The Australian dollar is near five-year lows and these 4 ASX sectors stand to benefit

Australia’s underlying inflation rose at its slowest pace since early 2021 in the December quarter, strengthening the case for a rate cut next month. However, the data also weighed on the already struggling Australian dollar, pushing it closer to a five-year low. Since September 2024, the Aussie has dropped seven cents (nearly 10%) against the US dollar, now sitting near the bottom of its historic trading range.

That cyclical move has implications for all of us - from the holidays you take to the price you pay at the pump. But it's especially important for investors because while you may be buying a domestically listed company, all of us buy businesses that have some form of global exposure.

With this in mind, Morgan Stanley have shared with us their views on the Australian Dollar, and more importantly, how that will affect the upcoming February reporting season and the wider picture for where earnings momentum will come from in the Australian equity market.

Morgan Stanley's 2025 calls at a glance: From "it's tricky" to "many moving parts"

- CY2025 price target for the ASX 200: 8500

- Current forward earnings multiple of 17x is warranted but meaningful upside has to be justified by sustainable earnings growth

- Note: The ASX 200 is currently trading above this 17x figure.

- First RBA rate cut is likely to come in February (previously May), although the bigger question is not when it starts but rather what the entire easing path looks like

- Don't rule out the possibility of a Coalition majority at the 2025 Federal Election even if the polls do tend to hint at a minority government

- Four key themes for markets in 2025: Technology diffusion (AI), the future of energy, a multipolar world, and longevity

What can keep this equity market rally going?

While it's simple to say that the answer is just 'the Banks', the truth is that the ASX 200 is suffering from a widening price-to-earnings gap. That is, while the ASX 200 continues to appreciate, earnings have been lagging. But there is good news on the horizon.

"We have an 8500 price target for this year but that's predicated on getting some earnings recovery in the market. This year, we need to fill the earnings gap," says Nicol.

That earnings gap will likely be filled by three main sectors:

- Energy

- Materials

- Healthcare

...and one unifying factor among those three sectors: the falling Australian Dollar.

"The currency has started to drive an inflection in market earnings," Nicol adds. "There's a lot of leverage in resource [company] earnings. The index weight for resources plus energy is 23%. But the earnings weight is 33%. So if you get a turn in resource earnings, that can have a disproportionate effect on what our market looks like from an earnings perspective."

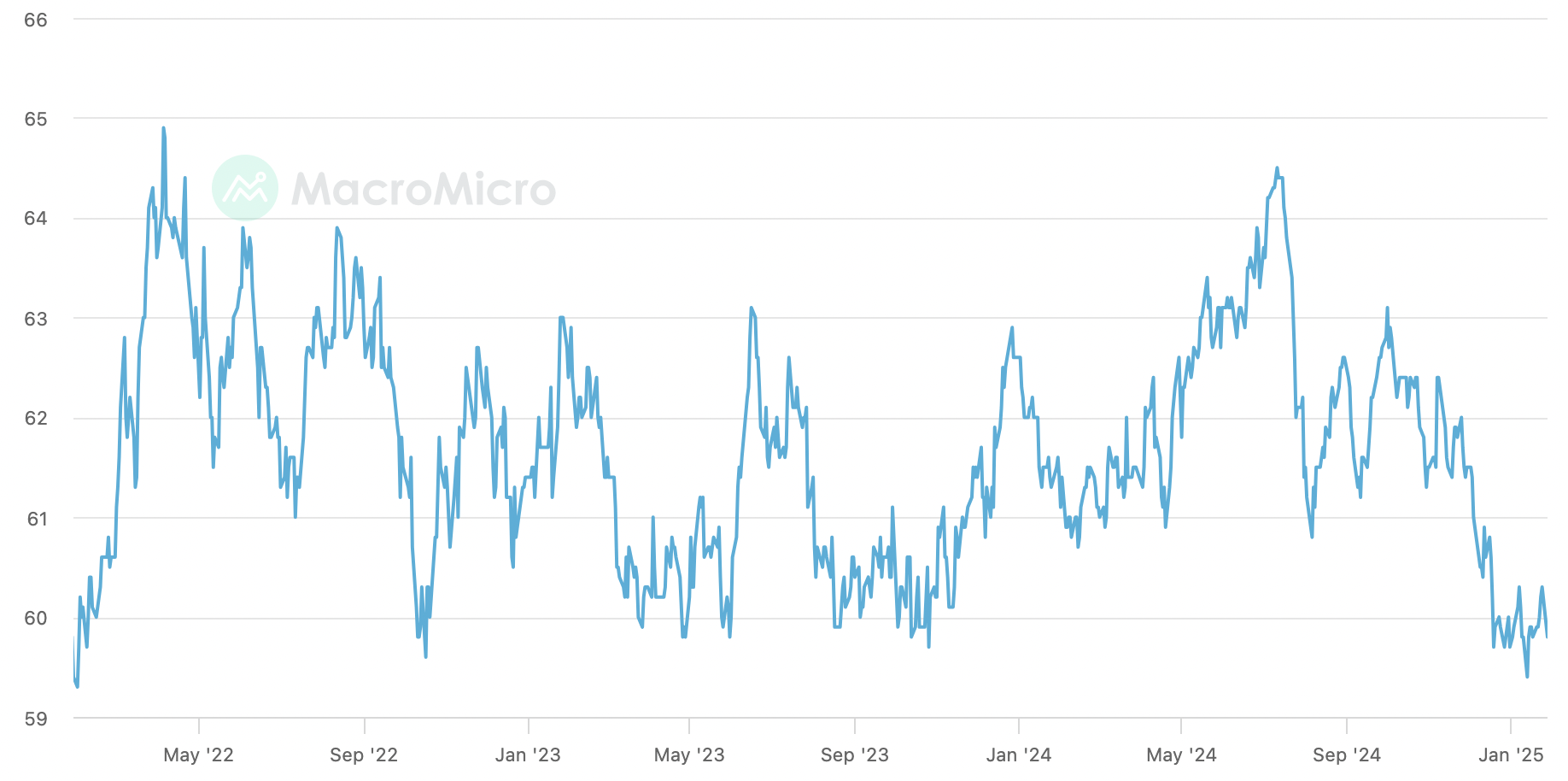

"This sector has seen all the earnings upgrades at the moment. Most of the analysts I can see, in those key bellwether stocks, are using 68-70 cents in their forecast. So there's a tailwind to earnings that can come through from a lower Australian Dollar when it's 62-62.5 cents," Nicol also notes.

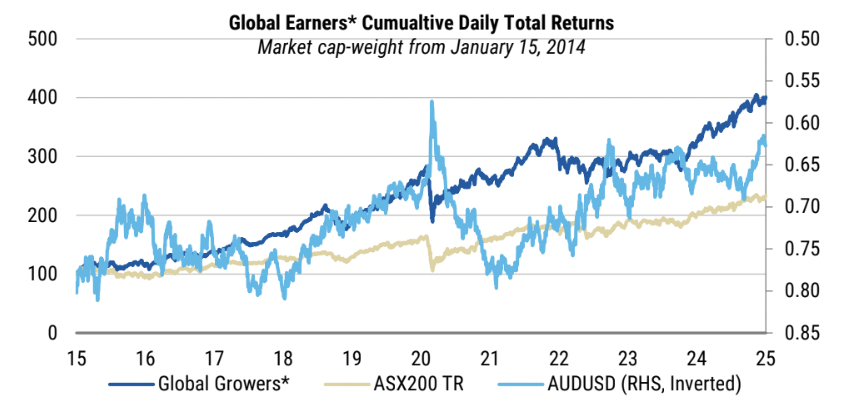

One other benefit of a falling Australian Dollar: Global earners

The other sector (or more correctly, investment style) worth watching are the global earners. That is, companies who earn at least 40% of their revenues offshore. Many of these companies, like the major miners, will earn their revenues in US Dollars but will then report their earnings in Australian Dollars.

This group, believe it or not, accounts for over 26% of the total index by float-adjusted total market cap, which is comparable to the index weights for Financials and Resources. It is, Nicol emphasises, one key area to watch.

"A rule of thumb is that a 10% move on the currency leads to a 3-5% boost to market earnings. We've had that 10% move in currency now so that's the move we're expecting to see come through," Nicol says but he did add that he does not see the Aussie falling even further into the 50-60c range.

In addition, just as the falling Australian Dollar is great news for global earners, it's not good news for others.

"One thing that the falling Aussie does pose a headwind to is companies that import stuff like retail stocks for example. If the currency holds at these levels, that's going to be cost a headwind for those sectors that are direct importers," he adds.

The other party this won't be good news for? The Reserve Bank.

That's because the Australian Dollar Trade Weighted Index (A$ TWI) is now below 60%. On a 12-month view, Nicol says "that could potentially become inflationary" that has the power to "alter the path of the central bank." In other words, don't rule out a rate hike when the Australian Dollar is this weak.

Two key avoid areas: The consumer and the big banks

One key area that he sees trouble in over the coming 12 months is the consumer discretionary space.

Although retail sales held up over 2024, earmarked by a reasonably strong Black Friday and Christmas sales period, it's clear that things are changing. So much so that this is where some earnings-induced volatility may lie this coming February.

"Where there has been disappointment is the margins. We have a much more promotional discounting environment because the consumer is fatigued," Nicol says. "The foot traffic is beholden to that and it comes at a consequence to margins more often than not."

"We felt that there were some nuances to consider when compared to prior periods. Firstly, consumers are looking for better value and are increasingly reacting only to promotional activity. Secondly, there is the potential that the pull forward in sales could jeopardize December and January non-clearance sales or at least enforce a trading regime where discounting stays elevated. Thirdly, commentary in updates to date suggest a focus on cleaning up inventory - again with elevated promotional activity," Nicol wrote in a research note dated January 19th.

The other key area are the Big Banks. Of the seven major banks listed on the ASX and under Morgan Stanley's coverage, only Judo Bank (ASX: JDO) and NAB (ASX: NAB) are OVERWEIGHT rated. Meanwhile, Westpac (ASX: WBC), Commonwealth Bank (ASX: CBA), and Bank of Queensland (ASX: BOQ) are the UNDERWEIGHT rated banks.

Overall, Richard Wiles, Morgan Stanley's lead research analyst for the Australian banks, says the sector is priced for perfection and risks are mounting, including deposit pricing pressures, cost concerns and credit quality complacency. While dividend growth is set to be modest, he expects bank valuations to remain supported by ongoing buybacks and positive macro drivers like falling inflation and central bank easing.

To read more of Wiles' view, you can read this piece from my colleague Vishal Teckchandani:

.jpg)

5 topics

1 contributor mentioned