3 ETFs to take advantage of the recent market drawdown

Last week was rough for people who were long the equity market. The ASX 200 had its worst week since September 2023, while the NASDAQ 100 finished last week down by more than 6% in the middle of what has otherwise been a healthy earnings season (so far). Meanwhile, the S&P 500 rallied at the open then closed lower for four consecutive days last week - the longest streak of intra-day reversals in six years.

The small pullback has encouraged some people, like ex-Pendal fund manager Vimal Gor, to tell investors that this is the kind of short-term pullback that should be used as a buying opportunity. Others, like the team at Fundstrat (who are borderline permabulls), argue the fundamental case for stocks is still intact and will remain so unless the conflict in the Middle East were to spread.

So if you're in the market (and have the cash) to take advantage of the recent drawdown, then this wire is for you. We've engaged the help of Cameron Gleeson at Betashares for the final edition of The $10,000 Idea.

What’s your opinion on valuations in the markets that you cover?

Cameron Gleeson: In terms of equities, many country indices are not far from all-time highs, so it is important to focus on which companies can deliver earnings growth over time to justify valuation multiples. Companies that can generate high or improving profitability, strong cashflows and have low financial leverage should (and generally do) command a premium.

While much of the market’s rally since November was driven by falling bond yields and valuation multiple expansion, there is also strong underlying earnings momentum in US tech, Japan, India and (more recently) global energy stocks.

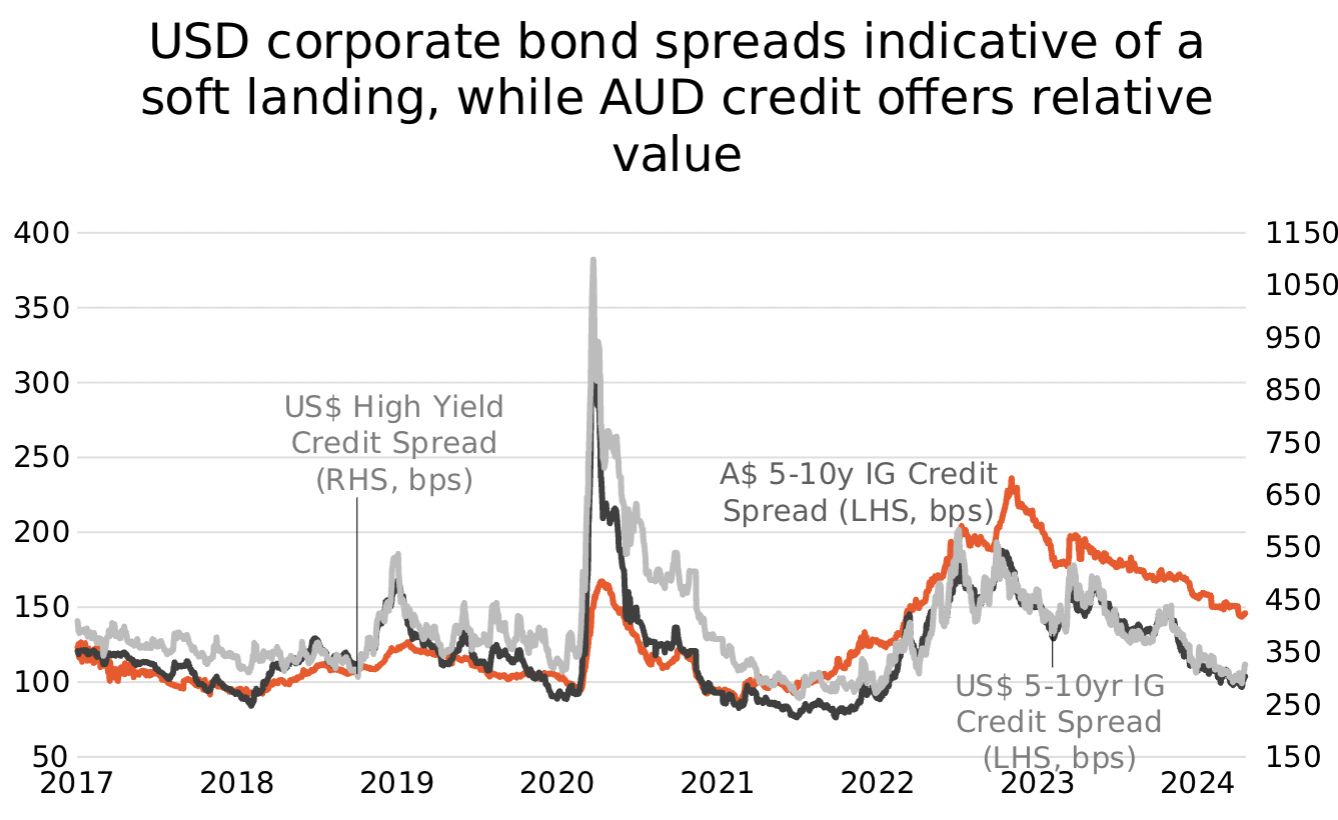

In fixed income, government bonds are offering reasonable compensation (Australian 10-year yielding ~4.5% p.a. at the time of writing) for defensive assets. US credit spreads (investment grade and high yield) are close to multi-decade lows, even as we are seeing rising stress in high yield, whereas investment grade credit spreads remain attractive in Australia where default risk is incredibly low, given the quality and sector makeup of key issuers.

In commodities, both gold and oil provide a hedge against the risks of inflation remaining elevated and the potential for escalating conflict in the Middle East.

What is your biggest hope and concern for markets moving forward?

Cameron Gleeson: The biggest hope from a financial markets perspective is that the US economy remains strong while the Fed continues to manage inflation back to target for a soft landing.

Just weeks ago, a soft landing this year, accompanied by rate cuts looked likely. However, recent news about the potential for Middle East tensions plus the recent uptick in the U.S. CPI could put that at risk. In terms of the Middle East, approximately 30% of global oil trade passes through the Strait of Hormuz, and any restrictions on that choke point by Iran is a major risk to both inflation and global growth.

If inflation remains sticky and central banks are not in a position to cut rates, the higher-for-longer regime may start to bite, particularly for corporations seeking to refinance cheap COVID-era debt. However, for the moment, our central case is that US employment and economic activity hold up and equity earnings avoid a major hit.

Explain your process for deciding which assets you’d pick for this experiment.

Cameron Gleeson: For this aspect, allocations are considered for the core component of the portfolio, being global and Australian equities and fixed income, and it is assumed the investor already has a relatively well-balanced portfolio with a “growth” profile.

Cameron's $10,000 Ideas

| Asset Class | ETP and Stock Code | Allocation (%) |

| International Equities | BetaShares NASDAQ 100 ETF (ASX: NDQ) | 40% |

| Australian Equities | BetaShares Australian Quality ETF (ASX: AQLT) | 35% |

| Credit Income | Betashares Interest Rate Hedged Australian Investment Grade Corporate Bond ETF (ASX: HCRD) | 25% |

The case for global tech

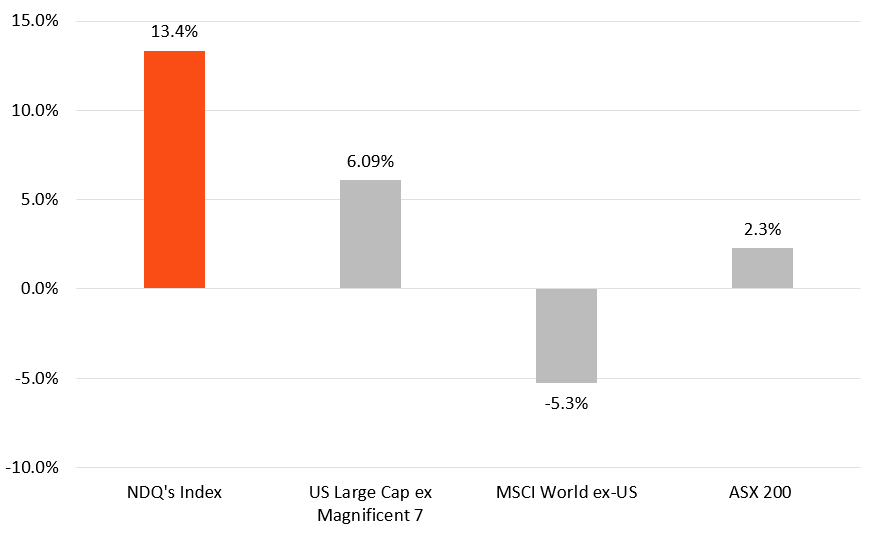

Over the past few months consensus earnings forecasts have been upgraded in the US and downgraded elsewhere. A deeper dive into US equities shows that earnings upgrades are largely being driven by companies in the Nasdaq 100. In fact, ex-Nasdaq earnings growth is nothing to get excited about.

Consensus 1yr forward EPS growth rates

Source: Bloomberg. As at 30 April 2024. Calculations based on 12-month forward EPS estimates.

At an index level, the trailing PE for the Nasdaq 100 might sit toward the top end of its long-term range at 30.4x, but the 3-year forward P/E is 20.2x – on this measure, the Nasdaq 100 arguably looks cheap. Nasdaq companies have a history of beating consensus forecasts, and their long-run growth story is backed up by their commitment to innovation. On average, Nasdaq companies spend nearly 7x as much on R&D as non-Nasdaq S&P500 companies.

Over time, this has created a virtuous circle, with the introduction of a new highly profitable product driving earnings growth and funding the development of the next generation of highly profitable products.

More and more of the world’s best companies, including those from outside the US like ASML Holding (NASDAQ: ASML), Linde PLC (NASDAQ: LIN) and Atlassian (NASDAQ: TEAM), are choosing to list on the Nasdaq. Nasdaq companies generate revenue from a globally diverse customer base, with scalable platforms that transcend national borders. At an index level, half the Nasdaq 100's revenue is now sourced from outside the U.S. (equivalent to the MSCI World Index) making it a truly global exposure at that level.

For Australian investors, Betashares Nasdaq 100 ETF (ASX: NDQ) offers significant sector diversification benefits when paired with Australian equities, which provides the potential for not only higher returns but also lower portfolio-level volatility.

The case for Australian Quality

Cameron Gleeson: Quality companies are defined by their high return on invested equity, low levels of leverage and earning stability. The dominance of the big banks and miners in our local market means the ASX 200 Index is skewed towards more value-oriented companies which have historically weighed on our market's performance relative to global peers.

Despite the dominance of value-oriented companies in Australia by size, local companies that fit the quality definition have historically outperformed, including during the recent earnings season, with our expectation being they will continue to be favoured over lower-margin, more indebted and cyclical businesses going forward.

The Betashares Australian Quality ETF (ASX: AQLT) tracks an enhanced index to give you a broad Australian equity core, with greater weights assigned to higher quality companies.

For example, AQLT has a higher weight to Macquarie Group (ASX: MQG) relative to the broad market and a lower relative weight to the ‘Big 4’ banks. Over the last 10 years, Macquarie has had a higher return on equity than the ‘Big 4’, whose profitability has been squeezed by competition in key market segments and APRA’s regulatory capital. This has translated into Macquarie shares having a price return of 334% over the last 10 years while the average of ‘Big 4’ banks, who pay out most of their earnings as dividends rather than reinvesting for growth, experienced ~0% price return for the period.

Macquarie and 'Big4'bank price return: Dec 2013 - Dec 2023

AQLT has outperformed the S&P/ASX200 Index by 3.7% YTD and on average by 3.4% p.a. since inception.

The case for Investment Grade AUD Credit

Cameron Gleeson: If it’s the potential for strong risk-adjusted returns that you are after, few asset classes can match credit. Market expectations of a US, and global, soft landing provide a constructive backdrop for credit generally as the risks of default and illiquidity can be expected to decrease and credit spreads compress under this scenario.

Further, Australian investment grade (IG) credit currently offers particularly compelling relative value against global equivalents as Australia is yet to experience the levels of spread normalisation observed elsewhere.

Considering the high quality of Australian Investment Grade corporate issuers like infrastructure providers, Australian Pacific Airports, NBN Co, Transgrid, AusNet and WestConnex, and leading Australian and global corporates, such as Coles (ASX: COL), Woolworths (ASX: WOW), Wesfarmers (ASX: WES), McDonald's (NYSE: MCD), and Verizon (NYSE: VZ), compensation. These are entities with robust businesses well placed to meet obligations, even during a severe downturn.

Source: Bloomberg. As at 17-Apr-2024; Credit spreads defined by option-adjusted spreads against equivalent government bonds

Betashares Interest Rate Hedged Australian Investment Grade Corporate Bond ETF (ASX: HCRD) invests in an equally weighted portfolio of 50 investment grade corporate bonds selected based on expected returns rather than debt outstanding, seeking to avoid the shortcomings of traditional debt-weighted indices and provide higher returns (HCRD gains this exposure by investing in Betashares Investment Grade Corporate Bond ETF (ASX: CRED).

HCRD then hedges away the interest rate risk inherent in its underlying portfolio by shorting Australian government bond futures. In doing so, HCRD strips out the greatest source of corporate fixed-rate bond volatility (interest rate risk) and maintains the most consistent source of return (credit risk).

Since its inception, HCRD’s approach to isolating Australian IG credit premia has outperformed the major fixed and floating rate benchmarks, subordinated bank Floating Rate Notes, listed hybrids, and all by some margin.

Given recent market conditions, it has even outperformed the ASX 200 over this period, and with a fraction of the volatility, reinforcing the case that investors no longer need to stretch out the risk spectrum for liquid sources of income. The aforementioned market factors provide a favourable environment for HCRD’s strong performance since its inception to continue.

This is the final edition of the current series of The $10,000 Idea. If you missed any of the other pieces in the series, you can catch them here.

.png)

.png)

Reach your financial goals with Betashares

Whether you’re looking to grow your savings, invest in your super or get started on reaching your first financial goals, Betashares can help you look forward. Find out more.

3 topics

13 stocks mentioned

4 funds mentioned

1 contributor mentioned