The Match Out: Energy shares carry ASX higher, eyes turn to RBA tomorrow

The ASX saw the best of it early on today, buoyed by overseas strength on Friday while a ~7% rally in the oil price this morning following OPEC+ production cuts had the Energy sector flying, however, higher Oil prices are inflationary which is a net negative for the trajectory of interest rates, once that sunk in, equities pulled back from early highs.

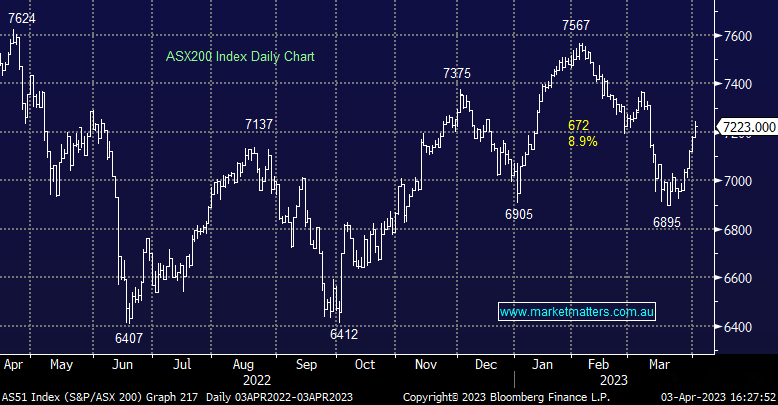

- The ASX 200 finished up +45pts/ +0.63% at 7223

- The Energy sector was best on ground (+2.25%) while Real Estate (+1.92%), Tech (+1.91%) & Consumer Discretionary (+1.86%) were also strong.

- Utilities (-0.70%) was the only sector to close lower today, though Telcos (+0.16%) and Consumer Staples (+0.27%) were notable underperformers.

- Banks enjoyed some buying today, although inline with the broader market, they topped out in the first 2 hours of trade

- The oil market is red hot and rallied almost 10% today as traders position ahead of inventory data that’s tipped to show US holdings down to the lowest level since 2014.

- OPEC+ cut oil production on Sunday which prompted a ~6% rally in the Oil price during Asian trade today.

- Not surprising to see Energy stocks were the standout on the market today with Santos (ASX: STO) +2.46% and Woodside (ASX: WPL) +2.67% up strongly as a result. Portfolio Manager Harry Watt discussed the move this morning in Ausbiz – Watch Here

- The broader read-through though is a negative one. Higher Oil prices are inflationary and therefore more hawkish for interest rates – not surprising we saw the ASX close well off early session highs.

- Ahead of the RBA decision tomorrow, the major forecasts in the market are: (ASX: CBA): None and done (CBA – no hike on Tuesday, 3.60% peak cash rate) (ASX: NAB): One and done (NAB – one hike on Tuesday then done 3.85% peak cash rate), (ASX: WBC): None, one and done ((ASX: WBC), UBS – pause on Tuesday, hike in May then done - 3.85% peak cash rate) (ASX: ANZ): One, one and done (ANZ – hike on Tuesday, again in May then done – 4.10% peak cash rate)

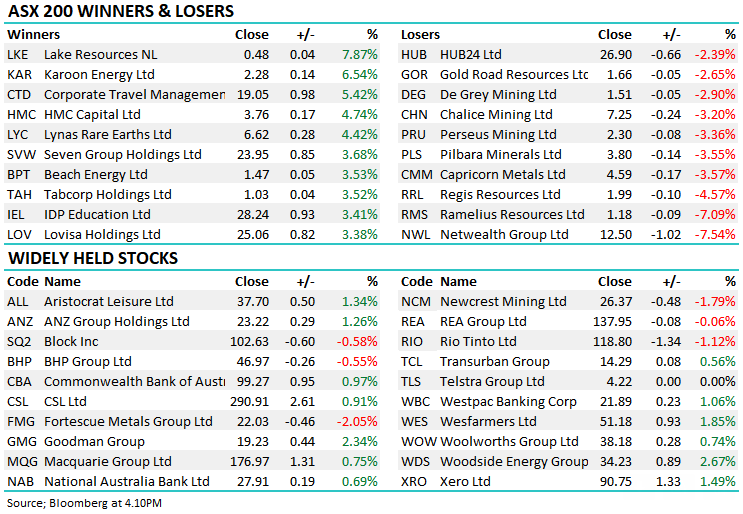

- Netwealth (ASX: NWL) -7.54% hit hard today on softer-than-expected fund flows as market volatility caused a delay in the timing of transitions and new business from existing clients. They placed a big caveat over full-year guidance.

- Sonic Healthcare (ASX: SHL) +0.75% acquired 15 15 pathology labs in Europe with its acquisition of Diagnosticum Laboratory Group. The deal will be fully cash-funded and immediately EPS accretive from the settlement.

- Lake Resources (ASX: LKE) +7.87% had independent verifiers confirm its lithium product had a purity of over 99.8% after treatment making it battery grade product.

- Aussie Broadband (ASX: ABB) -0.64% struggled after its MD sold ~$800k worth of stock and flagged another ~$700k is likely to be sold. It represents just 3% of Phillip Britt’s holding with the proceeds said to be going towards tax obligations – a fair reason but you never like to see insiders taking money off the table.

- Iron Ore was ~2% higher in Asia today weighing on the bulk miners. Fortescue (ASX: FMG) -2.05% was the most impacted.

- Gold continued to track lower, falling -0.75% to ~US$1954 in Asian trade.

- Asian stocks were mixed today, Japan’s Nikkei up +0.52% but the Hang Seng in Hong Kong Hong -0.26%

- US Futures are mostly lower with the Dow flat, S&P futures -0.26% and Nasdaq -0.60% at our close.

ASX 200 Chart

Netwealth (ASX: NWL) $12.50

NWL -7.54%: Q3 update for the investment platform today was weak, with Funds Under Administration (FUA) up +$1.65bn for the quarter to $65.8b with growth hurt by current economic uncertainty and market volatility. They forecast FUA net inflows for the full year of $9 billion to $11 billion which shows growth is slowing (-21% q/q). This correlates with the feedback we’ve had talking to counterparts in the industry – much of the low-hanging fruit may have been harvested, and it gets tougher from here. They put a further caveat on FY23 guidance, saying it is subject to macro and geopolitical factors and timings of transitions. We sold out of HUB during the March quarter, and while we’ll likely re-enter at some point, a lot of blue sky is priced into these stocks.

Broker Moves

- Seven Group Reinstated Buy at Goldman; PT A$27.90

- Boral Reinstated Neutral at Goldman; PT A$4

- Core Lithium Raised to Neutral at JPMorgan

- Iluka Rated New Overweight at Barrenjoey; PT A$12

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

11 stocks mentioned