ASX 200 ends slightly lower in seesaw day, utilities gloom vs uranium boom

Today in Review

Markets

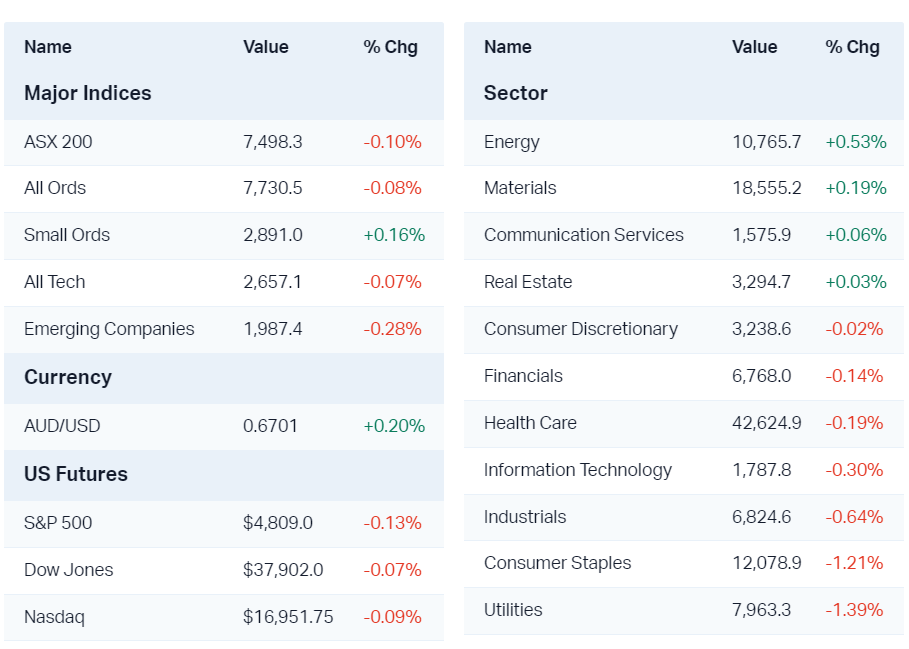

ASX 200 Session Chart

%20Intraday%20Chart%2012%20Jan%202024.png)

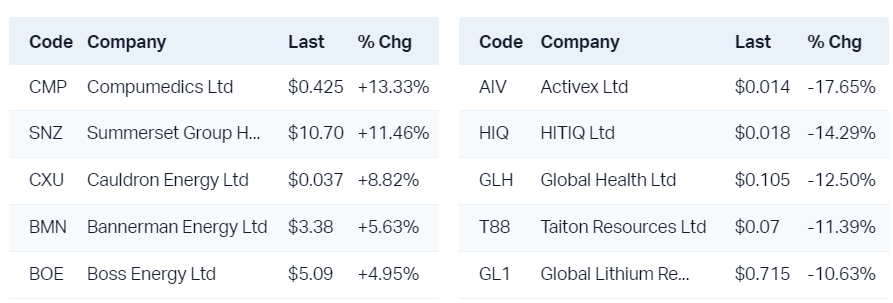

The S&P/ASX200 (XJO) finished 7.7 points lower at 7,498.3, 0.3% from its session low and just 0.1% from its high. Not terrible, and even less notable given the trading range was a measly 0.4%. Volumes were miniscule, even for this time of year.

In the broader-based S&P/ASX 300 (XKO), the neutrality of the day was reflected in the advance/decline line...advancers lagged decliners by just 123 to 150.

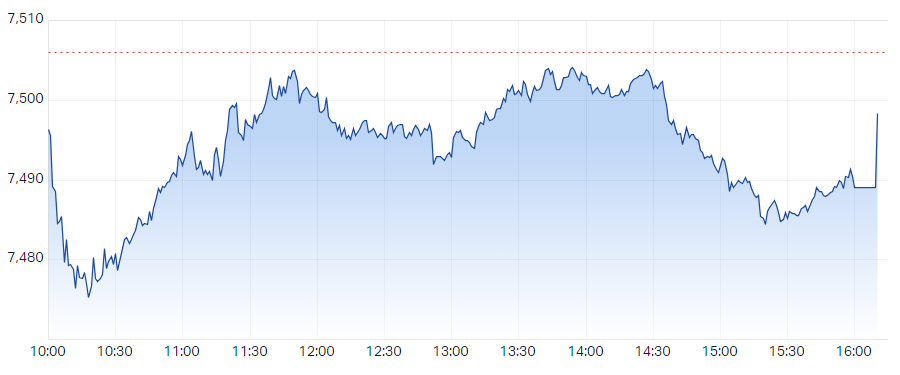

The S&P/ASX 200 Energy Sector (XEJ) +0.5% was the best performing sector today, well, it kinda had to be – it was the only sector seeing any gain! Crude oil and natural gas prices are both trading a little higher in Asia. If you're invested in, or thinking of investing in the ASX energy sector, this article I wrote today is a must read!

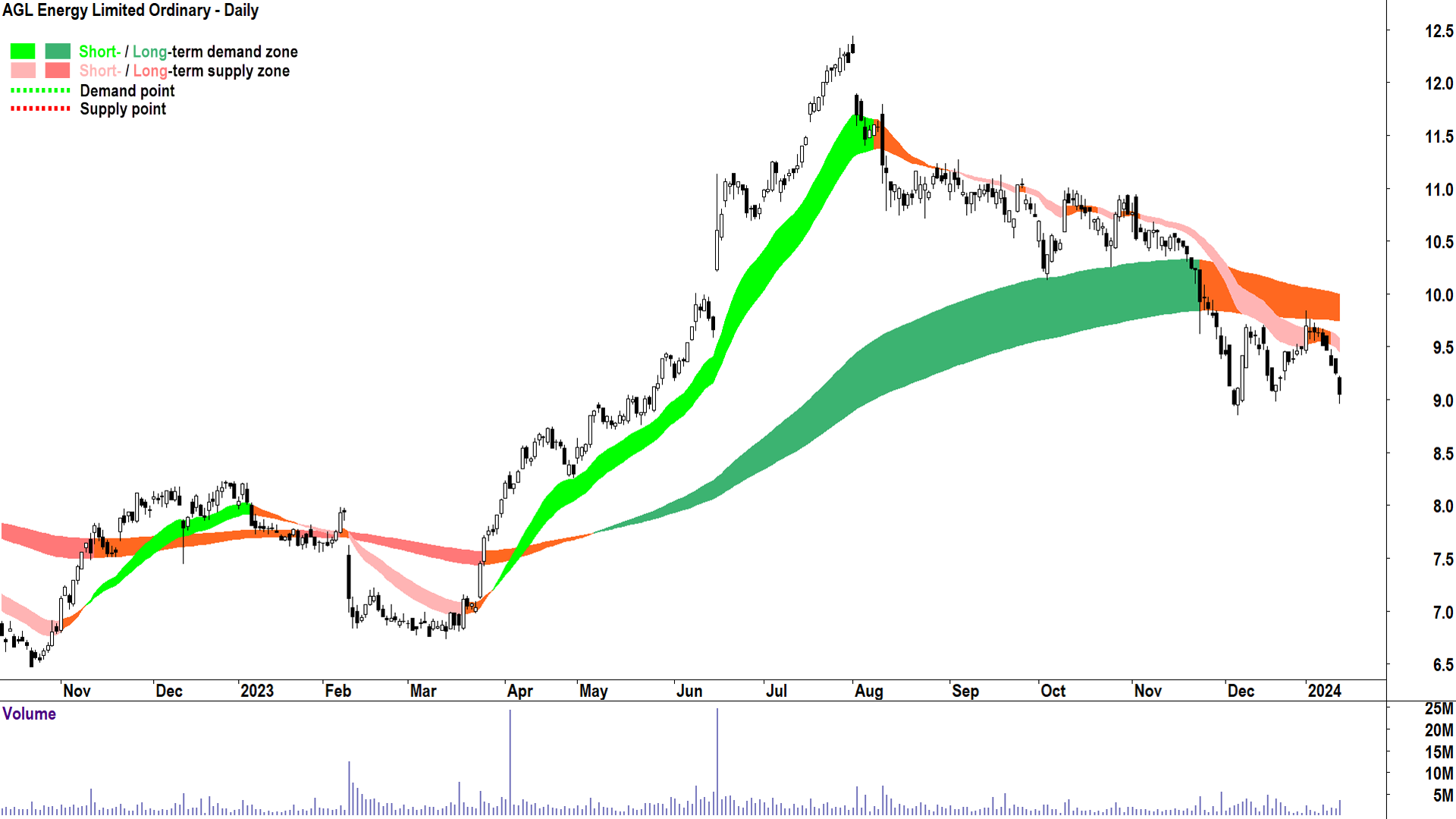

Doing it tough today was the S&P/ASX 200 Utilities (XUJ) -1.4%. The XUJ was weighed down by majors Origin Energy (ASX: ORG) -0.7%, AGL Energy (ASX: AGL) -2.2%, and APA Group (ASX: APA) -1.9%. It's worth checking these charts. ORG and AGL look like they're potentially slipping into long term downtrends, and APA looks like it's resuming one.

As covered in depth in this article I published earlier today, there’s been plenty of excitement in social media given a certain uranium price provider reported the uranium price tipped US$100/lb. As you can see from the table below, the ASX uranium sector was a clear winner (technically uranium stocks are also part of the XEJ, so this also explains why the XEJ outperformed today).

Economy

No major economic data releases today

What to watch out for...

Tonight:

USA Producer Price Index (PPI) at 12:30am, forecast to rise 1.3% p.a. for the 12 months to December, a monthly increase of 0.1% (vs core +1.9% p.a. & +0.2%)

Monday:

MI Inflation Gauge at 11:00am, previous reading +2.3% p.a.

ANZ Job Advertisements for December, previous reading -4.6%

Latest News

ChartWatch: Uranium bull run continues: US$100/lb down, where to next?

Woodside, Santos attractive, but this is the cheapest stock in ASX energy: JP Morgan

Morning Wrap: ASX 200 to fall, S&P 500 eases + US inflation accelerates in December

Evening Wrap: ASX 200 notches important win as tech, consumer discretionary gain

9 of the best stocks to buy in a sell-off

Why Core Lithium's mine closure was just the tip of the iceberg

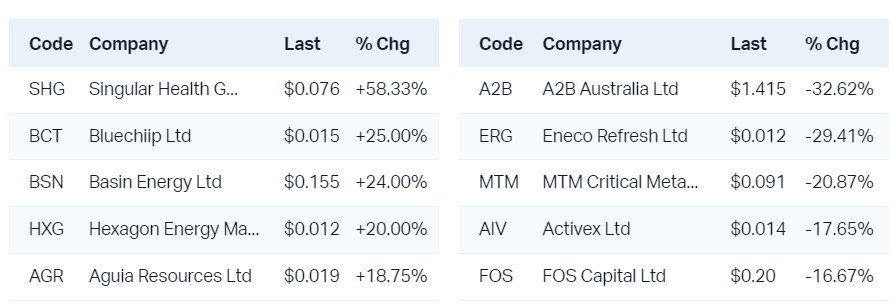

Interesting Movers

Trading higher

+7.7% Core Lithium (CXO) - No news since 05-Jan Strategic Review Update

+7.6% Deep Yellow (DYL) - Uranium price tips US$100/lb, broad sector rally, rise is consistent with short and long term trends

+5.6% Bannerman Energy (BMN) - Uranium price tips US$100/lb, broad sector rally, rise is consistent with short and long term trends

+4.9% Boss Energy (BOE) - Uranium price tips US$100/lb, broad sector rally, rise is consistent with short and long term trends

+4.6% Bellevue Gold (BGL) - No news, rallying off long term uptrend ribbon

+4.3% Neuren Pharmaceuticals (NEU) - No news, rise is consistent with short and long term trends

+4.0% Seven West Media (SWM) - No news, rally is small compared to overall long term downtrend

+3.9% Navigator Global Investments (NGI) - No news, improving short and long term uptrends

+3.6% Telix Pharmaceuticals (TLX) - No news since 08-Jan JP Morgan Healthcare Conference and Trading Update, trying to break out of recent trading range

+3.2% Lotus Resources (LOT) - Uranium price tips US$100/lb, broad sector rally, rise is consistent with short and long term trends

+3.2% Sandfire Resources (SFR) - No news, trading to hold technical support around $6.50

+3.0% Ainsworth Game Technology (AGI) - No news, rise is consistent with short and long term trends

Trading lower

-12.9% Nuix (NXL) - 1H24 Results Update

-8.2% Zip Co (ZIP) - No news, appears to be resuming long term downtrend

-7.6% Healius (HLS) - No news, decline is consistent with short and long term downtrends

-5.6% Piedmont Lithium Inc (PLL) - No news, decline is consistent with short and long term downtrends

-5.0% Red 5 (RED) - No news since 08-Jan December Qtr Positions Red 5 to Achieve Top End of Guidance

-4.7% Carnarvon Energy (CVN) - Fallout from 10 Jan: Downgraded to neutral from overweight at JP Morgan; Price Target: $0.19 from $0.20

-4.6% The Star Entertainment Group (SGR) - No news, decline is consistent with short and long term downtrends

-4.6% Calix (CXL) - No news, decline is consistent with short and long term downtrends

Broker Notes

ANZ Group Holdings (ANZ) retained at neutral Citi; Price Target: $26.00

Bendigo and Adelaide Bank (BEN) downgraded to sell from neutral at Citi; Price Target: $8.85 from $9.25

Bank of Queensland (BOQ) downgraded to sell from neutral at Citi; Price Target: $5.20

Commonwealth Bank of Australia (CBA) retained at sell Citi; Price Target: $84.00

Coronado Global Resources Inc. (CRN) retained at buy Bell Potter; Price Target: $2.15 from $2.00

Core Lithium (CXO) retained at neutral Macquarie; Price Target: $0.20 from $0.32

Healius (HLS) downgraded to underweight from equal-weight at Morgan Stanley; Price Target: $1.30

Insignia Financial (IFL) downgraded to underperforrm from equalweight at Macquarie; Price Target: $2.85

National Australia Bank (NAB) retained at sell Citi; Price Target: $25.75

Pinnacle Investment Management Group (PNI) retained at outperform Macquarie; Price Target: $10.75 from $10.76

Red 5 (RED) upgraded to buy from hold at Canaccord Genuity; Price Target: $0.39 from $0.32

Westpac Banking Corporation Ordinary (WBC) retained at neutral Citi; Price Target: $22.25

Whitehaven Coal (WHC) retained at sell Bell Potter; Price Target: $7.25 from $6.50

Worley (WOR) retained at buy Citi; Price Target: $20.50

Scans

This article first appeared on Market Index on 12 January 2024.

4 topics

10 stocks mentioned