Your prescription for finding the best healthcare stocks

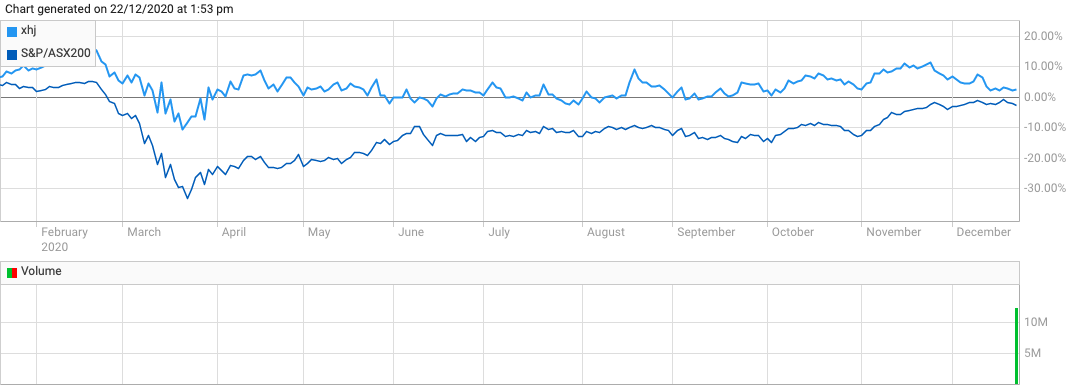

In a year in which medical matters dominated discussions at almost every level, healthcare has been a key investment theme. And as a sector it has performed relatively well, the ASX 200 healthcare index ending the year around 5 per cent up. But that performance has come with considerable volatility, as shown in the chart below.

Local large-cap healthcare stocks versus S&P/ASX 200 YTD

Source: ASX, comparing S&P/ASX 200 Healthcare Index (XHJ) with the S&P/ASX 200

Healthcare is a highly diverse and complex sector, including everything from private hospital operators to drug developers, medical equipment makers and pathology service providers. It’s also a very global industry, in which a few countries, particularly the US, move the dial the most.

To help make sense of the sector, I recently asked the following Australian portfolio managers and a specialist healthcare analyst which parts of the segment are best-positioned for 2021, and beyond.

- Emma Fisher, portfolio manager, Airlie Funds Management

- Stuart Welch , senior research analyst, Alphinity Investment Management

- Chris Kallos, director and life science analyst, MST Access

A bucket approach

Emma Fisher, Airlie Funds Management

We might think of the Australian-listed healthcare sector as divided into three buckets:

- The globals (CSL, Cochlear, Resmed, Fisher and Paykel, Sonic, Ramsay),

- The locals (Healius, Virtus, Monash, aged care)

- The hopefuls (biotech stocks including Telix, Starpharma).

While sector performance tends to be correlated, the individual companies have vastly different economics, barriers to entry, markets and demand profiles. As a result of the difference in business models, it can be dangerous to flock to any-and-all healthcare stocks for perceived “safety” during periods of market volatility.

By and large, we believe the best long-term returns lie in the global bucket, as these businesses have long growth runways and superior economics.

The local businesses typically offer Medicare-funded services. While these have defensive volume growth, with a single government payer it is unlikely that these businesses will sustain above-average returns over the medium term. We have seen this play out recently in the aged care space via funding cuts.

The best time to buy a local business is when the reimbursement outlook looks stable, and volumes are strong or recovering. Right now, that description applies to Healius, Virtus and Monash, although we remain wary of the more capital-intensive aged care space.

The hopefuls are typically loss-making biotechs that are using equity markets to fund their clinical trials and early marketing efforts for any successful drugs/devices.

These businesses are higher-risk and investors face significant downside if trials prove unsuccessful – see Factor Therapeutics (ASX: FTT) and Acrux Limited (ASX: ACR) for a warning.

We are not attracted to the typically binary outcomes that the hopefuls provide, albeit we note that if investing in the space, it’s best to select those businesses that have multiple shots on goal via different products in development.

Three reasons Aussie healthcare appeals

Stuart Welch, Alphinity Investment Management

The key opportunities currently in the healthcare sector broadly fit into three buckets. Firstly, there are some COVID beneficiaries where the market is underestimating the magnitude or duration of the increased demand for their products. A good example of this would be Fisher & Paykel Healthcare (ASX: FPH). Changes to clinical practice guidelines made through COVID will support increased adoption of FPH’s products going forward.

Secondly, there are some companies that were badly impacted by COVID that are recovering faster than anticipated, and that may potentially achieve greater than pre-COVID profitability. This could be driven either through better pricing, as is the case with CSL (ASX: CSL); or market share, as is the case with Cochlear (ASX: COH).

Thirdly, there are some companies that will benefit from pent-up demand once normal operations resume post-COVID.

A good example of this is Ramsay Healthcare (ASX: RHC), which will benefit from the large backlog of elective surgeries to be cleared.

Small-cap listings tipped to explode

Chris Kallos, MST Access

Biotechnology generally has attracted a lot more attention. This year has been a huge one for capital raising, as companies anticipating slowing of the economy looked to strengthen balance sheets. Generally, these have been early-stage companies that typically need capital to advance clinical programs.

Aside from the terrible toll COVID has taken, it has drawn people’s attention to the whole biotech space. As such, people are now much more aware of the importance of biotechnology overall. A year ago, some people wouldn’t even know what a vaccine was, let alone the different types of mRNA and viral vector vaccines – so the retail investor space has become much more attuned to the whole biotechnology sector.

On a mid- to long-term basis, COVID has been quite positive in educating the market and building investor confidence.

I think there’s going to be a lot more interest in companies at the small end of the spectrum.

This is an area that requires more research than other sectors given the variety of companies represented and often complex technologies.

The attention and money thrown at the COVID vaccine effort have really shone a light on the whole sector. As such we expect more biotech companies coming to market over the medium term.

Conclusion

Whether in segmenting the big players in healthcare, or describing the different stages of COVID’s effect on the sector, it’s interesting to see both Airlie’s Fisher and Alphinity’s Welch apply “bucketing” to make sense of the space. And it will be fascinating to see how the “hopefuls” perform in the next few years, and whether Fisher or MST Access’s Kallos are closest to the mark on local biotech performance.

Stay up to date

Don't forget to follow my profile to read the upcoming wires in this three-part series, and give this article a like if you enjoyed it. The next instalment will discuss which healthcare segments and markets have the best opportunities; and in part three each commentator will discuss their preferred healthcare stocks.

1 topic

11 stocks mentioned

5 contributors mentioned