diana: Goldilocks will be the word for 2025 for both markets and the economy. She thinks economic growth will continue to be sluggish for both the US and Australia, and adds it's hard to see a big rebound coming. But she also notes that a recession is a low probability outcome as is a massive crash in growth. A slower central bank interest rate cutting cycle is also likely to be a headwind - though not as much a headwind as it was feared originally to be.

Stephen: NOISE... but not with any great conviction. While Stephen's big call will acknowledge that higher bond yields are a big issue for 2025, he also accepts that the momentum is on the side of the bulls and that inflation is not the wall of worry that central bankers were concerned about even just 12 months ago.

Simon: SIGNAL - The environment is now quite conducive for equity markets and the conditions are all there for a strong year next year.

Stephen: Bond yields are sharply higher in 2025, leading to headwinds for equity markets resulting in lacklustre returns from both asset classes. This implies a continuing focus on the most important principle of investing: diversification. Investors should seek out exposures uncorrelated with equity and bond beta (long/short; macro/quant hedge funds; gold and other selected commodities; and – for the adventurous – small exposures to crypto).

Simon: NOISE - While Morgan Stanley do agree there will be some inflationary impact from Trump's economic policies, he sees enough room for disinflation and interest rate cuts to continue (as a general trend.)

Diana: NOISE - AMP's base case is for bond yields to fall next year, stemmed from the base case of more rate cuts coming next year. While budget deficits are a key risk, there is now a Department of Government Efficiency (stateside) which may lessen some of this key risk.

Chart of the Year

Diana's Chart: S&P 500 and ASX 200 in 2024

Stephen's Chart: America's borrowing binge to impact bond investors

Simon's Chart: The driver of US market valuations

5 topics

4 stocks mentioned

2 contributors mentioned