Livewire readers share 18 stocks that became success stories

We love a success story here at Livewire and we love hearing stories about how you found out about a company, bought it, held it and - most importantly - made a ton of money on it.

Last year when we undertook this exercise, almost 6000 of you read the wire. Since then, a lot has happened even if inflation is (still) not back in the target band.

And while stock markets continue to hit all-time highs, we know you are all chasing future winners at heart.

With that in mind, we surveyed readers of both Livewire and Market Index to share with us their secret stock winners. We received a ton of responses - and this wire will highlight a handful of them.

Secret Stock Winners: The honour roll

Before we get into the stories, we thought we'd use the data to highlight some of the outstanding performance returns that you all submitted. Please note this information has been taken at face value and the performance numbers are over different timeframes.

| Reader | Stock and Stock Code | % gain since the initial buy |

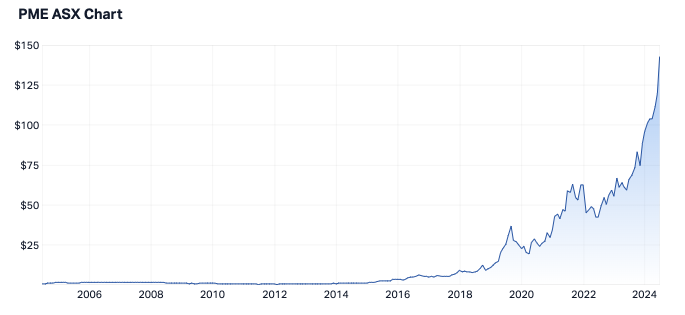

| Ray | ProMedicus (ASX: PME) | 12,556% |

| Big Graham | WA1 Resources (ASX: WA1) | 8,974% |

| Paul | HUB24 (ASX: HUB) | 3,565% |

| Russell | Commonwealth Bank (ASX: CBA) | 2,589% |

| Steven | Wildcat Resources (ASX: WC8) | 1,166% |

| Annie | Droneshield (ASX: DRO) | 1,090% |

| Johno | Fisher & Paykel Healthcare (ASX: FPH) | 800%+ |

| Arjuna | Telix Pharmaceuticals (ASX: TLX) | 725% |

| Matt | Rolls Royce (LON: RR) | 530% |

| Gary | Findi (ASX: FND) | 430% |

Note: Some of the top performers did not have their stories featured below and some of the stories featured below are not represented among the top performers in this table. This is not a competition and everyone runs their own race and has their own goals when they invest. Finally, as always, please seek professional advice before making any investment. Past performance is not a reliable indicator of future return.

And now, here are the best of the individual stories.

Mentioned Stocks: Stories inspired by mentions on Livewire and Market Index

Prospect Resources (ASX: PSC)

Market Capitalisation: $76.6 million

Wayne made over 200% on Prospect Resources (ASX: PSC), in a lesson that involves both reading Livewire and buying batches at a time.

"If I recall, it was a Livewire recommendation to buy. [I] bought a batch in April 2022 and again in July 2022, before a very large batch ex-dividend. Including the dividend payment in August 2022 and its current value, I'm up 238% in 2 years... gotta be happy with that."

And so you should be, Wayne!

Pro Medicus (ASX: PME) (I)

Sector: Healthcare, provider of imaging IT services to hospitals and healthcare facilities

Market Capitalisation: $14.9 billion

Livewire favourite Rudi Filapek-Vandyck also provided reader James with a stock call that is now a household name - ProMedicus (ASX: PME).

"Rudi Filapek-Vandyck was asked to mention a stock under $1 that he was watching," James recalls.

We actually asked Rudi if he remembers writing that piece and here's what he shared with us:

"I attended a number of company presentations [at a conference] and one of those was Pro Medicus. I met and talked with at least one fundie, who was a shareholder, and I liked what I heard and saw.

Plus, I was all too familiar with that acquisition they’d made in the US during the depths of the GFC. But I was also all too aware this was still a small-cap, and nothing but an emerging story. I definitely spoke about ProMedicus to a fundie and he bought the shares. Many months later he called me to say thanks. He made a killing on the shares. I don’t remember writing about my impressions after the conference, but I think I have written about that fundie saying thanks," he recalled.

Uniti Group (de-listed)

Sector: REIT

No longer listed on the ASX, it was acquired by investment house Morrison & Co in 2022.

Jason didn't just read about Uniti Group (formerly ASX: UWL) through Livewire - he really went to town on the research. "From there, I did as much research (Livewire, YouTube, Hot Copper) and kept adding during dips." The research must have worked - he tells us that he turned $5K into $15K on that story.

Jason, if you're reading this, we'd love to know when you sold out - and more specifically, if you sold out just as the takeover offer to go private was made.

CSR (ASX: CSR)

Sector: Industrials, specifically building products

Market Capitalisation: $4.28 billion

Mark told us about his relatively recent holding (bought within the last year) in CSR (ASX: CSR) - which he read from a Market Index article ("thank you!!!" he shared).

Another reader named Mark (likely not the same Mark) also called out CSR. But his reason had a lot more research behind it:

"Filtering stocks for a good return on equity, low debt level, sustainable income and a stable dividend preferably fully franked. Examined CSR and believed its products would continue to be sought by customers in future years. [Was also] impressed by CEO Julie Coates," he says.

CSR, of course, is about to be taken off the boards as French conglomerate Saint-Gobain will buy the Australian conglomerate for $4.3 billion.

Researched Stocks: Stories that involved readers who did their own research - and went the extra mile

Droneshield (ASX: DRO)

Sector: Technology, specifically providing Artificial Intelligence based protection against advanced threats such as counter-drone and Electronic Warfare applications

Market Capitalisation: $1.13 billion

This idea came to Annie at a mining conference.

"[At a] small booth at a mining conference in London 2014. The idea of counter-drones appealed to me. [Bought it at] stock price of 14c. [It was] also very interesting [that the] advisory board [is] in US despite being an Australian stock. Now [that] wars [are] everywhere, [it's] vitally necessary," she wrote.

Telix Pharmaceuticals (ASX: TLX)

Sector: Healthcare, focused on the development and commercialisation of radiopharmaceutical products

Market Capitalisation: $6.3 billion

Two readers - RK and Arjuna - were among a few people who called out Telix Pharmaceuticals. But these two were the ones who turned media reading into research and therefore, a fully-fledged investment case:

"[It] has a great product pipeline in a field with high demand and growth. Had decent fundaments and great technical indicators," RK said.

"[Heard through a] podcast interview of CEO (Dr Christian Behrenbruch) with Alan Kohler some years ago. Gradually built a position. Adding over the years as the Company kept growing and the CEO was not selling into the share price rise. R&D costs [are] being balanced with operating cash flows avoiding dilutive capital raising," Arjuna said.

Telix has been described at various times as a company that could become the next CSL and was a top-tipped stock by readers for 2024.

Pro Medicus (II)

"About 5 years ago, I started experimenting by studying balance sheets. I picked a few probable winners, didn't buy them, and just waited 2 years to test the outcome. It seemed to work. 3 years ago I bought lots of PME. I'm happy. My portfolio is up 30% this year," Tom says - no doubt, with a giant grin on his face.

Findi (ASX: FND)

Sector: Financials/Technology

Market Capitalisation: $220 million

Nick has made a 630% return on ASX-listed fintech firm Findi (ASX: FND). He used a filter to focus on this firm.

"Filtered for cashflow positive companies with a market cap less than $50 million. Findi stood out as cashflow from ops in FY23 was $4 million against a market cap of $25 million," Nick recalled.

Fellow reader Alex also nominated Findi (and the 280% gain he's made in under a year on that stock) - but he didn't find Findi through filters. He found the company's impact on a trip to India:

"I became curious about that company after my travel to India last year and then the stock price broke out, and I took a position, I added several times smaller positions during the run," he said.

Inspired Stories: Stocks that were identified because of a close affiliation with the investor's day-to-day life or work

Sprintex (ASX: SIX)

Sector: Automotive engineering, research, product development and manufacturing

Market Capitalisation: $26.9 million

Benjamin tells us of a stock he found as a rev head - "[I've] been watching it for many years as a supercharger for cars - Jeeps / Lamborghini etc. Recently, they moved into Industrial Blowers which seems to be hitting goals. The top 20 [shareholding] is tight (80%+). The last 2 to 3 releases seem to imply things are about to turn. Management is incentivised for big revenues," he said.

Whitehaven Coal (ASX: WHC)

Market Capitalisation: $6.44 billion

Tristen found this stock given he works in an industry that is adjacent to Whitehaven.

"I came from an industry aligned with mining, oil and gas, specialised in technical asset assessment and solutions to prolong use. Oversold 2020 markets and [the] green revolutions [narrative] were my entry. Australian coal will remain critical. Dependable Energy and Carbon Steel from Coal have no viable, or [as] yet, [a] close equal," they said.

Botanix Pharmaceuticals (ASX: BOT)

Sector: Healthcare, biotechnology

Market Capitalisation: $575 million

Our next story is a heart warmer from Penny. She invested in a micro-cap biotech firm after some experiences that hit very close to home:

"I read a brokerage report on Botanix which was already selling its Hyperhidrosis formulation in Japan and was applying for FDA approval. My son has hyperhidrosis and I could see the value in this product," Penny told us, adding she doesn't plan to sell anytime soon.

Ardent Leisure (ASX: ALG)

Now known as Coast Entertainment Holdings (ASX: CEH) following its December 2023 rebrand.

Sector: Consumer Discretionary, travel

Market Capitalisation: $227.17 million

Oleksandr used to be a Queenslander. He loved visiting the Gold Coast - and being surrounded by all those theme parks gave him an investment idea of his own:

"My partner and I enjoyed the Q1 hotel, SkyPoint Observation Deck, Dreamworld, and WhiteWater World. I invested in ALG shares at the start of the COVID lockdown and made 5x return," Oleksandr said.

Honourable Mentions: Stocks with great stories that didn't fit any of the above categories

FLOAT STORIES: Commonwealth Bank (ASX: CBA) and csl (ASX: CSL)

Donald told us how this 1400% profit story came to be. I quote - "it discovered me". In fact, several readers told us they bought CBA at the IPO in September 1991 and never sold out. Boy, have they done well or what? Numerous people also told us they had been invested in CSL (ASX: CSL) - if not since the float, then certainly for many years. Those gains were also eye-watering.

Pilbara Minerals (ASX: PLS)

Sector: Resources

Market Capitalisation: $9.48 billion

Denise learned of the lithium darling in an, arguably, unusual way. Before everyone hopped on the bandwagon, she heard about the company through an article written by federal Senator Matt Canavan. Canavan, apparently, got her into PLS at 21 cents/share and BHP (ASX: BHP) at $28.40/share.

Premier Investments (ASX: PMV)

Sector: Consumer discretionary, retail

Market Capitalisation: $5.16 billion

Reader Don bought the former Just Jeans before it ended up becoming part of Solomon Lew's Premier. He's made 400% on that investment since.

Netflix (NASDAQ: NFLX)

Sector: Technology, mega-cap tech

Market Capitalisation: US$290 billion

Pershing Square Capital Co-Founder and famed hedge fund manager Bill Ackman also inspired one of our readers. Alex bought the streaming giant due to its "huge" fundamentals but was nearly scared off after the share price fell 70% and Ackman, once one of its largest shareholders, sold out. But Alex held on anyway and now, he's up 200% (and he doesn't plan to sell anytime soon).

Fisher and Paykel Healthcare (ASX: FPH)

Sector: Healthcare, manufacturer of sleep apnea devices

Market Capitalisation: NZ$17.69 billion

And my personal favourite - Johno's 800% return on the dual-listed healthcare giant came down to simply "luck". That's not bad for luck. Although Johno, if you're reading this, I suspect there is more to this story than just luck - and we wouldn't mind hearing about it.

Get to know more of your fellow readers with our Meet the Investor Series. You can also catch up with last year's story here:

18 stocks mentioned