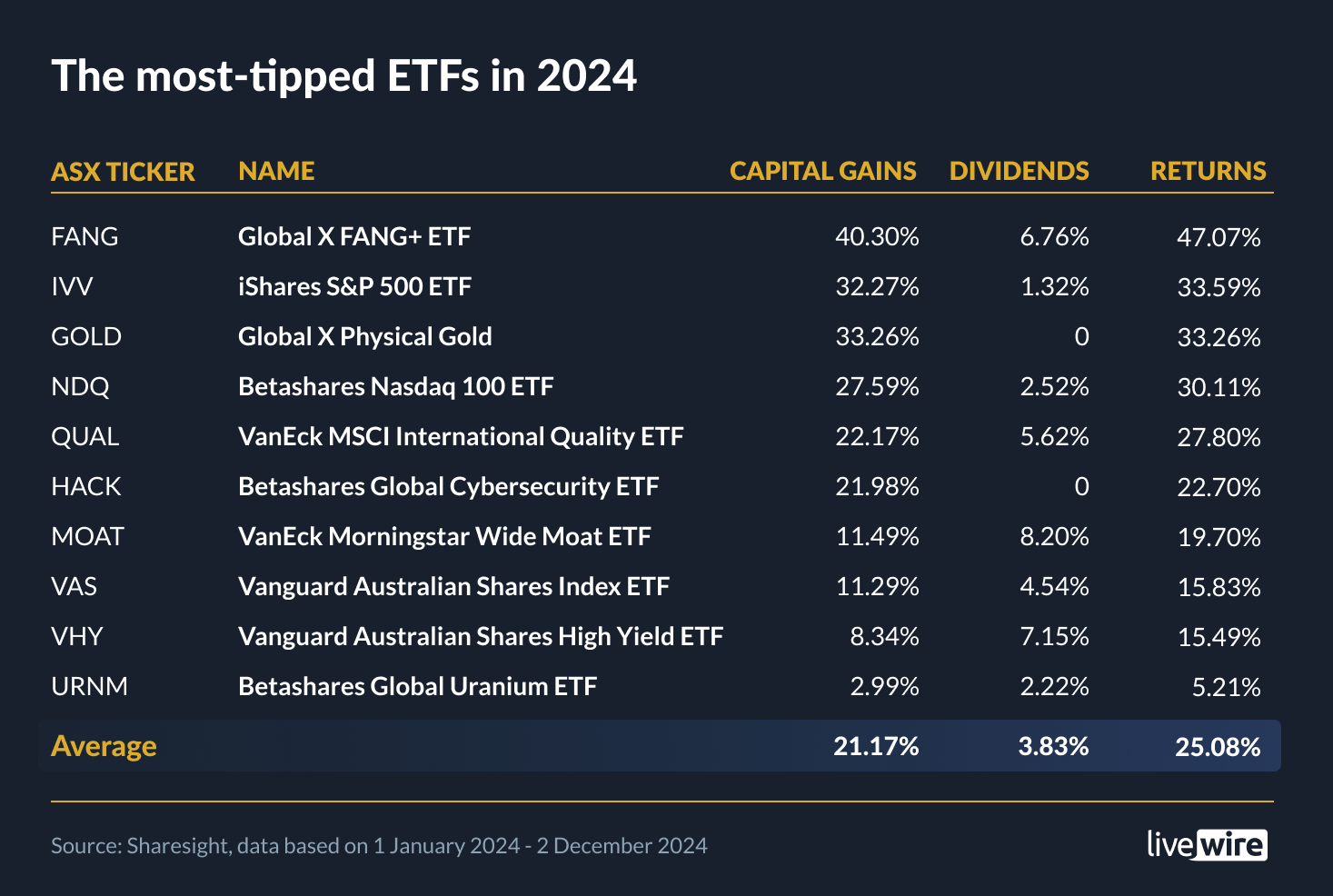

Your most-tipped ETFs returned 25.08% on average in 2024

For a year that was expected to usher in an economic slowdown and rate cuts, you could say it hasn’t been half bad for markets - although that would be an understatement.

What a year it has been. We've seen record highs in the S&P 500 and the S&P/ASX 200, and that’s all before we consider the major catalysts of the year, from Trump 2.0 to Bitcoin’s stellar resurgence, to the ongoing strength in the Magnificent Seven.

Bloomberg Intelligence recently noted that nearly 96% of ETFs delivered positive returns for the year, with most in the double-digits. While this data reflected US listings, the Australian number can’t be far off.

Livewire readers slanted towards global equities, particularly big tech, in their picks for 2024. That was hardly a surprise given the AI-boom that started in 2023, and continued to pay off in 2024.

The expectation of volatility (and high prices) also saw GOLD feature in the list, and it similarly hit record prices across the year, particularly in the lead-up to the US Federal Election. Of course, it has seen one of its worst sell-offs in over a year post the election of Donald Trump as US President. It begs the question whether we may see the inaugural selection of a bitcoin or other crypto ETF in the top picks for 2025.

The selection of URNM is also interesting, given that at this point last year, we were starting to hear more about future demand and shortages, along with the fact that the ASX-listed companies in the space were not yet producing uranium. The ETF was relatively new, having only been launched in June 2022. Over the course of the year, we’ve seen Boss Energy (ASX: BOE) re-start production and uranium prices climb to new highs. Will we see uranium return in next year’s picks?

In this wire, I’ll review your 10 most-tipped ETFs for 2024 and how they performed. There are no prizes for guessing the bigger driver of winning performance.

Please note data is as at 2 December 2024.

1. Global X FANG+ ETF (ASX: FANG)

The FANG ETF seeks to invest in companies at the leading edge of innovation – in short, it holds the Magnificent Seven sans Tesla plus a few additions (Broadcom, ServiceNow, Crowdstrike, and Netflix).

For much of the year, not holding Tesla has benefitted the ETF, with the company's share price declining sharply due to lower earnings and competition with Chinese EV manufacturer BYD. That said, Tesla experienced a bump after better-than-expected Q3 earnings and the announcement of CEO Elon Musk’s appointment to run a commission into US Federal Government efficiency.

2. iShares S&P 500 ETF (ASX: IVV)

The iShares S&P 500 ETF offers exposure to the largest 500 US companies by market capitalisation, seeking to replicate the S&P 500 index.

The US market has been on a tear this year, and the AI boom has been a significant player. It’s also worth highlighting strength in a number of sectors. The US market surged after the US Federal Election on the back of expectations for corporate tax cuts and is likely to continue to be a staple holding well into 2025 and beyond.

3. Global X Physical Gold (ASX: GOLD)

The Global X Physical Gold ETF invests in physical gold bullion, with each unit of investment representing a 0.009249232 fine troy oz (as at September 2023).

Gold prices reached an all-time high of US$2790.07 in October 2024, and have risen 29.75% YTD. Prices did fall post the US Federal Election (though remain high). Gold is typically favoured in periods of volatility and uncertainty like today’s environment, but on the flip side, President-Elect Trump’s interest in promoting Bitcoin as a reserve currency may see some challenges to gold prices. The GOLD ETF is the oldest physical gold ETF in the world, and has been a long staple for many portfolios.

4. Betashares Nasdaq 100 ETF (ASX: NDQ)

The Betashares Nasdaq 100 ETF invests in 100 of the world’s largest non-financial companies across technology, consumer services and other growth-oriented businesses.

Following the Nasdaq 100 is often used as a proxy for the US market, given big tech has been largely responsible for the gains in the S&P 500 in recent years.

Performance has been strong for NDQ for a number of years now – and it similarly has been a most-tipped ETF for Livewire and Market Index readers for some time. It was last year’s top performer.

5. VanEck MSCI International Quality ETF (ASX: QUAL)

QUAL gives investors exposure to a diversified portfolio of quality international companies listed on exchanges in developed markets around the world (ex Australia).

Quality is a constant in times of uncertainty and volatility – and certainly the index played to the value of that. Where we’ve seen earnings cuts domestically and internationally, quality has usually stayed firm and this has tracked in performance.

6. Betashares Global Cybersecurity ETF (ASX: HACK)

The growing need for cybersecurity is not going anywhere. The world had a pointed reminder of how dependent we are on protective businesses during the Crowdstrike outage earlier this year.

HACK tracks exposure to leading companies in the cybersecurity sector, such as Palo Alto Network and Fortinet and, as investment continues to grow in this space, leaders in the sector continue to benefit and offer performance.

Many fund managers have pointed to the critical importance of this theme and the investment growing it. You can read some recent discussion of this in the following wires by contributors.

7. VanEck Wide Moat ETF (ASX: MOAT)

MOAT offers investors exposure to a diversified portfolio of attractively priced US companies with sustainable competitive advantages according to Morningstar’s equity research team. It’s a high-conviction approach and the biggest sector allocations are towards financials and healthcare.

Both financials and healthcare benefited across the year.

8. Vanguard Australian Shares Index ETF (ASX: VAS)

The largest ETF in Australia, VAS tracks the S&P/ASX 300, which has had a bumper year. There’s been strong dividends and earnings from the likes of the big banks and big resources (I’m looking at you BHP) to support the performance of this ETF across the year.

9. Vanguard Australian Shares High Yield ETF (ASX: VHY)

The Vanguard Australian Shares High Yield ETF seeks to provide low-cost exposure to companies on the ASX that have higher forecast dividends relative to other ASX-listed companies by tracking the FTSE Australia High Dividend Yield Index.

The Big 4 banks and big resources (BHP, Woodside, Rio Tinto) all offered bumper dividends across the year and, on the whole, delivered solid earnings.

10. Betashares Global Uranium ETF (ASX: URNM)

URNM aims to provide exposure to a portfolio of leading companies in the global uranium industry. Prices continued to climb in 2024, and uranium has increasingly become a point of discussion, particularly in light of the need for power supply to maintain AI and data centre demand. It is a resource that has been underinvested in over the past 20 years, and demand outstrips supply.

While it's not the type of performance we've seen from big tech equities, there's a lot to suggest we're at the start of the uranium trend.

Some recent articles on this theme follow:

Livewire's Outlook Series for 2025 returns in January.

You can join in and share your views and top picks via our survey. As a thanks for joining in, you'll gain early access to the top ETF and stock picks from fellow readers, as well as the top stock picks from this year's panel of experts.

2 topics