Banks have bounced back from concerns

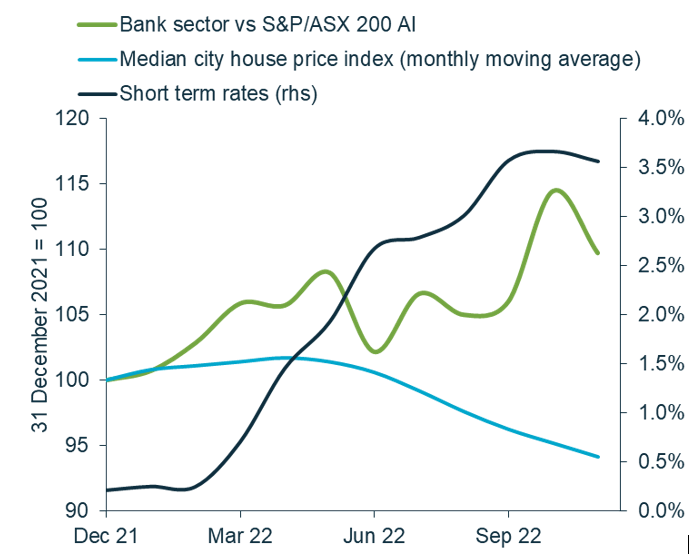

Australian banks spent much of the first half of 2022 facing concerns about the fallout from steeply rising rates on consumers, house prices, and credit risk. Since then, the material tailwind of higher rates for net interest margins (NIMs) has been recognised in share prices, with a reversal in sentiment between NIMs and housing risk.

Total returns, house prices and rates

Source: Martin Currie Australia, Bloomberg, , CoreLogic; As of 30 November 2022.

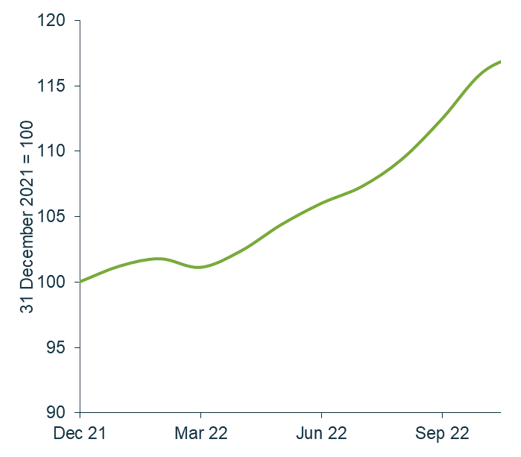

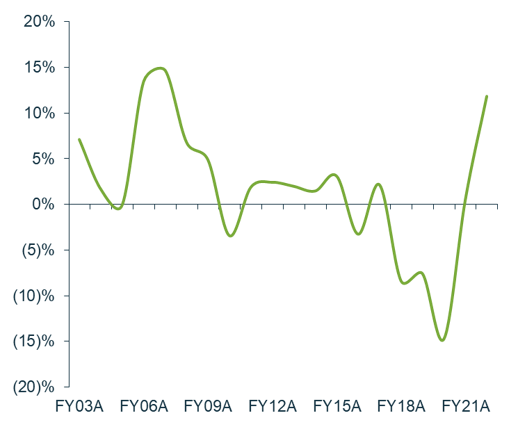

Reporting season reinforced profit growth

Banks were also one of the standout sectors through the August reporting season and November AGM period for upgraded revisions and share price performance. We are now seeing almost unprecedented top-line and pre-provision operating profit (PPOP) growth from the banks, and at least for now, impaired assets remain incredibly low.

Banks: Consensus next 12-month forecasts for revenue

Banks: Pre-provision operating profit (year-on-year growth)

Source: Martin Currie Australia, FactSet; As of 30 November 2022. Expected next 12 Months (NTM) data is calculated using the weighted average of broker consensus forecasts of each portfolio holding – because of this, the returns quoted are estimated figures and are therefore not guaranteed and may differ materially from the figures mentioned. The figures may also be affected by inaccurate assumptions or by known or unknown risks and uncertainties. In respect of the broker consensus data the number of brokers included for each individual stock will depending on active coverage of that stock by a broker at any point in time. A median of brokers is typically utilised. All estimates avoid stale forecasts which are removed after a certain number of days.

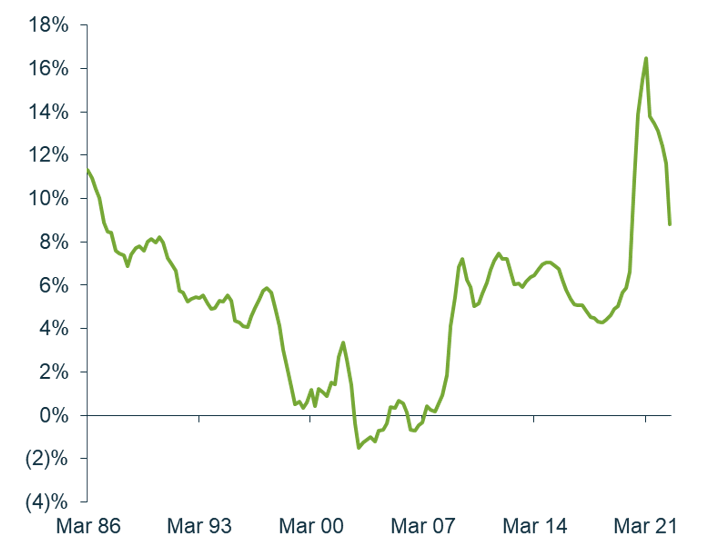

But debate over housing risk is likely to resurface

It seems that despite house prices continuing to fall throughout 2022, bank investors have now shrugged off earlier concerns, now focusing more on the peak in rates and evidence of consumers staying stronger for longer with adequate buffers to handle stress. However, the pressure from rising interest payments and fixed rate mortgage maturities is still largely ahead. We expect the debate for the banks sector earnings will swing back again as greater evidence for consumer pressure emerges.

Net savings from household gross disposable income

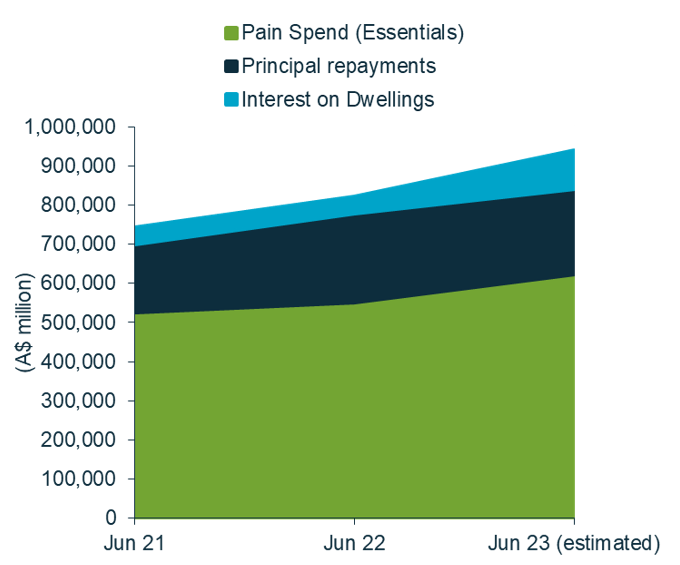

Aggregate Australian household non-discretionary spend

Source: Martin Currie Australia, Australian Bureau of Statistics (ABS), Reserve Bank of Australia (RBA); as of 16 December 2022.

Sector is resilient for now, and ANZ remains our preferred exposure

Despite looming consumer pressure, we believe that bank earnings will continue to look solid for the near to mid-term, with the NIM tailwinds to be ongoing in 2023. The sheer weight of recent credit creation in the system is also providing support.

Our active positioning within the banks sector is most focussed on Australia and New Zealand Banking Group (ASX: ANZ), Virgin Money (ASX: VUK), Bendigo and Adelaide Bank (ASX: BEN). We see that all these banks have ample exposure to rising rates and other factors that will support a positive P/E re-rating.

Learn more

The Martin Currie Australia Value Equity strategy seeks to maximise returns for longer term investors by investing in a high conviction portfolio of securities which are trading below our assessment of intrinsic value, whilst considering each company’s direction and quality. Learn more here.

3 stocks mentioned