A closer look at Pushpay Holdings

Pushpay offers a mobile payments and engagement product, specifically targeting the US faith sector. Pushpay has become a leading solution provider within this sector and has grown from nothing to processing an annualised equivalent run-rate of US$3b of giving to US churches, in ~5 years.

The US faith sector consists of ~340,000 churches, represents ~US$123b p.a. in payments and has typically grown at GDP levels, despite stagnating

participation amongst the broader population. In 2017, ~75% of churches

had some form of online giving solution, however only 15% of total giving

was done online. When compared to mobile engagement and payments in

the retail sector, the US faith sector falls far behind. In retail, we note:

- Global mobile payments for online goods and services is estimated to grow to ~2.1b users in 2019. [Criteo]

- M-commerce will reach ~US$284b, or 45% of the total U.S. commerce market by 2020. [BI Intelligence]

- 60% of shoppers plan to start making more mobile purchases in 2017 and shop with retailers offering mobile solutions. [Facebook IQ]

While these may represent a relative extreme, we believe it highlights a

significant opportunity for a mobile giving solution as the US faith sector

emerges from the ’digital dark ages’.

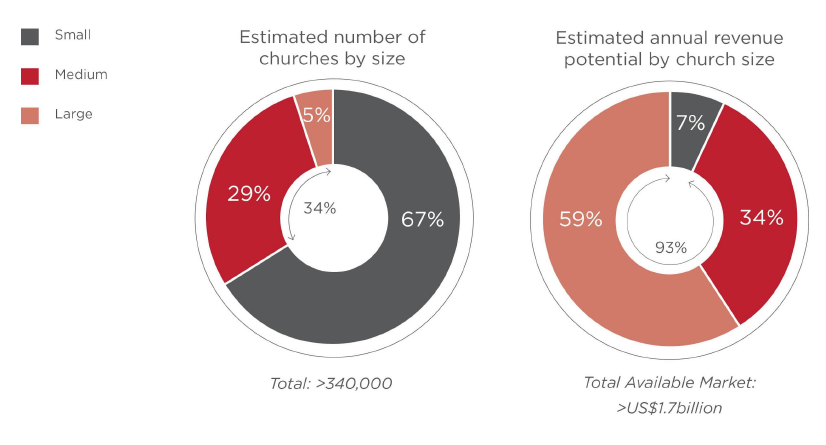

Pushpay’s market opportunity is significant. Assuming a 30% penetration

rate in digital giving and using current subscription and payment processing

rates (Pushpay’s two key revenue drivers), the revenue opportunity is

~US$1.7b p.a., as illustrated in the chart. If digitalisation approaches levels

similar to that of retail (50%+), this increases to in excess of US$2.5b p.a. We

also note that Pushpay has pivoted its strategy in 2017, with a focus on the

large and medium segment of the sector. This segment comprises ~35% of

churches by number but represents ~90% of total giving. The Company has

only captured ~4.5% of this total revenue opportunity and we believe it has

scope to capture a significantly higher level.

Pushpay is well placed to achieve ongoing success due to the following:

- Simple user interface that is easy to sign-up and use, which simplifies the ability to give to your church, whether it be to the general fund or any ad-hoc fundraising initiatives.

- Strong payment processing (further improved with payment assurance) and seamless integration with key church management software platforms.

- Continued focus on enhancing the solution which is backed by top cloud service providers, thus offering scalability.

- A multifaceted and fully funded marketing approach that spans from the annual eChurch Summit, to smaller thought leader conferences and direct sales engagement with churches.

Source: Pushpay

Our fundamental research effort extended to a comprehensive review of

the US faith sector, in which we reviewed over 1,000 churches (mostly large

sized, 1,000+ weekly attendees) to identify those using Pushpay as well as

the extent of penetration by competitors. From this analysis, we believe that

Pushpay is firmly a leading provider of mobile giving and engagement

solutions to the US faith sector. We also conducted a proprietary survey of

churches to understand how implementing the Pushpay solution has

benefited them. This analysis has provided insights into the typical uplift

that Pushpay’s solution can provide a church, as well as how their marketing

approach is driving adoption, despite being a premium priced solution.

In our view, we think Pushpay can maintain strong growth from customer

adoption (5% to 10% p.a.), particularly among the large to medium size

segment (higher net lifetime value). We also believe there is latent value in

the existing customer base. Additionally:

- When implemented, the typical initial level of giving is ~20% and progresses towards ~30% within the first few years. The focus is now in aiding churches to lift that rate towards 50%+ (Pushpay claims some churches are at 80% ‘ceasing basket’ service). This has two impacts, firstly more giving is processed through Pushpay and secondly digital givers typically give more and are more persistent in giving levels thus lifting overall giving for a church.

- There is potential for a material uplift in the existing book as ’legacy’ contracts are rolled over to be more consistent with Pushpay’s pricing for the service today (which is more comprehensive than when those contracts were signed). Any churn risk of churches leaving the solution (rare to our knowledge and typically small in sized) are readily replaced by higher value churches.

- Greater use and adoption of the engagement aspects of Pushpay’s solution, in which additional revenue can be earned as churches add modules to their level of service.

Pushpay is well-placed to grow materially over the medium term (3-year

revenue CAGR of 30% p.a.+) as it continues to execute its strategy and

benefits from the growing digitalisation within the US faith sector. We rate

management highly who are incentivised and aligned via their strong insider

ownership. Comparable high-growth ’software as a service’ (or SaaS)

companies exhibiting leading market positions are commanding premium

multiples supporting Pushpay’s favourable risk-reward.

For further insights from Paragon Funds Management, including our full update for April, please click here

1 topic

1 stock mentioned