3 powerful trends for the future

State Street Global Advisors - SPDR

The notion of environmental, social and governance considerations tend to land in the spotlight during extreme events, such as the 2019 heatwave in Europe, wildfires in Australia and California — and now, the COVID-19 crisis.

In the context of a global pandemic and shifting investor preferences, the team at State Street Global Advisors have compiled this white paper entitled ESG Investing: From Tipping Point to Turning Point. The report highlights the growth in the area and explores three powerful trends will drive a nearly eightfold increase in global ESG ETF and fund assets — from US$170 billion as of May 31, 2020 to more than US$1.3 trillion by 2030.

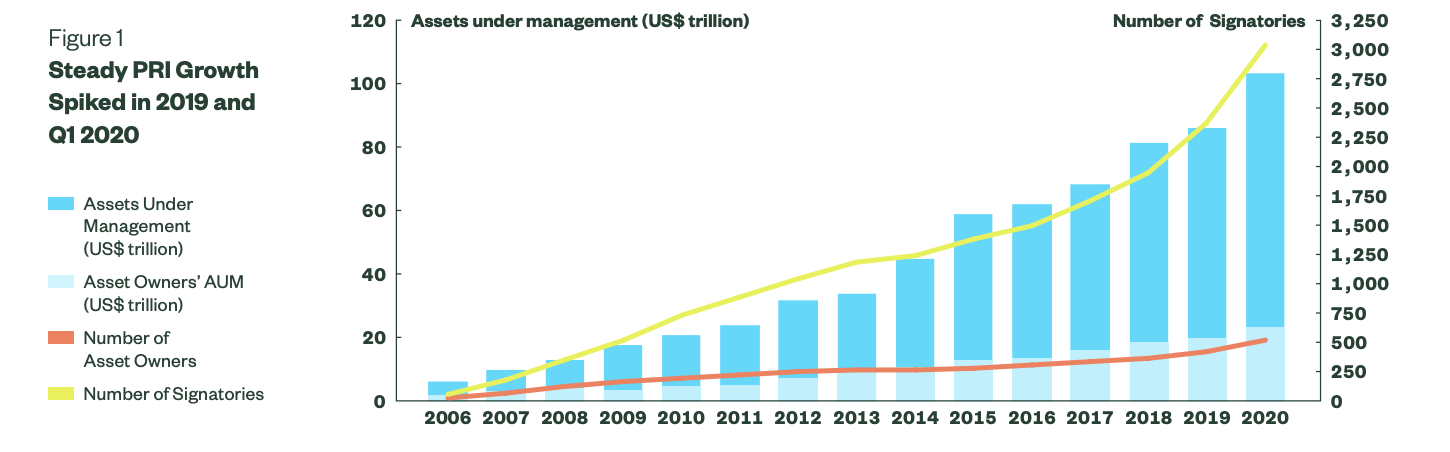

Beyond the headlines, interest in ESG has been growing steadily for some time. Illustrating this greater awareness of ESG issues, the number of signatories to the United Nations supported Principles for Responsible Investment — the principal framework for investors committed to integrating ESG issues into their decision-making — has been increasing, and stood at more than 3,000 as of March 31, 2020. Led by European-based institutional investors, assets under management of these PRI signatories has grown from less than US$6 trillion at PRI’s launch in 2006 to US$103.4 trillion through the first quarter of 2020.

Source: Principles for Responsible Investment, as of March 31, 2020.

Source: Principles for Responsible Investment, as of March 31, 2020.1. "Great Reset" in a turbulent 2020: In addition to the human tragedy, COVID-19 has had severe negative impacts on the economy, corporate profits and the labor market.

One of the most gut-wrenching consequences of this pandemic is that the health, social and financial struggles it has created are not shared equally. The people least able to combat the negative impacts of the virus are the ones shouldering the biggest burdens. Fed Chairman Jay Powell observed, “The people who’re getting hurt the worst are the most recently hired, the lowest-paid people. It’s women, to an extraordinary extent. We’re releasing a report tomorrow that shows that, of the people working in February who were making less than $40,000 per year, almost 40% have lost their jobs in the last month or so.”

The COVID-19 pandemic and its aftershocks have put a spotlight on important ESG issues, such as income inequality, diversity and inclusion, social injustice, employee welfare and climate change. Burying our heads in the sand, hoping that it all just goes away or that somebody else will deal with these issues is no longer an option. Many investors have also concluded that they can no longer look the other way and are ready to address these ESG issues in their portfolios.

The 2010s were all about laying the groundwork for ESG investing through education and government regulation. We expect the 2020s will be about renewed commitment and putting ESG investing into action.

2. Investors reshaping the investment industry: In the past decade, investor appetite for indexing and transparent rules-based factor investment strategies at an affordable cost with greater tax efficiency has permanently changed the investment landscape.

Investors are demanding even more choices when it comes to their investments. Unsurprisingly, exchange traded funds and index mutual funds have been the primary beneficiaries of this massive industry transformation.

However, until recently, investor adoption of ESG ETFs and index mutual funds has been, at best, uneven. Despite compound annual growth rates of more than 30%, ESG ETFs make up a fraction of the industry’s more than $6 trillion in assets under management globally.

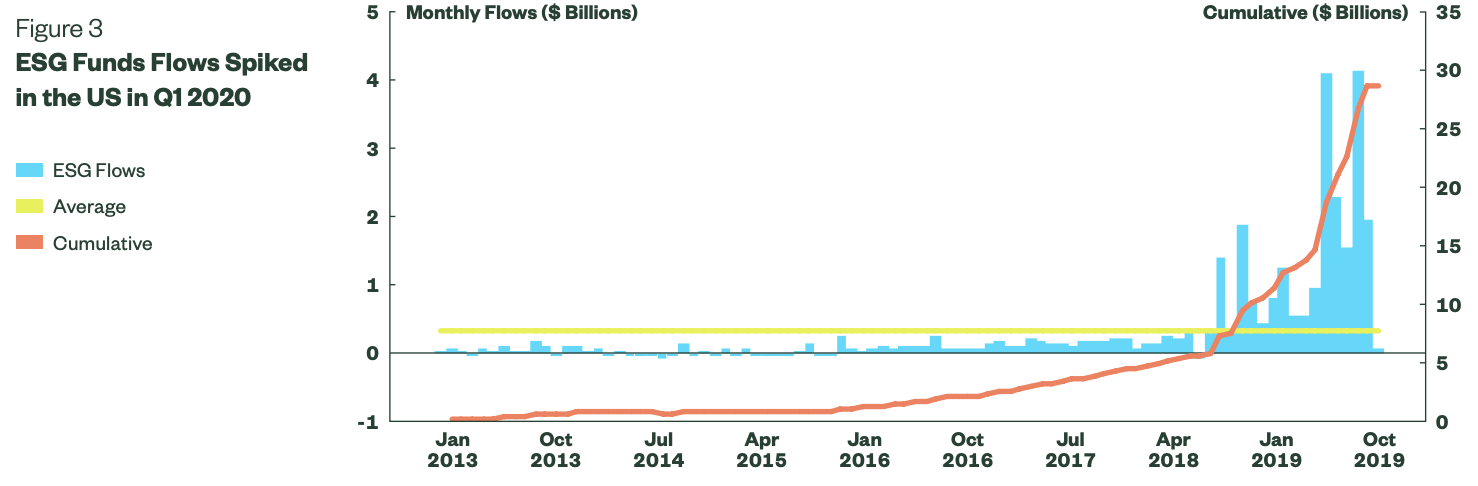

But the COVID-19 pandemic may be changing investor attitudes toward ESG investing. In fact, according to Morningstar, during the first quarter of 2020, ESG funds attracted record inflows. Globally, ESG funds saw inflows of $45.7 billion, while the broader fund universe had an outflow of $384.7 billion as markets plunged in response to the pandemic.

Source: Data from Bloomberg Finance L.P., as of 03/31/2020, calculations by SPDR Americas Research as of 06/15/2020.

Source: Data from Bloomberg Finance L.P., as of 03/31/2020, calculations by SPDR Americas Research as of 06/15/2020.Although you might expect companies with stronger governance, risk management practices and labour standards to outperform, we believe many investors wrongly associate ESG issues with negative effects. That is, they hold that incorporating ESG data, especially in the “best-in-class” space (where companies with better ESG ratings are systematically overweighted), negatively impacts a portfolio’s performance. But a recent Morningstar study concludes that there is “no evidence that investors need to sacrifice returns when they invest in good ESG companies globally compared with bad ESG stocks.”

Moreover, studies have identified a positive link between ESG integration and measures of corporate performance. In fact, in a well-known meta-study of over 2,000 academic studies, 90% showed a non-negative relationship between the incorporation of ESG factors and corporate financial performance, and 63% identified a positive link.

These studies suggest that portfolios with ESG integration may provide downside protection when markets are struggling, underscoring ESG’s potential role as a long-term investment.

3. Boomers preparing to transfer wealth to their children: We believe that ESG investing’s ability to manage risk and create long-term value — so attractive to institutions — also makes ESG a clear choice for individual investors, especially families thinking about legacy planning. In our view, greater use of ESG as a quality factor that can improve portfolios and lead to a better world will have an especially profound impact on society as the greatest intergenerational wealth transfer in history begins.

During the pandemic, stay-at-home orders around the world combined with the economic pain unleashed by COVID-19 have resulted in more forced family togetherness. Sadly, many younger adults have lost their jobs and abandoned urban city centers to return home to the perceived safer suburbs of their youth. Not to mention college and high school students unexpectedly stuck at home with dear old mom and dad. By some estimates, more than 35% of adults between the ages of 18 and 35 are living with their parents.

With the human tragedy of the COVID-19 pandemic unfolding and the increasing focus on the need to address systematic racism, Boomer parents and their stuck-at-home children are having real conversations about personal values. This growing dialogue between parents and their children has naturally flowed into discussions about estate planning, planned giving and family philanthropy as a means to enact real societal changes. In our view, there has never been a greater sense of urgency to act than there is right now.

We think of ESG investing as a bridge between Boomers — who are desperately trying to hold on to their youthful dreams of making the world a better place — and their children who want to ensure that their actions, including their investments, are aligned with their values. Ultimately, this may create a powerful joint vision for the family’s legacy.

We believe that as the transfer of wealth occurs, ESG investing will soon be in the mainstream of every investment portfolio. In our view, that change will reverberate and be magnified through increased government regulation and institutional investments.

Conclusion

The world has undergone tremendous changes in the past six months. From the vast human tragedies, a passionate commitment to make long-lasting, positive changes has seemingly emerged. Along with social change, it appears apparent that the trends reshaping the investment management industry and the largest wealth transfer in history will collide to result in a nearly eightfold increase in ESG ETFs and index mutual fund assets this decade. To access more insights, you can find the full report here.

Never miss an insight

Stay up to date with our latest thoughts by clicking follow below and you'll be notified every time we post content on Livewire.

2 topics

Meaghan Victor is Head of SPDR ETFs Asia Pacific Distribution at State Street Global Advisors. We launched many of the world’s first ETFs, including the first Australian-listed ETF in 2001, and the first ETF launches in the United States, Hong...

Expertise

Meaghan Victor is Head of SPDR ETFs Asia Pacific Distribution at State Street Global Advisors. We launched many of the world’s first ETFs, including the first Australian-listed ETF in 2001, and the first ETF launches in the United States, Hong...