With major banks “priced for perfection”, these 4 stocks offer value in ASX financials

Few, if any, major brokers currently rate Australian banks as a buy - a point my colleague Carl Capolingua highlighted in his popular three-part series on the lenders. The 2024 rally, which pushed CBA past $150 (despite broker valuations closer to $110), has heightened fears of a bubble in the sector.

Our readers share these concerns: 94.5% are either avoiding increasing their bank exposure or actively reducing positions, while 25% see “shorting Aussie banks” as 2025’s top contrarian trade in our annual Outlook Series survey recap.

With near-record valuations and sky-high share prices - CBA hovering at $160 and Macquarie nearing $250 - investors are asking, “What’s next?” and “What are the alternatives?”

Given Australian banks’ prominence in portfolios for their brand strength, relative stability and juicy dividends, we sought insights from experts including: Matthew Davison, Portfolio Manager at Martin Currie; Hugh Dive, Chief Investment Officer of Atlas Funds Management, and the Morgan Stanley research team for their thoughts on:

- how they’re navigating the majors from a portfolio construction perspective, and

- where they’re finding value in ASX financials outside the Big Four plus Macquarie.

Putting the rally into perspective

The Morgan Stanley research team recently published an insightful report, Australia Banks 2025 Outlook: A High Bar, authored by analysts Richard Wiles, Andrei Stadnik and research associate Sally Hong.

"Priced for perfection" is their summary of the banking sector’s stellar performance, following a remarkable 31% average return for the majors in 2024.

"Everything went right for Australian banks in 2024: As the year progressed, operating conditions and the outlook improved, driving upgrades to consensus estimates. Even though RBA rate cuts did not materialise, the re-rating of the major banks in this interest rate cycle has been much earlier and larger than in previous cycles," the report states.

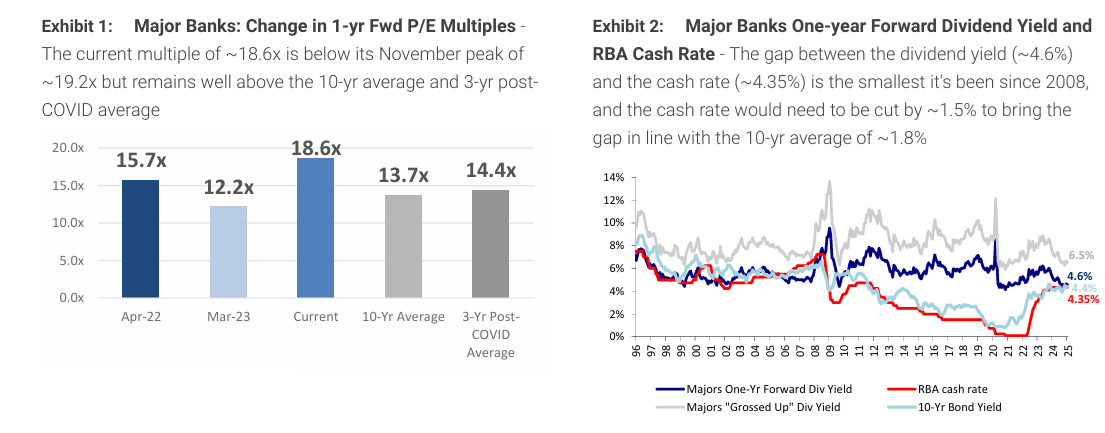

Their data highlights that Australian banks are now 23% more expensive than their 10-year average, with dividend yields as competitive as cash and bonds, despite not a single rate cut in 2024.

The "flow of funds" effect exacerbating valuations

Dive and Davison concur that the banks are expensive. Davison notes that CBA's trailing P/E ratio of over 28x “defies the typical pattern of banks trading at a discount to the market due to limited earnings growth, regulated capital, and tail risk from credit losses.”

All the experts agree that the explosive growth in passive investing has also influenced price movements over the past year, but Morgan Stanley goes further.

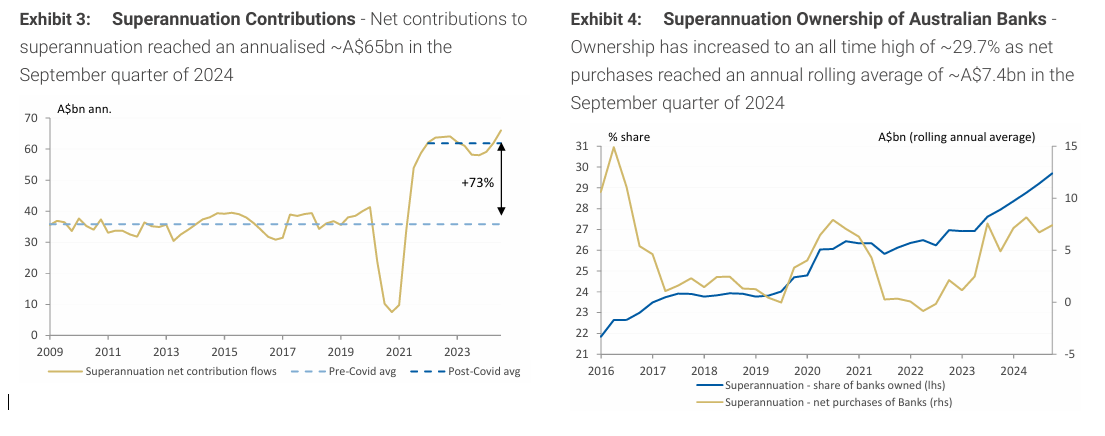

The investment bank highlights that the increase in the super guarantee to 11.5%, coupled with strong population growth and a robust job market, has driven more money into super funds.

These funds need to keep allocating substantial portions of their investments to the Australian market, with banks being a natural beneficiary, as illustrated in the graphs below. As a result, it has created a “flow of funds” effect, where expensive companies keep becoming more expensive.

Reducing weightings

Davison notes that Martin Currie is "significantly underweighting banks" in several strategies, citing unjustified sector-wide valuations. Their Martin Currie Sustainable Equity Fund, for example, is holding 18% of its portfolio in the major banks as at December 2024, compared to the index weight of nearly 27%.

Conversely, Dive takes a selective approach, emphasising the importance of not making knee-jerk portfolio decisions based on bearish calls such as this and this.

"Blindly selling all banks in 2024 would have resulted in poor performance. A fund manager following that advice 12 months ago would likely be looking for a new job now," he says.

.png)

Atlas has gradually reduced its weighting in CBA over the past six months while maintaining positions in Westpac, Macquarie, and ANZ, citing favourable conditions such as low bad debts, rising dividends, and share buybacks.

Notably, NAB, ANZ, and Westpac resumed buybacks in January, collectively purchasing 10-15% of their daily trading volume on the ASX.

On the income argument, Dive says the outlook for term deposit rates looks weaker as the banks price in future interest rate cuts. And importantly, cash won’t give you capital growth or franking credits, so it's fair to reason bailing on banks altogether doesn't make sense for long-term investors.

Morgan Stanley, while cautious, isn’t recommending an outright exit from the sector either. Instead, they advocate selective positioning, ranking NAB, ANZ, Westpac, and CBA from overweight to underweight.

4 ASX financials offering value

That said, investors are understandably hesitant about allocating more money to the big banks at the moment and are actively seeking better value opportunities elsewhere. The good news? There are companies within the financials sector that meet these criteria. Here are some alternatives from the experts:

#1 & #2 - Martin Currie’s top picks: Medibank (ASX: MPL) and QBE (ASX: QBE).

Davison highlights opportunities in insurance, pointing to Medibank Private and QBE Insurance as his preferred plays.

Medibank Private (MPL): The private health insurer is "well managed and set to preserve strong margins in its core private health insurance business." MPL has doubled its earnings per share over the past decade and generates a return on equity (ROE) consistently exceeding 20%.

QBE Insurance (QBE): Davison observes that QBE is "delivering more consistent operating performance" and addressing key risks.

"With the industry backdrop supportive, we see the market growing confidence in sustainably higher insurance margins, and with that further valuation re-rating from the current 10x," he says.

Trailing dividend yields: Medibank pays a yield of 4.32% while QBE is at 3.60% (before franking).

#3 - Atlas’ top pick: Suncorp Group (ASX: SUN)

Dive agrees with Davison that insurers are a value play within the broader context of ASX financials, nominating Suncorp as his preferred stock.

"We have been increasing our weight to Suncorp in the portfolio - insurers are enjoying one of their best periods in the past decade," he says.

Suncorp (SUN): Dive emphasises the company is "benefiting from a hardening rate cycle, prudent underwriting, and higher investment returns." The insurer is also expected to deliver an approximately $3 capital return and special dividend in mid-2025, following the $4.1 billion sale of Suncorp Bank to ANZ.

Trailing dividend yield: Suncorp currently pays a yield of 3.89%.

#4 - Morgan Stanley: Judo Capital (ASX: JDO)

Morgan Stanley is backing neobank Judo Capital (JDO), which specialises in small business lending and personal term deposits, as an overweight position.

Judo Capital (JDO): Morgan Stanley says Judo is set to "gain market share and increase revenue" while benefiting from more stable and improving margin trends. They foresee "double-digit ROE potential by FY27" and attractive P/E multiples for FY26-27. However, they caution that credit quality remains untested and that Judo is paying relatively expensive rates on its term deposits to win customers. Its price target is $1.75, but the analysts say it could get to $2.20 if it comfortably exceeds earnings expectations this financial year.

Trailing dividend yield: Judo currently does not pay a dividend.

Global alternatives to the big banks

For many investors, holding big banks in their portfolio feels like a necessity. These institutions are among the most well-regulated and financially resilient in the market.

But Dan Pennell from Plato offers a different perspective, suggesting that global banks could provide a compelling alternative for direct bank exposure at better value.

In this wire, he examines CBA's valuation compared to other major banks, making the case for equally impressive options like JP Morgan Chase and U.S. Bancorp. With stronger total returns and yield potential, some of these global giants are now offering larger dividends than the iconic yellow brand we all recognize.

What are you doing with your big banks?

How are you managing bank exposure at current valuations in your portfolio? Let us know in the comments below.

4 topics

8 stocks mentioned

1 fund mentioned

4 contributors mentioned