Chinese CPI y/y fell -0.3%, US core inflation m/m steady at 0.2%

Let’s hop straight into five of the biggest developments this week.

1. Chinese CPI y/y fell -0.3%

The Chinese economy experienced deflation of -0.3% in the 12 months to July, a reading that was better than market expectations of -0.4%. This was largely due to base effects coming from the third wave of the Covid-19 pandemic this time last year. The prior months reading was a 0% change. Deflation in the backdrop of economic growth is a tacit marker for falling demand and injects renewed cause for concern for the global economy.

2. New Zealand inflation expectations in Q3 rose to 2.83%

In New Zealand, business executives survey expected inflation to fall to 2.83% over the next two years according to a survey conducted this quarter. This was a slight uptick from the same survey last quarter where executives expected a rise of 2.79%. As such, while current and short-term inflation pointers remain elevated, businesses largely expect the RBNZ to have acheived its 1-3% inflation target in two years.

3. US core inflation m/m flat at 0.2% in July

Monthly core inflation in the US remained flat at 0.2% in July, this was in line with market expectations. This shows inflation in the US economy is thawing, with headline CPI y/y coming in at 3.2%, which was below expectations of 3.3%. High interest rates are taking effect and markets are largely factoring in a pause at the next interest rate meeting.

4. Chinese PPI y/y dropped to -4.4%

In China the producer price index was forecasted to drop by -4.1% in July, however the actual reading showed a decline of -4.4%. Both CPI and PPI are in deflationary territory as economic momentum continues to weaken due to lacklustre domestic demand. The PPI reading may put more pressure on the Chinese government to consider fiscal stimulus to soften these declines.

5. US weekly unemployment claims rose to 248K

Weakness is beginning to re-emerge in the US labour market, which has performed exemplary well in recent months. Unemployment claims rose for a second consecutive week after a long streak of falling claims. Unemployment claims rose to 248K, way over the 231K level of market expectations. It is still unclear whether historically high interest rates are hampering business labour absorption or if this is a temporary cyclical adjustment.

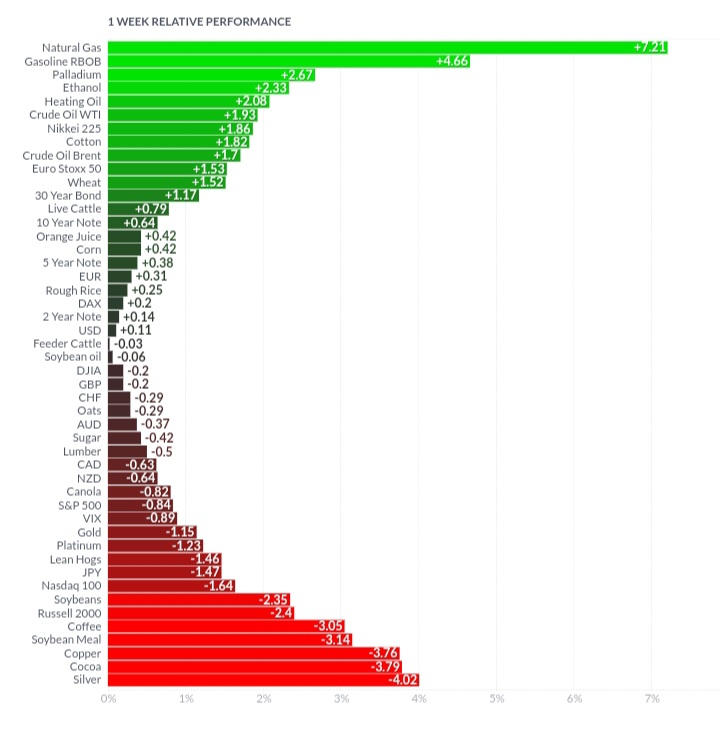

Here is the one-week performance of a variety of futures markets.

Heating oil, natural gas and other petroleum products extended gains for the week as a squeeze on supply continued. The sanctions on Russia were further exacerbated by systematic targeting of a Russian oil tanker by a Ukrainian sea drone, leading to fear of potential re-escalation. Moreover, the retaliation by Saudi Arabia to seize an American tanker after its own was confiscated by Washington added to market jitters. Most importantly, unilateral production cuts by Saudi Arabia to the tune of a million barrels a day makes for a perfect storm in the global oil and gas sector.

Wheat and corn were the biggest movers after Russia targeted Ukrainian grain loading facilities at the Izmail port in an effort to enforce its blockade of Ukraine, thereby cutting any possibility of Ukrainian grains entering markets. Moreover, the explosion of grain silos in Turkey created a market rush for grains. Copper fell as data from China renewed fear of a global recession.

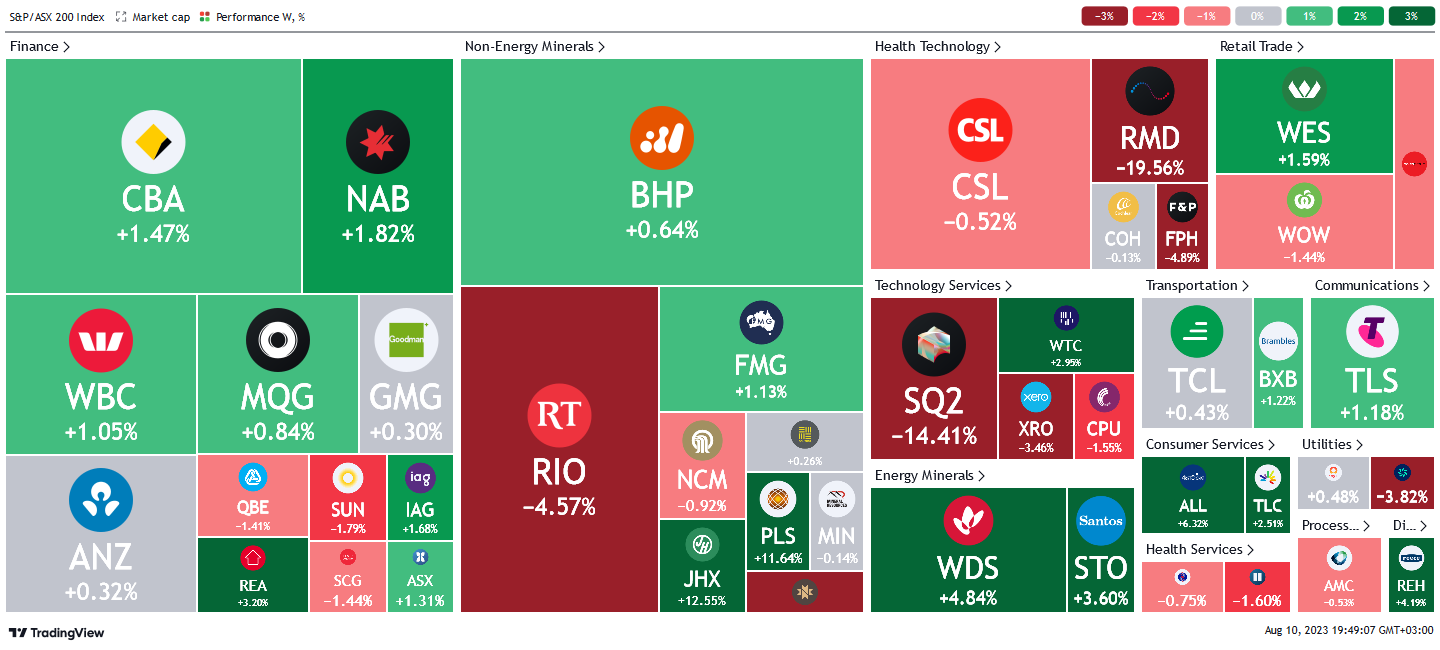

Here is the week's heatmap for the largest companies in the ASX.

The ASX rebounded with a big bang this week, recouping some of last week’s losses. Financials were the biggest gainers with NAB, CBA and WBC doing most of the heavy lifting. It was a seesaw for miners with BHP and FMG holding steady while RIO sold off sharply on weak demand for copper. Iron ore has drifted sideways to lower which has made it difficult for the big miners to get a bid. Health technology stocks were the biggest losers of the week with RMD leading the rout with a -19.5% sell-off. JHX and BLD performed exceptionally well with BLD reporting solid FY23 numbers.

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics