Gold Rally to Continue?

Gold prices finished 2018 on a tear, rallying well over USD $100oz from its mid August lows to close out the year at USD $1281.65oz (London Fix on 31/12/18). The metal moved higher in the first trading days of 2019, kissing USD $1300oz, though a strong payrolls report, and a much needed consolidation of a clearly overbought market, have seen the yellow metal pull back to USD $1285oz at present.

In AUD terms, the news has been even better for investors, with the gold price hitting a new all time high above AUD $1800z, a level last seen around the time of Brexit, though this move in gold has generated nowhere near as much attention.

There were no shortage of catalysts for the gold rally of the last few months, including the relentless sell off in equities, and the blowout in spreads, with credit conditions tightening at some of their fastest pace in years.

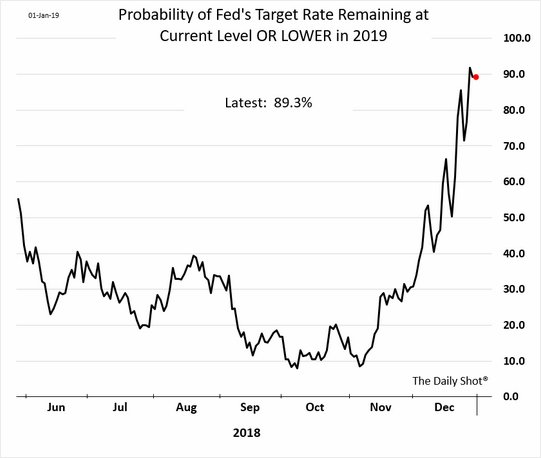

Combined, this saw the market drastically dial back their expectations regarding the pace of expected tightening by the Fed in 2019. This is best summed up in the chart you see below, with market probabilities around a flat to falling cash rate in 2019 rising from barely 10% in October 2018 to almost 90% by end December.

That is your gold rally right there.

An unwinding of a record 20 million ounce short position by managed money traders also contributed to the rally, though as 2019 gets underway, its worth pointing out that the latest positioning data available shows:

1). Short positions at still elevated levels by historical standards

2). Long positions are still subdued, indicating unwillingness by speculative money to chase gold too high

It's worth pointing out that whilst a sharp sell off in equities, an increase in spreads and skepticism re the Fed would all be expected to support gold, not all the catalysts you'd typically look for were evident.

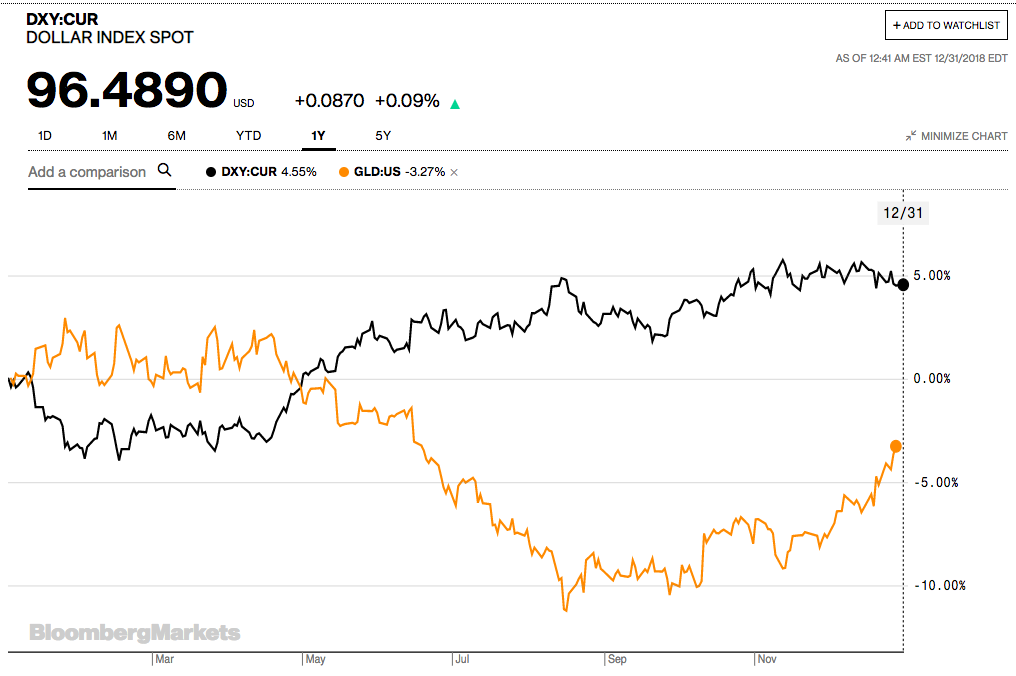

Inflation expectations have cratered in the last few months, as oil prices, and indeed the broader commodity complex have suffered, whilst the USD itself remained strong in the second half of 2018, after having rallied strongly from its February low.

The chart below plots the DXY vs GLD and you can see the sharp rise in GLD from late August onward occurs alongside a stable dollar.

These are our first clues as to what happens next, as a gold price rallying in the face of crashing commodities and a stable to rising dollar are a sign that the market is turning in favour of the precious metals complex.

A third sign is the performance of silver, which has rallied 13% from its mid November lows below USD $14oz, to over USD $15.50 today. This has seen the gold to silver ratio (GSR) fall from 86:1 to 82:1, indicating silver has been outperforming gold of late.

To be clear, the GSR is still incredibly elevated by historical standards, with readings above 80:1 only occuring a handful of times in the past 30 years, with significant moves higher in precious metals typically following.

The move higher in silver is notable for another reason, and that is that unlike gold, which is seen by the market as a purely monetary metal, silver is treated as a part monetary/part industrial metal.

This is interesting because the fact that silver is rallying so hard even though commodities as a whole are in major funk suggests it's the monetary aspect of silver demand that is coming to the fore, which is a positive sign for precious metal bulls.

A final positive note is the outperformance of some of the gold indices, not only over gold itself, but over broader equity markets. This can be seen in the chart below of the HUI Gold Bugs index vs. the S&P 500 over the past 20 years, with the huge outperformance of the gold sector from 1999-2012, and the savage underperformance that followed, clearly evident.

Source: Clive Maund, Gold Market Update, 30th Dec 2018

Like gold itself, gold mining indices increasingly look like they've formed a reverse head and shoulders bottoming process, and whilst we wouldn't be surprised to see them give back some of their recent outperformance against the broader equity market, that will likely prove a short term phenomenon, with the sector set to outperform in the coming years.

3 topics

.jpg)

.jpg)