Winners and sinners: Livewire's Australian equities webinar wrap up

Livewire Markets

Mystery. Uncertainty. An as yet unsolved riddle. If 2020 taught us anything it's that the only certainty was uncertainty. And if there's one key takeout of the FY20 reporting season it's that for the next six months companies still really have no idea what to expect.

“Unprecedented and uncertain” is how QVG Capital's small cap manager Chris Prunty put it in a recent Livewire webinar, where he appeared alongside all cap manager David Moberley of Paradice Investment Management.

Equity valuations, a head-scratching theme that has long occupied the best in the business, was among several topics discussed by the pair in the reporting season wrap-up.

Below, we summarise Prunty's and Moberley's lessons from earnings season and how their portfolios shifted in response. They also outline two "winner" and two "sinner" stocks of the reporting season.

1. Not a total train smash

“Good results went up, and results of COVID-impacted companies that were a disappointment, still rallied.”

Prunty and Moberley noted the market expectation for the August reporting season was grim. But the market didn’t punish the companies inherently disadvantaged by the pandemic. As observed by Prunty, companies in sectors including travel and media were expected to deliver poor results at a P&L level and so they did. But the results were not as bad as anticipated, resulting in a powerful re-rating.

2. Testing times for company management

For these two fundies, the COVID-19 crisis presented an opportunity to differentiate between good and great management. In their view, great management finds a way to innovate in the poorest of market climates and end up further entrenching their leading positions.

3. Companies with great management find a recovery

Companies with great management also found a way to recover. When Prunty spoke with companies earlier in 2020, they were all frightened at the potential effect of COVID-19. But after a few weeks grappling with the crisis, the best saw it as an opportunity to take market share and grow their business.

Prunty pointed to fashion retailer City Chic as one example of what great management can do in a crisis, shrugging off the fear of failure and instead innovated and outperformed.

SECTOR ALLOCATION

The big-cap outlook – Moberley’s stock selection

The large-cap outlook for the remainder of 2020 hasn’t changed too much since reporting season. Paradice’s Moberley spoke about the four sectors that he is currently overweight in, and some of the key stocks within those allocations:

INDUSTRIALS – Europe-centric motorway owner Atlas Arteria is a standout, showing great progress around traffic recovery and with a strong balance sheet and management team.

MATERIALS – Gold still shines for Moberley, the precious metal having benefitted immensely from central bank money printing. Australian miner Newcrest is a key beneficiary here, delivering plenty of free cash flow at the moment. Its production outlook is excellent and Moberley expects share price re-rating.

CONSUMER STAPLES – In supermarkets, specifically Woolworths, Moberley says the market was disappointed at the additional costs for the business. He believes the company’s high cost of doing business – operating leverage – will return with a vengeance.

HEALTHCARE – Ramsay, as one of two central healthcare holdings, has been affected by COVID due to the deferment of elective surgery. But these are already returning to pre-COVID levels and normality will resume when the virus is under control in Australia. This will be helped along by pent-up demand for surgery and Moberley anticipates a solid re-rating of the stock.

Beware the small-cap bounce - Pruntey's punts

Many companies that have benefited from COVID-19 may be riding unsustainable tailwinds, says Prunty. This magnifies the importance of understanding pre-virus performance to better inform post-COVID predictions. Retail is discussed as a key example, a sector that was already struggling and is likely to continue suffering after the recovery hits.

DIGITAL PAYMENTS – Point-of-sale payments company Tyro is one example of a company hit hard by COVID, particularly in its Victorian market. But it has capitalised on the digital payments thematic and is tipped to recover and accelerate post-COVID. Surprisingly, another digital payments company EML is also a buy for Prunty. Classified as a COVID victim, the company delivered a poor FY20 result but Prunty is confident the defensive nature of its card issuance will spearhead EML’s recovery.

E-COMMERCE – Like digital payments, Pruntey believes that e-commerce is a thematic that will continue to grow post-COVID. For a business like City Chic, the clothing retailer’s ability to move online underpins its transition to a market-leading position.

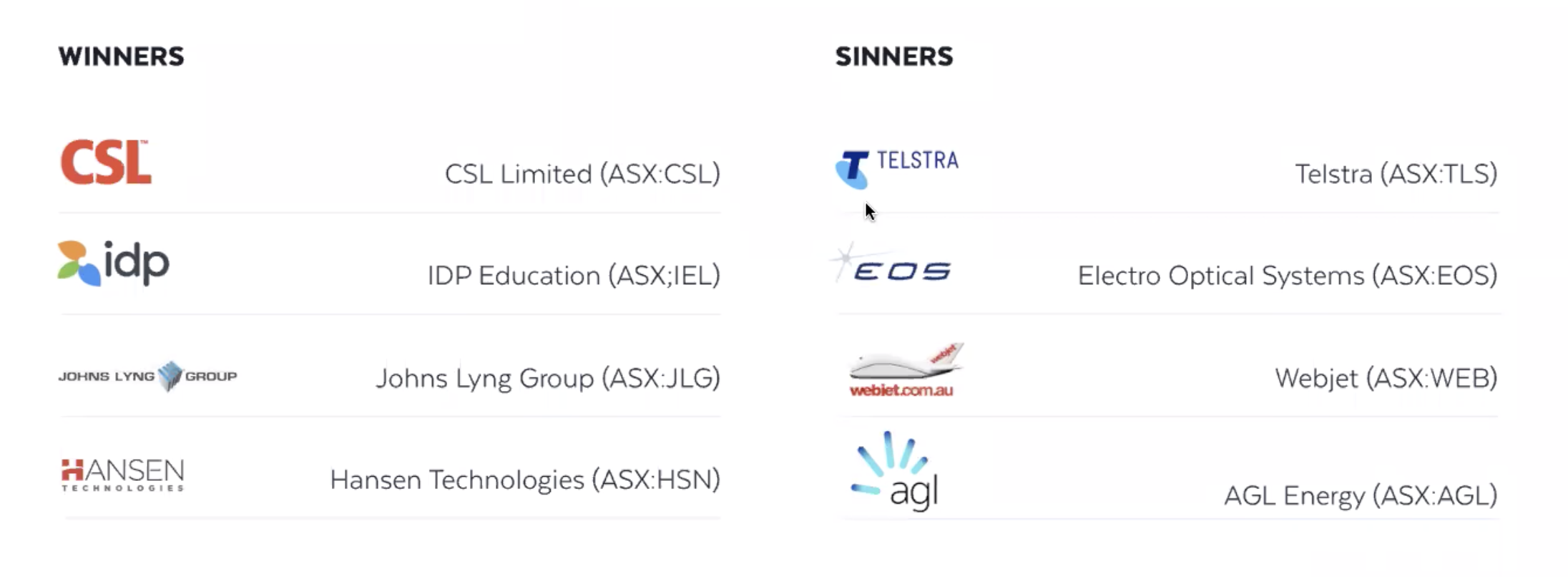

Stock heroes and headaches

We asked our two fundies to pick two stocks they were most pleased with over reporting season and whose future prospects shine the brightest. We also asked them to name two 'sinner' stocks that have given them headaches and will be avoided for at least the rest of 2020.

Valuations in the market

The fundies also spoke briefly about the market’s current valuations. They agreed growth stocks outperformed value, and Moberley emphasised the unprecedented environment of the world’s five largest companies (Microsoft, Apple, Amazon, Alphabet and Facebook), who comprise around 25% of the S&P 500. Drawing positivity from this, he says it proves growth opportunities still exist for those who know where to look.

Webinar replay

If you missed the webinar a replay is now available and can be accessed via the link below and a pdf copy of the slides is available at the bottom of the wire.

Q: Where will the price of oil be in 2022?

Chris: QVG holds no oil or gas positions. Part of our reluctance to own energy stocks is our inability to forecast future commodity prices with any confidence.

David: Short term it looks tough. Inventories have been building suggesting supply cuts have not been enough to balance the market given the current weakness in demand. Medium-term looks more interesting given a lack of investment in exploration to replace the depletion in reserves.

Q: What are your thoughts on Kathmandu (ASX:KMD)?

Chris: KMD reports its result on 23 September. If it’s anything like other retail results, it will surprise on the upside. Longer term we worry about the very large store portfolio and relative under-investment in eCommerce. At 11-times PE, some of these concerns may be priced-in already.

David: I don’t have a strong view on the upcoming result. It will be potentially interesting as a beneficiary if domestic travel and outdoor spend pick up (SUL update indicates this is happening). However large dilution from recent capital raising and question marks on the Rip Curl acquisition keep us sidelined.

Q: What are your thoughts on BlueScope Steel (ASX:BSL) and Lendlease (ASX:LLC)?

David: BSL - Good balance sheet and management. Steep spreads are improving, however, they are coming off a low base and probably need to see these sustained to see further upside.

LLC - Recent strategy update gave a clearer picture of the direction of the business post the exit of engineering. They are trying to accelerate the pipeline of development however this is into a difficult macro backdrop.

Q: Do you consider microcap stocks – including Pointerra, 8 Common, Knosys, Envirosuite or Selfwealth – or are they too volatile?

Chris: We own Selfwealth and have kicked the tires on EVS but the others are either too small for us or hard to value given they’re unprofitable. The microcaps we own are PSQ and PPE both of which have meaningful and growing earnings and very low leverage.

Q: What are your thoughts on BWX?

Chris: We like it. Consumer packaged goods businesses have excellent economics and BWX has outstanding management in CEO Dave Fenlon (he’s formerly of Blackmores). In the short-term BWX will have a soft 6 months to December as their new product development is weighted to the second half and their US business is struggling to make sales while some of their retailers are Covid impacted but longer-term we like it.

Q: What are your thoughts on Mesoblast (ASX:MSB)?

Chris: We’ve never owned it. Management over-promises and under-delivers and it burns cash. It looks like a punting stock to me, and not something you’d put in the bottom draw.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

5 topics

4 stocks mentioned

1 contributor mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.