Yardeni Research: US inflation's peak "is behind us" - but should you cash out?

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 4,110 (+1.06%)

- NASDAQ - 12,266 (+1.27%)

- CBOE VIX - 23.87

- US 10YR - 3.357%

- USD INDEX - 108.32

- FTSE 100 - 7,473 (+1.66%)

- STOXX 600 - 427.75 (+1.76%)

- UK 10YR - 3.083%

- EURUSD - 1.0120

- GOLD - US$1,736/oz

- WTI CRUDE - US$87.98/bbl

- NATURAL GAS - US$8.39/mmBTU

- DALIAN IRON ORE FUTURES - US$100.21/T

US CPI PREVIEW

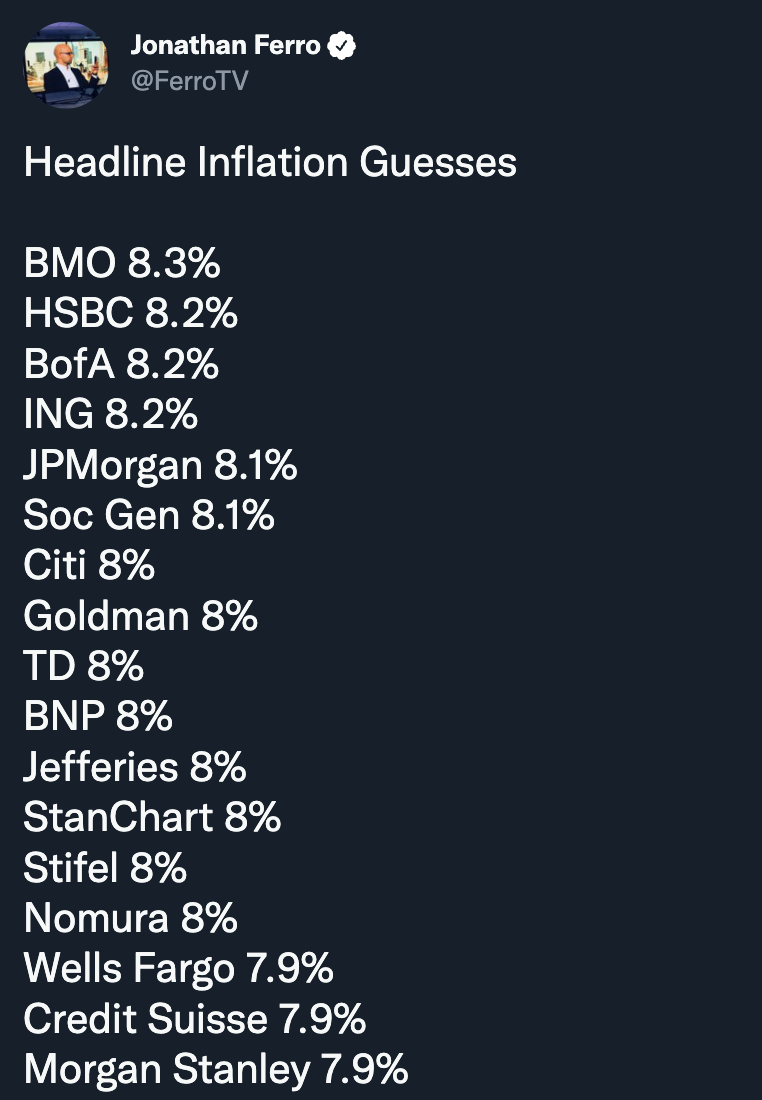

The good news is that headline inflation is likely to have slowed, given petrol prices have started to come down across the states. The bad news is that we won't know for sure until 10:30pm Sydney time tonight.

Either way, economists polled by Reuters are forecasting that inflation fell 0.1% month-on-month in August. That will take the headline rate to a year-on-year reading of 8.1%, down from 8.5% last month. Where economists do not see a cooling is in the core inflation print. Falling used car price anecdotes have been counteracted by rising shelter rents. In fact, last week, the US mortgage rate hit its highest level since 2008. The national average is now 5.89%, more than double this time last year and more records are being shattered across the timeline.

So what does it mean for assets? Here's a bevvy of commentary from the analysts:

TD: We expect inflation to continue slowing on a monthly basis as we approach the end of the year, as excess household savings continue to gradually dwindle, supply constraints ease, and oil prices lose further momentum, but for now the data remains strong on a historical basis.

Mizuho Bank: The bar is really high for this week's US CPI to protest, much less derail, growing bets on an upsized 75bp hike at next week's (21st Sep) FOMC meeting.

Yardeni: If the market rallies on a better-than-expected CPI print, we would suggest that trading accounts take some of their profits. Long-term investors should continue to invest for the long-term with more confidence that the worst of the inflation news is behind us.

ANZ: Core goods inflationary pressures are abating amid falling commodity prices, lower shipping rates, a stronger USD, and easing supply bottlenecks. By contrast, robust rental and wage growth is set to keep services inflation well above longer-run trends.

Westpac: For the upcoming September meeting, this points to another outsized increase. Whether it is 50bps (as we currently forecast) or 75bps will depend on the pulse of core inflation in August, due for release next week.

Either outcome will take the fed funds rate to the top end of the FOMC’s neutral range for policy, allowing a return to 25bp increments for the remaining hikes of the cycle. To our mind, given underlying inflation dynamics and the absence of activity growth, 3.375% at end-2022 is the most appropriate peak rate for this cycle, particularly as it is to be held for 12 months.

Citi: Unchanged messaging from Fed Chair Powell and a similar focus on fighting inflation from Vice-Chair Brainard helped cement our call (since July) for a 75bp policy rate hike at the September 21 FOMC meeting. This is despite August CPI that will likely register a softer -0.1% month-on-month headline and 0.3-0.4% month-on-month core [print].

CHEAT SHEET

THE CHART

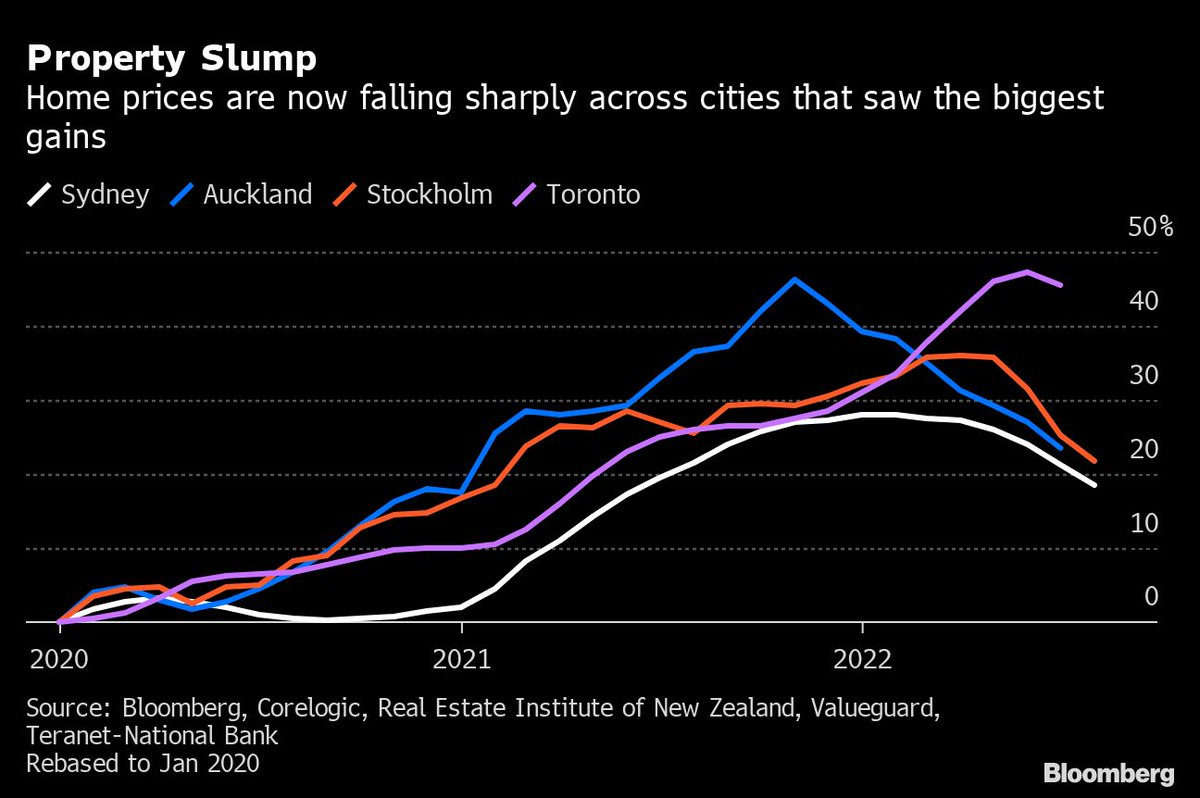

Ah, housing. The story that keeps on giving. Today's chart of the day is the trend being seen in four of the world's bubbliest markets - Sydney, Auckland, Stockholm, and Toronto. While we all think Sydney's house price falls are relatively dramatic (and they are), check out the bubble that has burst in Auckland. Even more impressive, check out the bubble that has yet to burst in Toronto.

Conclusion: Home bias sometimes distorts your perspective. Come to think of it, if the Maple Leafs finally win a Stanley Cup, a few more fans might flock to condos in Toronto's downtown to be closer to Scotiabank Arena. Imagine what rents and prices will be like if that happens!

THE INFOGRAPHIC

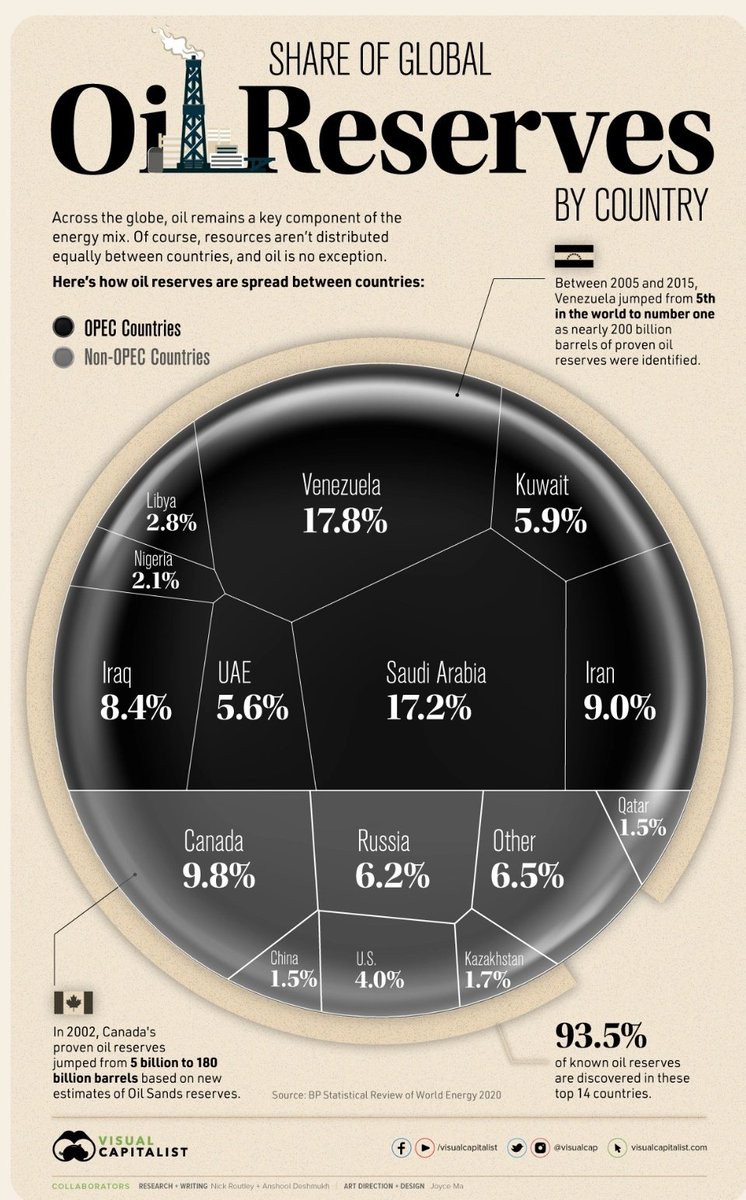

This has to be one of my favourite things I've seen online this year. Black gold has not seen a lot of love over the past decade as ESG-centric movements took over across financial markets. But the Russo-Ukrainian war has proven that old-world energy is needed as much as ever. Having said this, where nations will get it in the post-conflict world may be up for debate.

As this infographic shows, it is true that most of the world's oil reserves are held in places like Iraq, Iran, and Saudi Arabia in particular. But there are also some very powerful players outside of the OPEC+ cartel - namely Canada (read: Alberta) and, yes, Russia. When the world runs out of power, these nations attract the largest spotlight.

(QUICK) STOCKS TO WATCH

Today's stocks to watch segment will be uber-quick for two reasons.

- There aren't a lot of moves right now as we all digest reporting season and wait for more catalysts in the interim.

- All eyes are on those worldwide inflation prints anyway.

But we do have a quick upgrade and downgrade here from Jarden that's worth digging into:

Suncorp Group (ASX: SUN) is now a buy instead of an overweight at the broker. Adding in some of the other brokers on FNArena, Jarden is now the fifth broker who has positive views on the stock. The only overtly negative rating belongs to Morgan Stanley, which has an underweight rating.

Sims Metals (ASX: SGM) is now neutral instead of overweight. But - in a stranger than strange twist - Jarden is now also the fifth broker to institute a neutral rating on the company. Their reason is the uncertain outlook for scrap metal. There are no negative ratings on this stock, according to the FNArena compilation department. Just two buys and five neutrals.

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

2 stocks mentioned

1 contributor mentioned