5 things you should know about ASX-listed battery metal stocks

Over the past two weeks, I’ve taken a deep dive into five major battery metals – lithium, copper, rare earths, graphite and nickel – with the help of five experts.

Lithium – Wilsons’ senior metals and mining equity analyst Sam Catalano

Copper – Tribeca Investment Partners’ portfolio manager Todd Warren

Never miss an updateGet the latest insights from me in your inbox when they’re published.

Never miss an updateGet the latest insights from me in your inbox when they’re published.

Advertisement

Rare Earths – Perpetual’s senior equities analyst Clarke Wilkins

Graphite – Fat Tail Investments’ commodities analyst James Cooper

Nickel – Janus Henderson Investors’ senior portfolio manager Darko Kuzmanovic

The deep dives were aimed at providing insights about how investors can balance near-term risks such as China's economic slowdown, recession risks and still-hawkish central banks against the otherwise bullish long-term outlook for EVs and decarbonisation. Today, I’ll be consolidating some of their spiciest insights into five key takeaways.

#1 Why lithium is king – it’s all about leverage

It goes without saying that a majority of lithium demand comes from the EV sector.

The same can’t be said for other battery metals like graphite, where roughly a quarter of supply goes into making anodes and nickel, where two-thirds of demand comes from the stainless steel industry.

The takeaway here is that the path of least resistance – or the commodity that’s most leveraged to the EV thematic – is lithium, at least right now. Whereas copper, graphite and nickel have tended to be heavily influenced by macroeconomic events – a dynamic that continues.

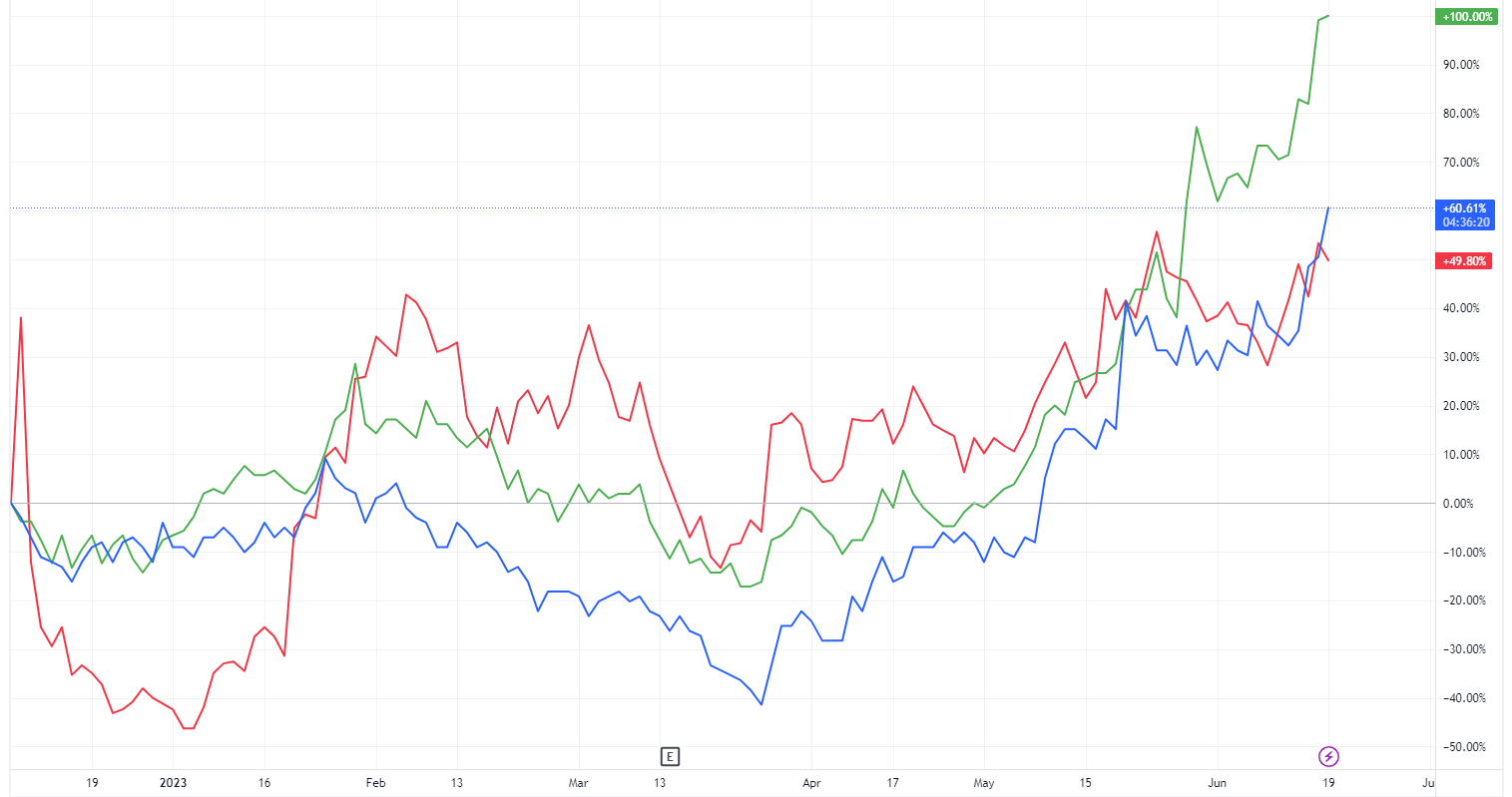

A copper bull can say all he or she wants about how a wind turbine requires 4.7 tonnes of copper. But at the end of the day, we know the copper is priced like an industrial metal. It’s this leverage that’s enabled most large cap lithium stocks like Pilbara Minerals (ASX: PLS), Allkem (ASX: AKE) and Liontown Resources (ASX: LTR) to trade within arm’s reach of all-time highs (although some M&A might have helped their performance as well).

%20Share%20Price%20-%20Market%20Index.png)

This has also seen the market, more recently, rotate into emerging names like Delta Lithium (ASX: DLI), Leo Lithium (ASX: LLL) and Patriot Battery Metals (ASX: PMT).

#2 Nickel – The bottom of the barrel

Nickel had the most depressing short-to-medium term outlook across the five battery metals.

From a supply perspective, it faces a tsunami of supply from Indonesia. Fastmarkets expects the nickel market to be “well supplied up to 2025”, with the view that prices will be “under some pressure this year and in the following years”.

But that isn’t the only problem. As Kuzmanovic explains – “Nickel’s demand is much more concentrated, driven by stainless steel and batteries.”

“Whereas copper sees a much broader demand outlook including demand from things like wind turbines and solar panels.”

If we go back to that discussion about leverage – Nickel doesn’t appear to have a whole lot of it. At least for now.

#3 Structurally higher prices

The concept of structurally higher prices was a recurring theme across my discussions for lithium, copper and rare earths. It’s the idea that there’s a floor for prices – because if they go any lower, it won’t encourage much-needed new supply.

Lithium was also bolstered by the M&A thematic. When lithium valuations were under pressure earlier this year, Albemarle tried to take over Liontown on three separate occasions.I asked Wilsons’ Catalano if this dynamic creates a floor for lithium stocks (and if the dip is buyable) – in short, he reckons so.

Interestingly, Chinese lithium carbonate prices fell around 70% between November 2022 and April 2023. But prices have now doubled from April lows to 312,500 yuan a tonne.

As for rare earths, Wilkins said there “is an expectation that we see structurally higher rare earth prices going forward.”

Tribeca’s Warren described copper as a “fairly asymmetric trade,” adding that “there are some potential headwinds in the immediate term but a lot of that’s already priced.”

An asymmetric trade refers to when the outcome of a trade has more profit than the loss or risk taken to achieve the profit (aka the potential upside is greater than the downside loss).

#4 Graphite and oil prices

Graphite is one of those commodities that can be produced in a factory via a heat treatment process that causes the carbon atoms to rearrange themselves into a crystalline structure.

Synthetic graphite is typically much purer than natural graphite, which makes it ideal for applications where purity is critical, such as semiconductors and batteries. Of course, the downside is that it's an energy-intensive process that produces harmful emissions.

But this creates an inverse relationship where low energy prices makes synthetic graphite more viable. As Fat Tail’s Cooper puts it, “If energy prices rise, then we could actually see upward pressure in graphite prices because synthetic becomes less viable.”

Graphite anode prices – both synthetic and natural – hit record highs in the first half of 2022 – which coincides with Russia’s invasion of Ukraine, which sent WTI crude as high as US$130 a barrel.

But oil prices are now trading around US$70 a barrel, around 25% below pre-Russian invasion levels. And unless we see a headline along the lines of “China clamps down on synthetic graphite production” – This could be placing downward pressure on graphite prices.

#5 Geography matters

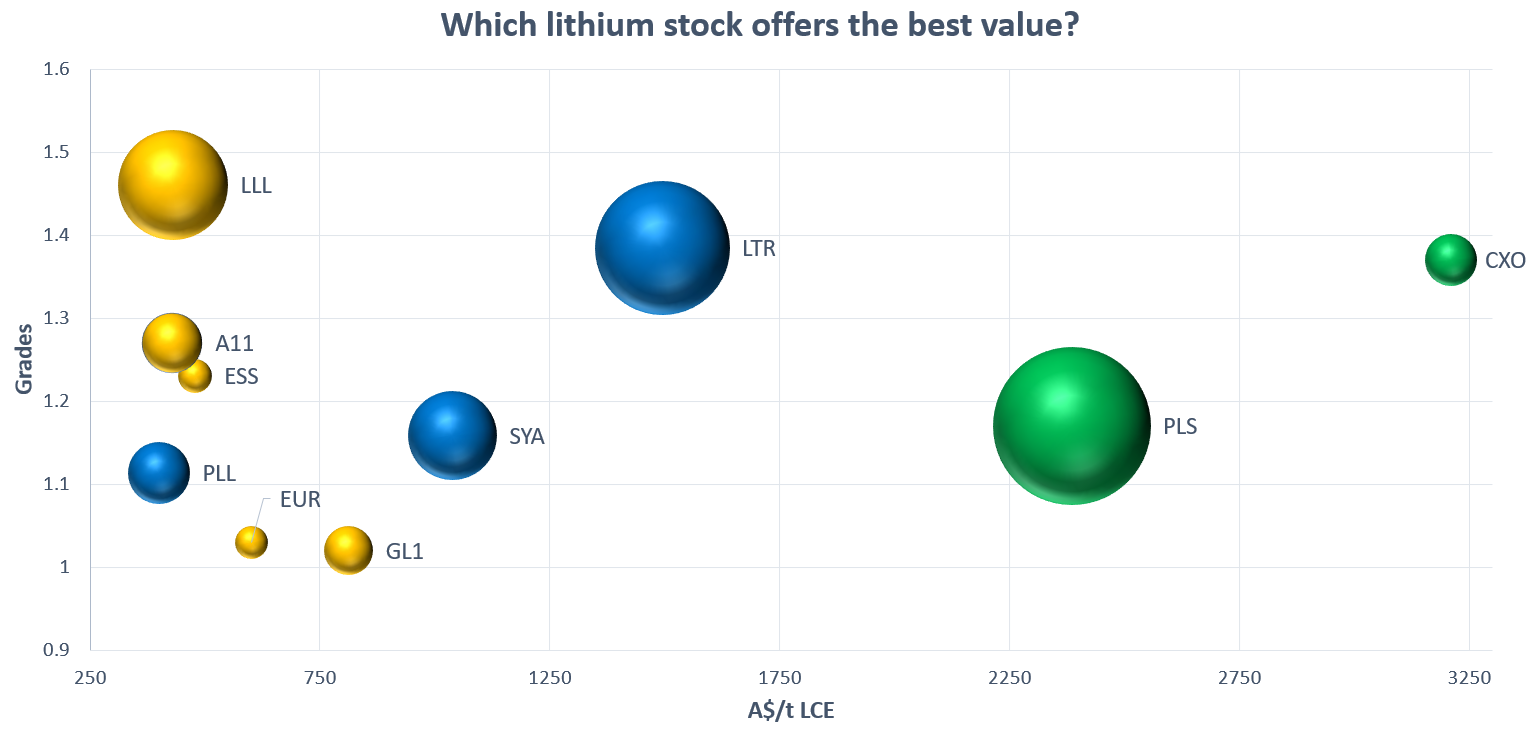

A few months ago, I wanted to provide a simple way for investors to see which ASX-listed lithium and graphite stocks (the other commodities are a work-in-progress) offered the best value for money based on two simple factors: Market cap and Mineral Resource.

You can read the lithium article here and the graphite one here.

In summary, being located in a Tier 1 jurisdiction like Australia or Europe typically resulted in a higher valuation (or you’re paying more for every tonne of resource). In the case of lithium, Africa-based developers like Leo Lithium and Atlantic Lithium appeared rather undervalued compared to peers like Core Lithium.

When I asked the analysts about this dynamic, I received two entirely different answers.

“A lot of the domestic, easy-to-own exposures are relatively fully priced. And that’s the difference,” said Catalano, adding that “the real upside opportunities lie in exposure to developers, whether they be domestic or offshore.”

Whereas for graphite, Cooper said “there’s not really any incentive to take on the extra risk of investing in Africa. Your focus should probably be on quality explorers and developers in stable jurisdictions.”

This wire was first published for Market Index on Monday, 19 June 2023.

Welcome to Livewire, Australia’s most trusted source of investment insights and analysis.

To continue reading this wire and get unlimited access to Livewire, join for free now and become a more informed and confident investor.

Join Free to unlock all exclusive content

To continue reading and gain unlimited access to all Livewire content, join free to become a more informed, confident investor.

5 topics

6 stocks mentioned

3 contributors mentioned