The RBA says interest rate cuts are off the table for 2024. These investors disagree

The Reserve Bank of Australia Board has been famously non-committal this year. For the entire 2024 cycle, they have been "not ruling anything in or out" and expressing a lot of "uncertainty" in their own forecasts. But that non-commitment took quite a sharp turn in this week's Statement on Monetary Policy as well as the Bank's post-meeting press conference.

"Based on what I know today and what the board knows today, what we can say is that a near-term reduction in the cash rate doesn’t align with the board’s current thinking," RBA Governor Michele Bullock said at the RBA's post-meeting press conference. She later clarified that near-term meant around six months, truly ruling the RBA out of the global rate-cutting cycle this year and leaving us well behind where our peers are.

But Yarra Capital Management's Darren Langer and Jessica Ren disagree, arguing they could cut as soon as the end of this year. I joined them for the 50th episode of Yarra Capital Management's RBA podcast The Rate Debate this week, and this wire summarises the highlights of that chat.

The key takeaways from the RBA's August interest rate decision

This week's decision was, with all due respect, a nothing-burger as soon as we knew the outcome of the Q2 inflation print. And while the RBA may have felt relieved (or vindicated, depending on your point of view) by the cooler-than-expected print, Langer argued the Board continued to sound as bland as possible.

"It was the most bland, non-committal statement I've seen since the last one. It's very much business as usual," Langer said.

Ren said the Board's statement and the accompanying Statement on Monetary Policy (the document which provides the RBA's own forecasts) was littered with uncertainty.

"It was quite interesting that the RBA seemed to have a pretty good view on what growth looks like. Honestly, I'm starting to have a little doubt on how accurate their forecasts are. But as to the RBA, they seem to be uncertain of their own forecasts as well," she said.

In fact, the word "uncertainty" appeared six times in the RBA's statement. A statement which, by the way, was only 725 words long.

Cutting, cutting, gone!

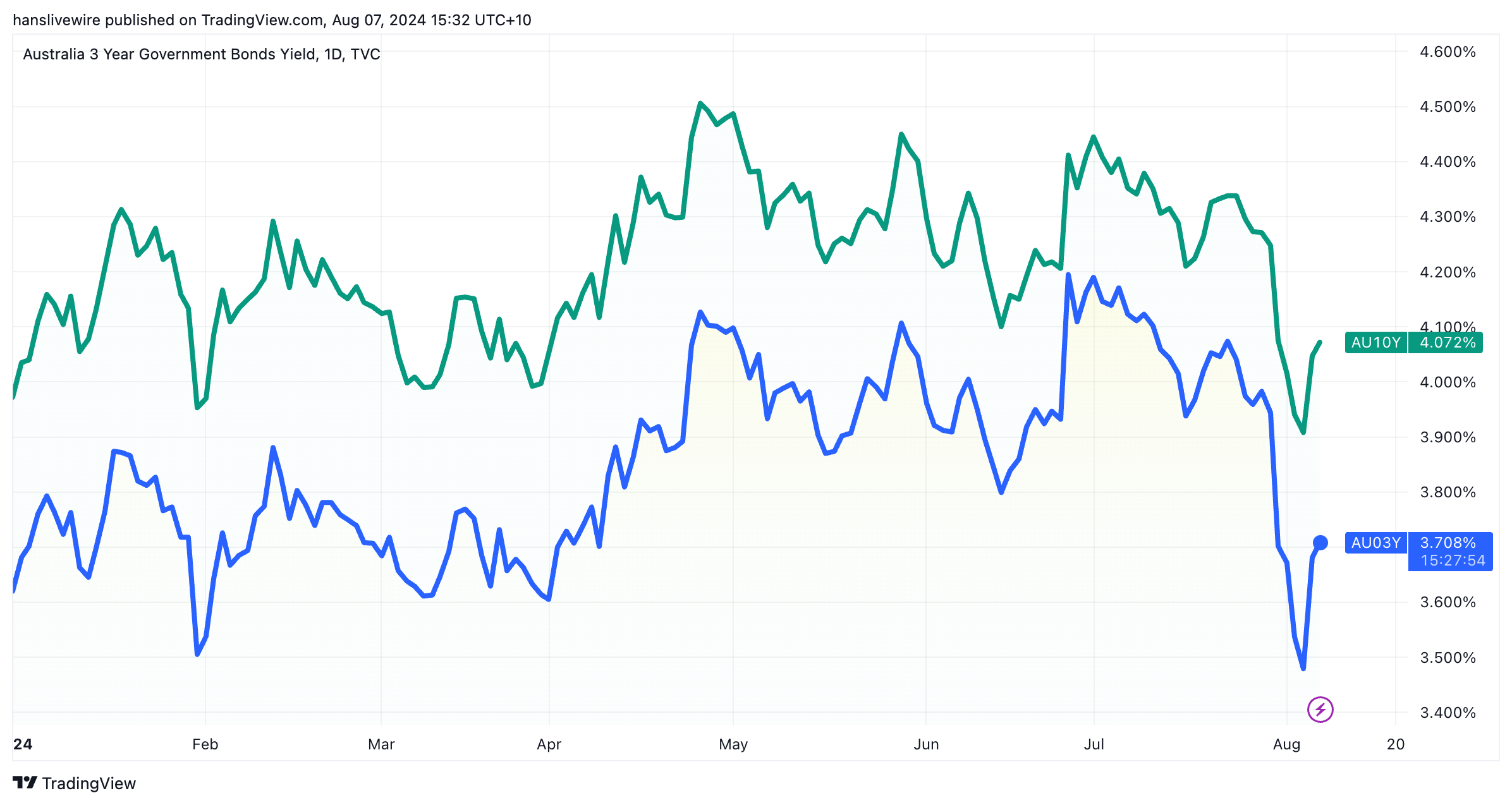

As my colleague Carl Capolingua has written already, rates markets well and truly killed the idea of a rate hike following last Wednesday's Q2 inflation print. In fact, they've returned to pricing in three rate hikes in the next 12 months despite Governor Bullock essentially telling them off (twice)!

First, in the statement:

"Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range."

Then, in the press conference:

"What I’m trying to tell the markets today is that I think probably expectations for interest rate cuts are a little bit ahead of themselves."

But is it the right thing for markets to go from one rate hike to three rate cuts so quickly and suddenly?

"I think you have to separate what is going on in Australia from what is going on offshore," Langer argued. "I think if you truly believe the next move is down, then it's reasonable for markets to start leaning that way. How far you want to lean depends on when you think that's going to happen. We still think this year is possible, only because we think the inflation and growth story will move a little bit faster than what the RBA is forecasting," he added.

Langer and Ren believe that the RBA's rate cutting cycle will start later this year and we could see anywhere between three and five 25 basis point cuts this easing cycle.

The question of "when" is now overdone

Ren spoke to the need for zooming out from eyeing exactly when the first rate cut is coming, and argued that investors need to be thinking big picture.

"The timing is still quite important - but another thing I think that investors are missing is the magnitude of the rate cuts. Depending on when they start and how much they cut by, that's important for the economy as well," Ren said but added:

"If the RBA does try to ignore what is happening around the world, the risk is they could be cutting a bit too late."

Langer said there is a much broader problem here at play.

"Ever since the GFC, there has been this one-sided risk policy that we've got where investors think that central banks are there to bail them out from risk," Langer said. "You don't want to take interest rates too low. Our feeling is that you don't want to take interest rates much below 3% if you can avoid it."

Where Australia is positioned globally - and what that means for fixed income investors

Langer has long said that Australia is at the back of a major global macro regime change. But in this episode, he argued that is not a bad thing.

"We're a small country. We probably shouldn't be leading the world in monetary policy. Perhaps, New Zealand has found that it's a much harder place to be the leader in that world. But the Fed is also not the be-all and end-all," he noted.

Ren added:

"The RBA started hiking later, they've hiked less than other central banks. They're not in too much of a hurry right now and they think they have some time to wait."

But what does this all mean in terms of tangible trades?

"We've got a really good economy, we're probably not going to end up in a recession, rates are at a reasonable level so you're getting good income. That's what fixed income is really all about. The capital gains are nice at times but in the end, you buy fixed income for income," Langer said.

As for where you want to invest, look no further than your own backyard.

"If you're suddenly worried about what might happen because the US has borrowed too much or Japan has borrowed too much, Australia looks like a really healthy place to be. We just think parking your money at home is not bad, from a fixed income context," Langer added.

Better still, if you're not already in, there's still time.

"I think it's not too late for anyone who has thought about holding fixed income or has missed their opportunity to get into the market," Ren said.

"There's quite a bit of uncertainty in the outlook. If the RBA is wrong and that we do go into a deeper recession, and if the government does cut migration, we could see the economy in a bigger recession than we thought. It's not our base case but it could happen. If you want to lock in the opportunity, it's still not a bad time to do so."

"For those who already own fixed income, we've already locked in quite a bit of profit so far. But if you are still of the belief that equities are overvalued and you still want to pick up that yield, then it's worthwhile holding on a little longer."

3 topics

3 contributors mentioned