Australia's property market is in crisis. But who (or what) is to blame?

Last month, RBA Governor Philip Lowe issued a blunt warning: housing supply will struggle to keep up with Australia's population growth.

In short, too many people and not enough houses to put them in.

"Population growth has picked up sharply and it now seems likely that the annual rate of population growth will soon be around 2%, which would be close to the peak reached during the resources boom," he said in a speech at the National Press Club.

"In contrast, the expansion in the supply side of the housing market is expected to be fairly modest. It takes a long time for housing supply to respond fully to shifts in population growth – in the previous episode of strong population growth, it took around five years."

.png)

The story has been broadly framed through the lens of migration. But is that the whole story?

In this wire, I identify the supply-demand imbalance gripping Australia's property market, note the effect it has on inflation, and identify the likely drivers of this imbalance. Spoiler: it's about a lot more than just migration.

The problem

There is a clear shortfall between housing supply and demand, according to the State of the Nation Housing report 2022-23, published by the National Housing Finance and Investment Corporation (NHFIC).

From 2023 to 2033, the cumulative gap between new household formation and anticipated new supply is anticipated to be -79,300 dwellings.

This has put upward pressure on rents.

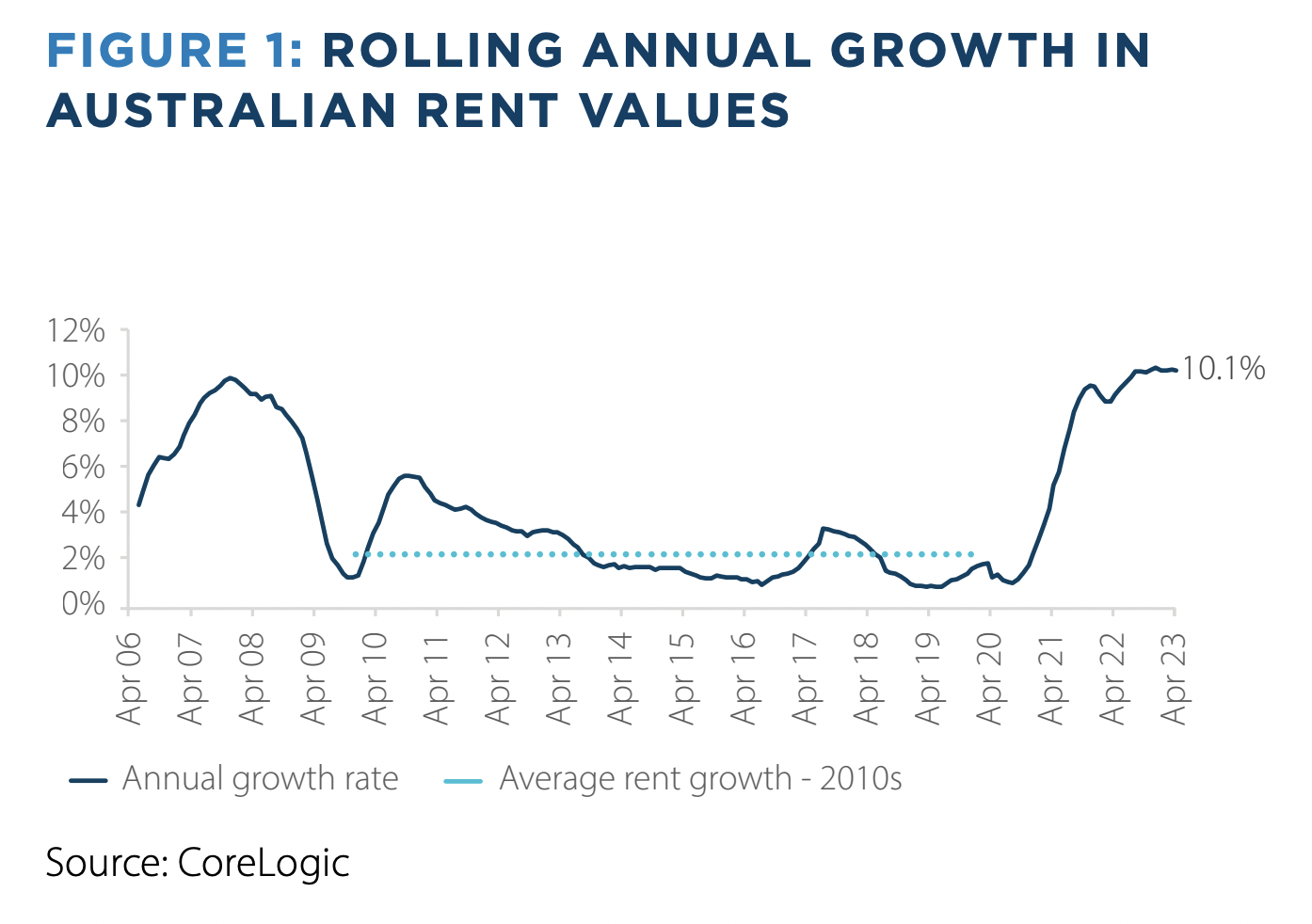

The CoreLogic hedonic rental value index had an annual average growth rate of 2.1% nationally in the decade to January 2020, more or less matching inflation.

In December 2022, though, annual growth in the index hit a high of 10.2%, retreating ever so slightly to 10.1% in the 12 months to March.

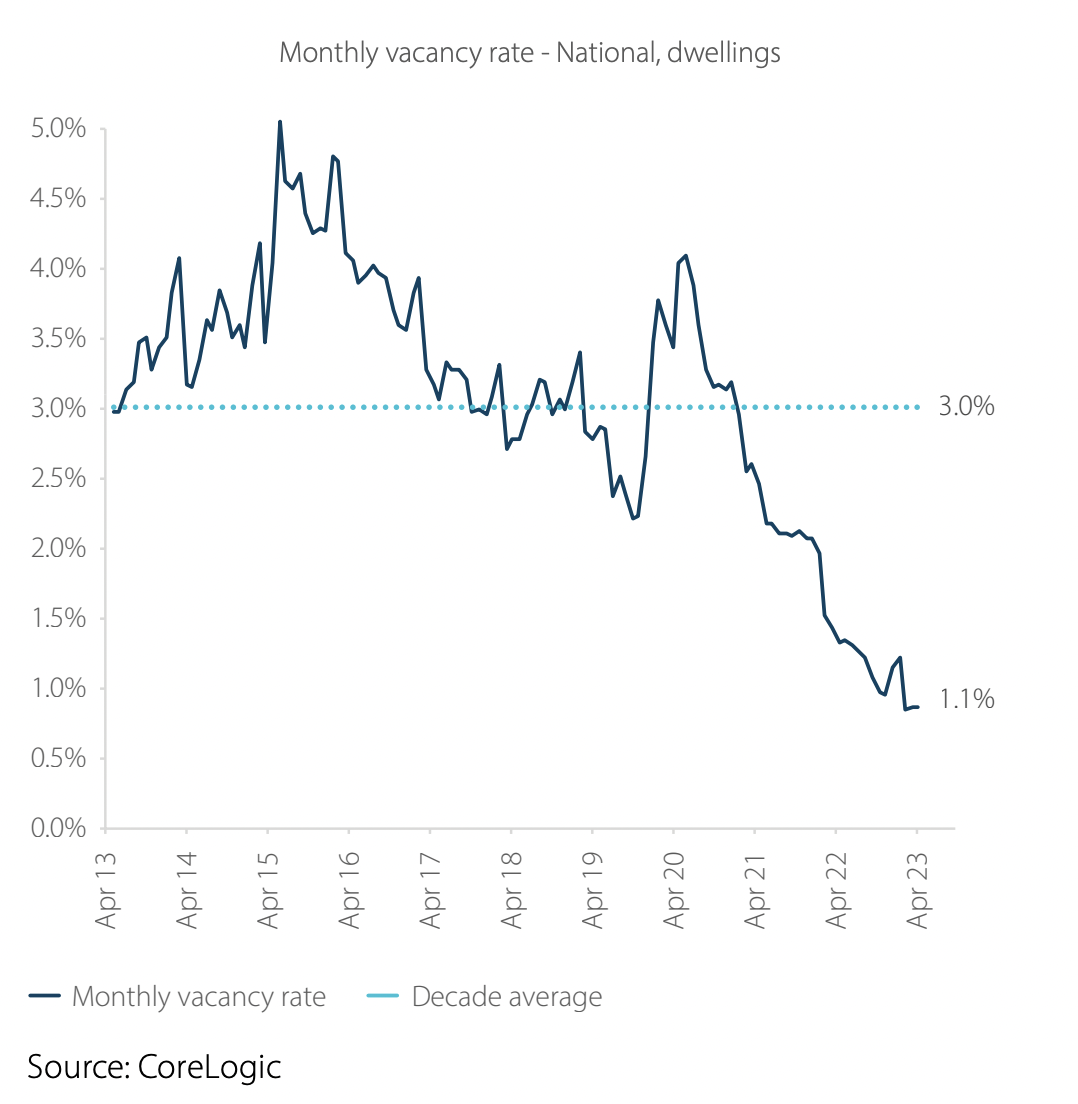

Meanwhile, vacancy rates and new listings have fallen precipitously.

Why does it matter?

Of course, anything that can be found on Maslow's hierarchy of needs is, well, needed.

But beyond that, housing is the highest weighted group in the CPI, accounting for around one-quarter of the basket.

“It’s a very significant issue because rents are the single largest component of the CPI [consumer price index]," Lowe stated in a Senate hearing last week.

“We’re expecting growth in rents as measured in the CPI around close to 10%."

Who (or what) is to blame?

Is immigration the chief antagonist it's made out to be? Or is it a straw man fallacy?

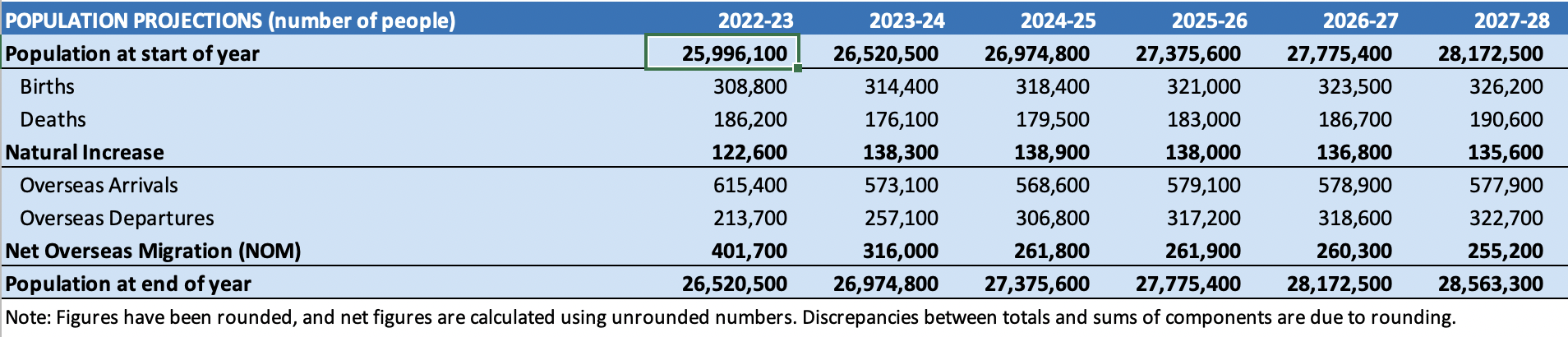

According to Centre for Population data, 2022-23 is expected to see net overseas migration (NOM) of 401,700 people. From 2024-25 onwards, NOM is set to hit 261,900, slightly more than pre-pandemic annual growth of 235,000.

Incidently, the forecast migrant influx for 2022-23, though large, roughly equals the nearly 400,000 international students, working holiday-makers and temporary sponsored workers who left Australia during the COVID-19 pandemic.

"This year’s budget predicts that by 2024 there will still be 215,000 fewer migrants in Australia than the Coalition government had expected in the 2019 budget," notes Grattan Institute's Brendan Coates, in an article published in The Australian.

"Migration certainly means we need more homes. But how does a smaller population than was expected just four years ago lead to a rental crisis?"

Coates believes more blame lies with the "race for space" driven by the work-from-home revolution.

"People want more space to themselves, either by taking an extra bedroom as a home office or by moving out of the family home or a share house."

This argument is borne out in the data. The RBA estimates that the number of Australians living in each home fell from an average of 2.55 people in late-2020 to 2.48 people by mid-2022.

"That change alone implies we need an extra 275,000 homes just to house the existing population," says Coates.

Shrinking property investment is another contributor to the mismatch between supply and demand.

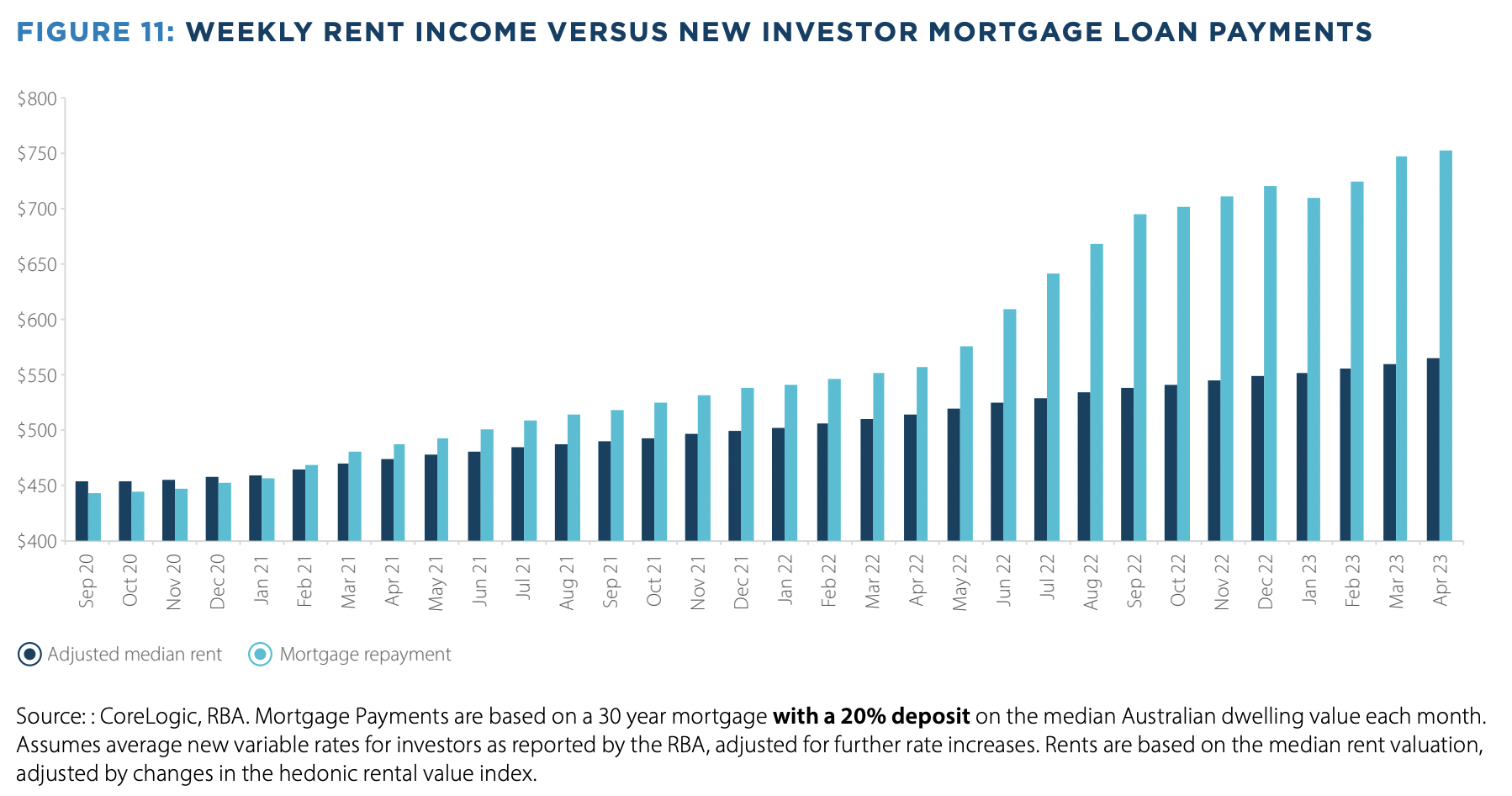

Thanks to negative gearing and capital gains discounts, the overwhelming majority of new housing supply has traditionally come from investors, with ATO data showing that most investment properties are negatively geared. According to CoreLogic, capital gain remains the primary driver for individual investment property decisions in Australia, rather than rental income.

Recently, property investment has cooled due to an increase in rates that has outpaced rents, coupled with falls in the value of residential property. As the chart below shows, housing finance lent to investors on a monthly basis has fallen -30% from its peak in January 2022.

How does it get resolved?

The obvious answer to all this is to build more homes. But in a world of cooling investment demand, inflated building costs and restrictive rates, that seems unlikely. Nor is there much fiscal appetite for expensive housing projects, given Australia's level of sovereign debt.

Much more likely, though unpalatable, is for us to simply let the price mechanism do its thing.

"The way that this ends up fixing itself, unfortunately, is through higher housing prices and higher rents," says Lowe.

"Because as rents go up people decide not to move out of home, or you don't have that home office, you [get] a flatmate."

"The increase in supply can't happen immediately, but higher prices do lead people to economise on housing."

"That's the price mechanism at work. We need more people on average to live in each dwelling, and prices do that," he said.

3 topics