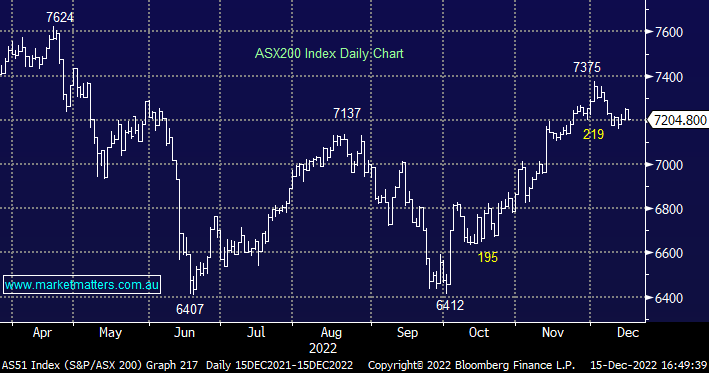

The Match Out: Stocks follow US markets lower post the Fed hike and hawkish rhetoric

A tough day for local stocks with the ASX200 closing down -0.64% on broad-based selling which saw over 70% of the market close down on the day. Overnight the Fed prepared investors for interest rates above 5% next year but equities are still unsure whether to embrace the comments as the worst is approaching fast or that this is higher than we expected and a recession is looming hence equities could fall further i.e. as we said this morning the next 48-hours are likely to dictate if we enjoy another seasonal Christmas rally.

- The S&P/ASX 200 lost -46 points / -0.64% to close at 7204.

- Consumer Staples (+0.73%) and Consumer Discretionary (-1.25%) / Materials (-1.35%) were the standouts in a risk-off session.

- The Australian index experienced a very quiet session compared to its US counterparts following the Feds rate hike and hawkish comments from Jerome Powell as investors seemed comfortable waiting on future leads.

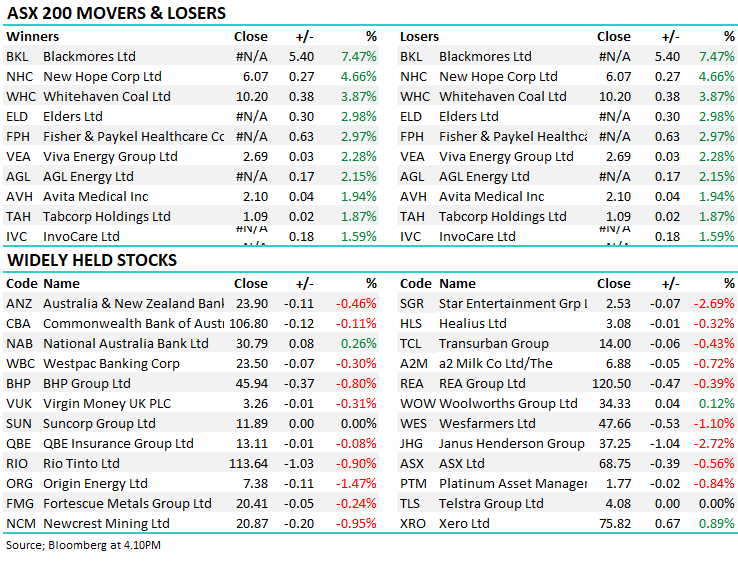

- Coal stocks led the winners with Whitehaven (ASX: WHC) +3.9% and New Hope (ASX: NHC) +4.7% catching the eye although a lack of selling across the banks limited the losses for the index, the absolute winner on the day was the rarely discussed Blackmores (ASX: BKL) +7.5%.

- WHC was raised to a buy at Cit with a price target of $11.110 which appeared to help sentiment.

- On the other side of the ledger it was another bruising session for the ESG names with Pilbara (ASX: PLS) –11.4%, Core Lithium (ASX: CXO) -9.4% and Liontown Resources (ASX: LTR) -7.9% the worst performers in the ASX200 with Cit to become the latest broker to downgrade its 12-months outlook for lithium, only a few days after Goldmans very negative note.

- To rub salt into the wound the latest Lithium (spodumene) auction, number #13 since this process kicked off in 2020, delivers a lower price, down ~3.4%.

- In a very different manner, to the rest of 2022 gold stocks were firm while lithium stocks plunged with Regis Resources (ASX: RRL) +1% the market’s best.

- As for the big miners they had a quiet day at the office with most drifting less than -1%, BHP Group (ASX: BHP) -0.8%, RIO Tinto (ASX: RIO) -0.9% and Fortescue (ASX: FMG) -0.2%.

- Data out today showed the Australian jobless Rate holding at a 48-year low, the $A slipped under 68.3c aided by weakness in the greenback overnight.

- Gold was down $16 in Asia, trading just above $US1800/oz.

- Asian stocks also fell, the Hang Seng was down -1.3% and Japan’s Nikkei -0.4%, while China also slipped -0.4%.

- US Futures are up around +0.1%

ASX 200 Chart

.png)

Broker Moves

- Australian Unity Raised to Buy at Moelis & Company; PT A$1.76

- Region RE Cut to Hold at Moelis & Company; PT A$2.90

- Pro Medicus Rated New Sell at CLSA; PT A$54.25

- Integral Diagnostics Reinstated Reduce at CLSA; PT A$3.15

- SiteMinder Ltd Rated New Outperform at RBC; PT A$4

- Whitehaven Raised to Buy at Citi; PT A$11.10

- Iluka Cut to Sell at Citi; PT A$9.50

- New Hope Raised to Buy at Citi; PT A$6.70

- JB Hi-Fi Cut to Neutral at Credit Suisse; PT A$45.73

- Breville Cut to Underperform at Credit Suisse; PT A$18.61

- PAR AU Rated New Corporate at Edison Investment Research

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

Welcome to Livewire, Australia’s most trusted source of investment insights and analysis.

To continue reading this wire and get unlimited access to Livewire, join for free now and become a more informed and confident investor.

Join Free to unlock all exclusive content

To continue reading and gain unlimited access to all Livewire content, join free to become a more informed, confident investor.

1 topic

10 stocks mentioned