2024: The year of elections

Recent election surprises in Mexico, India, and the European Union have underscored the volatility that can arise from unforeseen political outcomes. These events highlight the risks of relying on pre-election polls for investment decisions, as unexpected results can swiftly disrupt equity markets and currencies. With critical elections upcoming in France, the UK, Japan, and the U.S., investors should prioritize resilience and avoid making hasty portfolio adjustments based on predicted political outcomes.

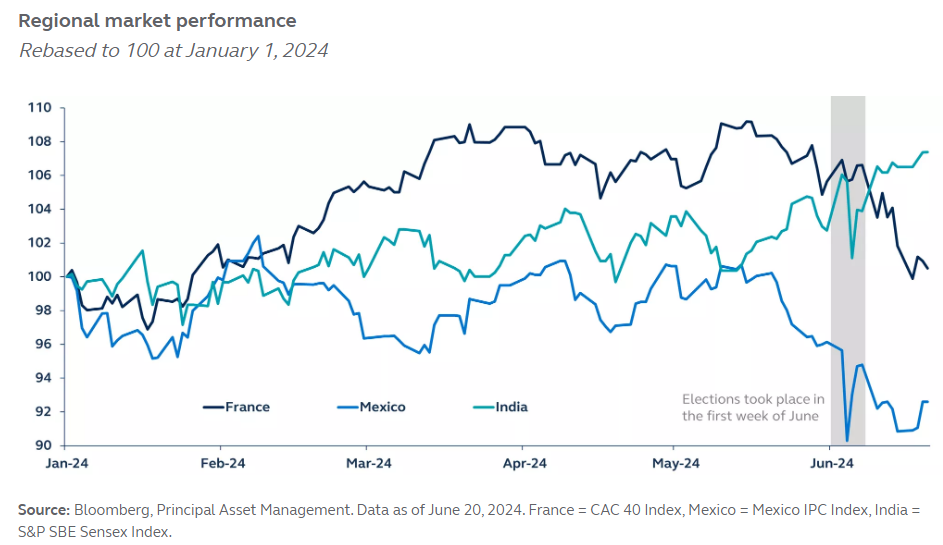

This year, over half of the world’s population have gone or will go to vote in national elections. The past month alone has seen three election surprises, each triggering losses in the region’s respective equity markets and currencies:

- Mexico: the Morena party won the election with an unexpected landslide victory, prompting concern that the party may amend Mexico’s constitution and may show less fiscal discipline.

- India: India re-elected Prime Minister Modi as expected but, rather than winning by a landslide, Modi’s BJP party unexpectedly lost its outright majority, casting doubt on its ability to push forward with important reforms.

- European Union: While the success of far-right parties at the recent parliamentary elections was expected, the French President’s decision to call snap elections was not. Markets fear that the result will risk policy paralysis and delayed fiscal consolidation.

While some of the market losses have now been partially reversed, the surprise results have provided a timely reminder to investors that pre-election polls do not have a perfect predictive track record, and unexpected outcomes can trigger significant volatility.

The coming months will see further elections, including in France, the United Kingdom, Japan and the big one, the U.S. presidential election. As recent elections have shown, election night shocks are not unusual, and adjusting portfolio allocation in order to position for who is most likely to win is a dangerous strategy.