The stage is set for rate cuts

Despite economic uncertainty, markets rallied in the first half of 2024, driven by expected Fed rate cuts and surging AI stocks. The second half of the year is likely to be largely characterized by potential Fed rate cuts, bond market stabilization, cash holdings shifting to risk assets, and election-driven volatility. Maintaining a long-term, disciplined approach will be key to navigating the next six months.

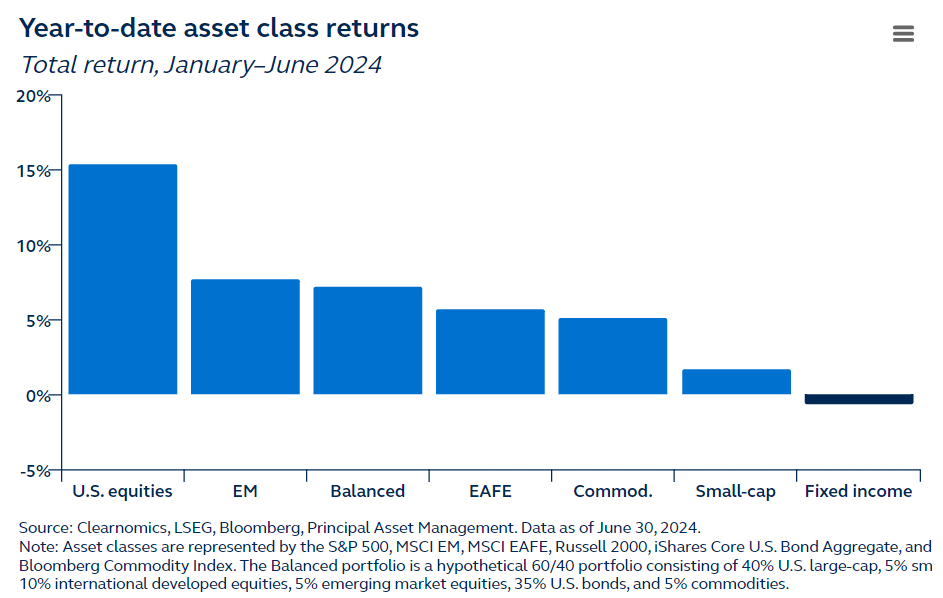

Despite ongoing economic uncertainty, the market rallied in the first half of the year, fueled by anticipated Fed rate cuts and a continued surge in artificial intelligence stocks. The S&P 500 rose by 15.3%, while the Nasdaq gained 18.6% over the six-month period. The 10-year Treasury yield dropped from its April peak of 4.7% to 4.4%, leaving the bond market relatively flat. International stocks also performed well, with developed markets increasing by 5.7% and emerging markets by 7.7%. Looking ahead, here are four key factors for investors to watch in 2H 2024.

- The Fed is closing in on rate cuts, as the U.S. economy moderates. We expect cuts in September and December, but that will require additional evidence of a slowdown.

- Steadier rates support bonds, and have boosted prices, keeping the bond market nearly flat year-to-date, a significant improvement from last year.

- Many investors remain in cash, attracted by elevated yields, and representing a potential tailwind to risk assets.

- The U.S. presidential election is heating up, leading to increased volatility. History shows markets can thrive under both parties, emphasizing the importance of a long-term perspective.

While these events introduce new risks, the first half of the year highlights how overreacting to headlines can lead to poor investment decisions. Staying invested, diversified, and disciplined to navigate uncertainties and seize opportunities throughout 2024 and beyond.