Macquarie's 10 best long ideas (and 12 shorts)

On Tuesday, the Reserve Bank of Australia inflicted investors (and mortgage holders) with its 11th rate hike since May 2022.

The news saw the All Ordinaries Index fall 90 basis points in just 30 minutes. Since the RBA's pause a month ago, the Index is now up just 0.42%. Over the past 12 months, the All Ordinaries is still -2.12% in the red.

On Friday, Macquarie analysts released a note outlining their positioning for their Australian Equities Strategy over the next 12 months. In it, analysts revealed that they believe the macro headwinds ahead will still favour bonds over stocks and defensives over cyclicals.

"Our read of leading indicators is that a US recession is still likely, and we prefer to position in advance rather than wait until more coincident employment data shows noticeable weakness," analysts wrote.

To figure out whether investors should be optimistic or not over the next 12 months, analysts went back to the books.

In this wire, I'll summarise Macquarie's base case for a US recession later this year, the sectors they believe could outperform (and underperform) in this scenario, as well as their top long and short ideas for the next 12 months.

Macquarie's base case: US recession in 3Q23

Macquarie is still positioned for a US recession and believes this could start in the third quarter of this year. The investment bank's macro strategy team believes this US recession will last around 12 months.

"The inverted yield curve and ongoing decline in the Conference Board’s leading index also signal a US recession," analysts said.

"A US recession in late 2023 seems consistent with Australia’s 3-year yield being below the cash rate, as this signals a pivot to easing. In past cycles where the RBA paused ahead of a US recession, the RBA cut rates five to six months later… So it’s not impossible we see cuts before 2024."

Whether or not we see cuts this year, Macquarie analysts predict that the RBA will shift to quantitative easing over the next 12 months as unemployment rises.

"While inflation is a constraint to easing today, it is important to note the RBA cut rates in the 2000s recession when inflation was still around 6% and the unemployment rate had only risen 50bps off the low when it was hiking," analysts explained.

So what happens if Macquarie's crystal ball isn't working? Well, analysts note they may be underestimating the need for further rate hikes if the labour market and inflation remain strong.

"This is not a scenario that can be dismissed given some cyclical data has improved (e.g. PMI, house prices) and this has occurred without rate cuts," analysts said.

"But a key reason we think this scenario is unlikely is that we believe the lagged effect of prior hikes is still to be felt."

So what typically works in a US recessionary scenario?

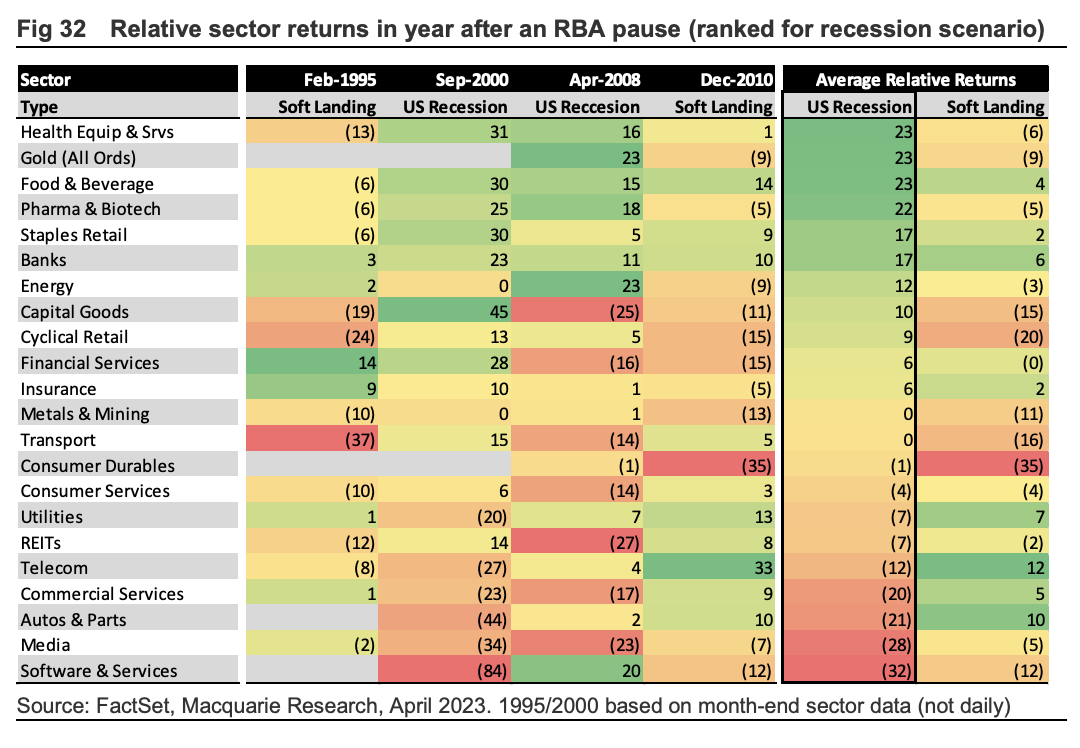

Glad you asked. Macquarie analysts note that bond yields usually fall after the masters of monetary policy pause, driving bonds to outperform stocks. While the RBA raised rates another 25 bps on Tuesday, Macquarie's base case is that rate hikes are pretty much done.

"Whether a soft landing or a US recession, the slower growth that drives central banks to pause (and later ease) also tends to drive earnings downgrades and the outperformance of defensives over cyclicals," Macquarie analysts wrote.

This should also support the outperformance of large caps over small caps, they added.

In the two cases where the RBA paused when there was a US recession, sectors such as healthcare, consumer staples and gold outperformed, driven by earnings growth. Meanwhile, sectors such as technology, media and real estate were more likely to underperform in this environment. (See table below)

"While we see increasing calls for this to be a new bull market, we continue to expect a US recession to drive more volatility," analysts said.

"But a rise in unemployment will also allow for central banks to ease and we think easy monetary policy is key to driving a new bull market in equities."

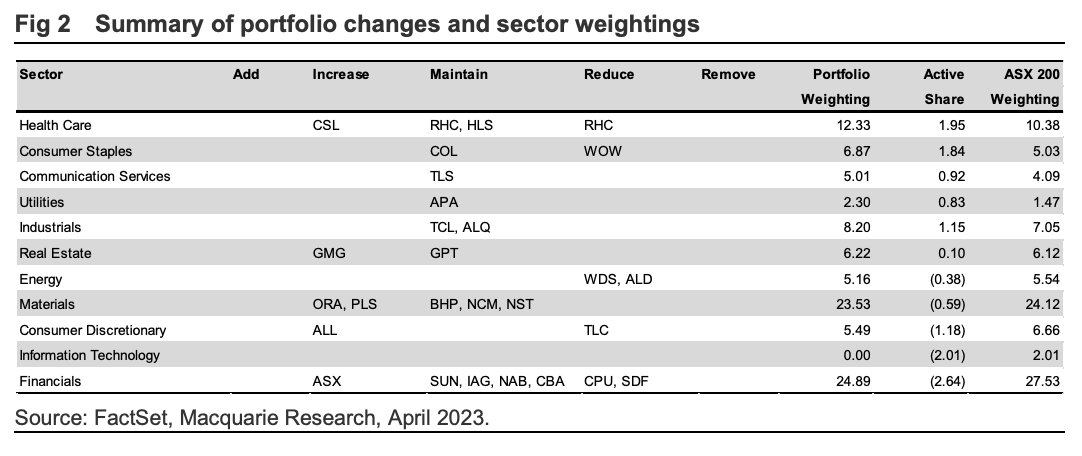

Macquarie has been positioned for a US recession since November 2022. Lately, they have been increasing their exposure to healthcare (as their top overweight), in particular, CSL (ASX: CSL) "given its record of outperforming after RBA pauses".

It has also renewed its focus on stocks that benefit from falling bond yields, cheaper defensives and quality companies. These include companies such as Goodman Group (ASX: GMG), Orora (ASX: ORA) and Aristocrat Leisure (ASX: ALL).

Meanwhile, it has been reducing its exposure to energy and expensive defensives, such as Woodside (ASX: WDS), Ampol (ASX: ALD), Woolworths (ASX: WOW), The Lottery Corporation (ASX: TLC) and Steadfast Group (ASX: SDF).

Macquarie analysts note that defensives such as CSL, Sonic Healthcare (ASX: SHL), Ramsay Health Care (ASX: RHC) and APA Group (ASX: APA) have outperformed in all four RBA pauses. Of these, CSL, Ramsay and APA are forecast to grow forward earnings per share above 10% over the next 12 months.

In past pause scenarios, the big four banks have also outperformed. However, analysts note that this was largely thanks to strong expected EPS growth. Whereas today, forward EPS for the big four doesn't look as peachy. This suggests the big four banks are less likely to outperform, Macquarie analysts said.

Macquarie's top long and short ideas for the next 12 months

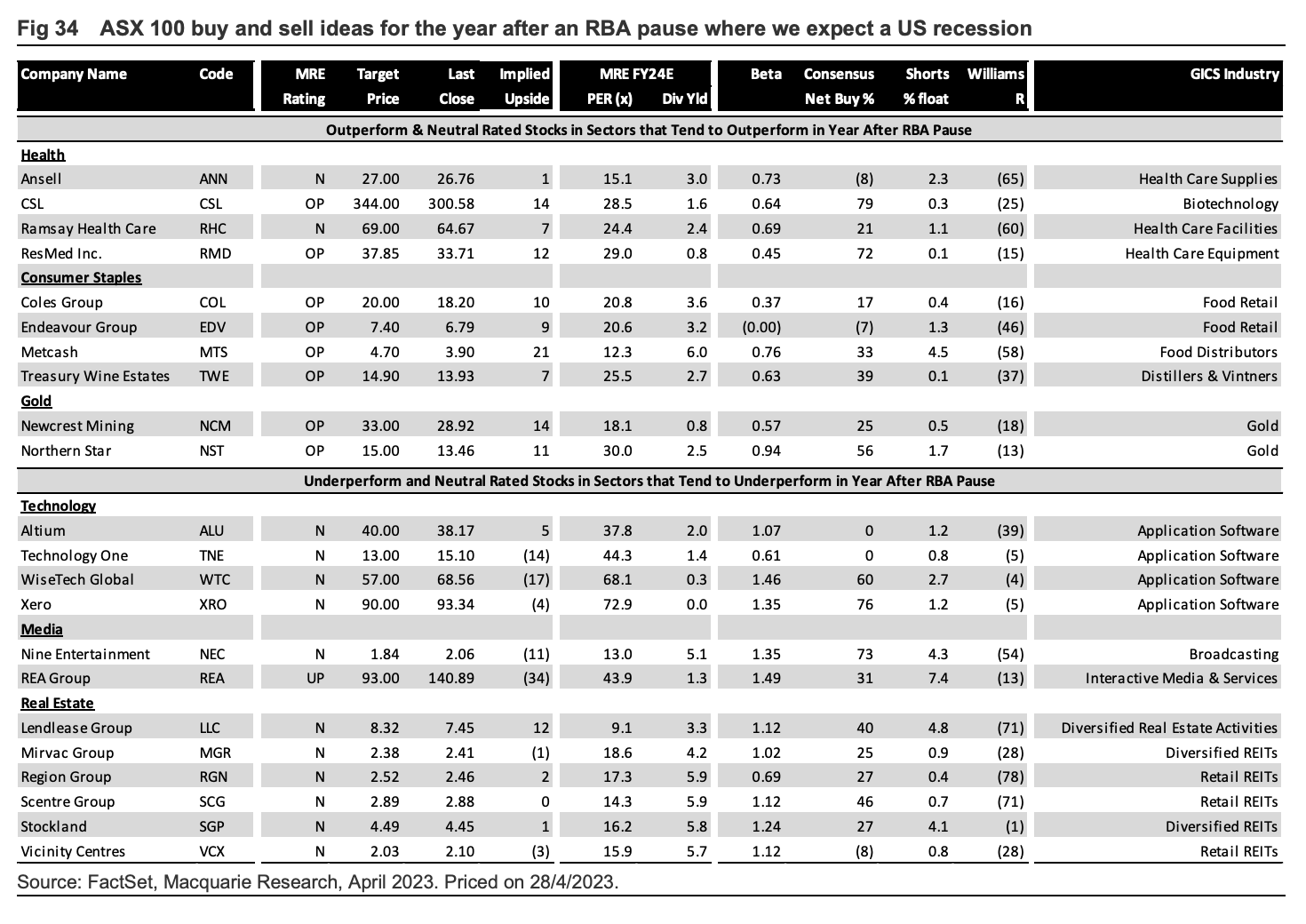

Given that Macquarie has found that large caps outperform smalls in past RBA pause and recessionary scenarios, analysts have only shared investment ideas within the ASX 100.

As mentioned earlier in this article, analysts are bullish on the outlook for gold, defensive healthcare companies and consumer staples - all of which typically outperform during a US recession.

Macquarie analysts have rated CSL, ResMed (ASX: RMD), Coles (ASX: COL), Endeavour Group (ASX: EDV), Metcash (ASX: MTS), Treasury Wine Estates (ASX: TWE), Newcrest Mining (ASX: NCM) and Northern Star (ASX: NST) as stocks that could outperform over the next 12 months. Ansell (ASX: ANN) and Ramsay have been rated as Neutral.

Of these, Ansell, Ramsay, Endeavour and Metcash are currently the least overbought.

In comparison, it would prefer to buy the technology, media and real estate sectors AFTER the RBA starts easing. Right now, given last month's pause and today's hike, these sectors are more likely to underperform.

"This might only be six months away, and some investors may be investing in

anticipation of easing, as they may already be overweight defensives," Macquarie analysts said.

Analysts have a Neutral rating on Altium (ASX: ALU), Technology One (ASX: TNE), WiseTech Global (ASX: WTC), Xero (ASX: XRO), Nine Entertainment (ASX: NEC), Lendlease Group (ASX: LLC), Mirvac Group (ASX: MGR), Region Group (ASX: RGN), Scentre Group (ASX: SCG), Stockland (ASX: SGP) and Vicinity Centres (ASX: VCX).

For the REA Group (ASX: REA) lovers out there, of which I admit I am one, Macquarie analysts have rated the stock as UNDERPERFORM. If anyone needs me, I'll be sobbing at my desk.

5 topics

32 stocks mentioned