Trending On Livewire: Weekend Edition - Saturday 26th October

This week, high-profile founders took centre stage.

Corporate governance issues at Wisetech and Mineral Resources dominated headlines, with shares in both companies taking a hit. Meanwhile, Tesla’s founder, Elon Musk, made a splash. After upbeat forecasts, Tesla shares saw their biggest rally in over a decade, adding a whopping $150 billion in market cap.

While these stories grab attention, there’s another one emerging that investors should heed. Veteran voices are sounding alarms on ASX valuations - especially growth stocks. Lazard’s Dr. Philipp Hofflin pointed out that the forward P/E ratio for the ASX’s priciest stocks is now at 47x. For context, that’s higher than the 2000 dot-com bubble peak and close to the 56.3x peak from the COVID-fueled rally in 2021.

After those peaks, what mattered most wasn’t what you owned but what you didn’t. So when you’re done watching the founder show it might be worth spending a moment to see if your portfolio has developed a few of its own bad habits.

James Marlay, Editor & Co-Founder, Livewire Markets

The straightforward approach to picking ASX growth stocks (and 7 examples for good measure)

For those who love Aussie equities, you’re in for a treat. This week's Rules of Investing episode features First Sentier Investors’ Deputy Head of Australian Equities Growth, David Wilson. Picking high-quality growth companies is Wilson’s bread-and-butter, and he’s not afraid to explain how he goes about it, acknowledge his missteps, and share a handful of stocks he likes right now. Listen to the podcast to learn what keeps Wilson motivated after 40 years in markets, how he is seeing the current market conditions, and learn a little more about his process for picking stocks – for good measure, he also shares which financial metric is a waste of time!

Are Australian equity valuations getting too stretched?

The Australian equity market continues to set fresh records, riding the coattails of a global equity surge. In the last 12 months, PE multiples have jumped from 14.4x to 18.3x, well above the 10-year average of 16x and the 20-year average of 14.7x. This expansion comes despite flat earnings growth in 2024, as investors look ahead. Yet, with 2025 earnings forecasted to grow only modestly, is the market becoming overvalued?

Top 3 Wires this Week

Our Experts

Some of the best wires from our Contributors this week:

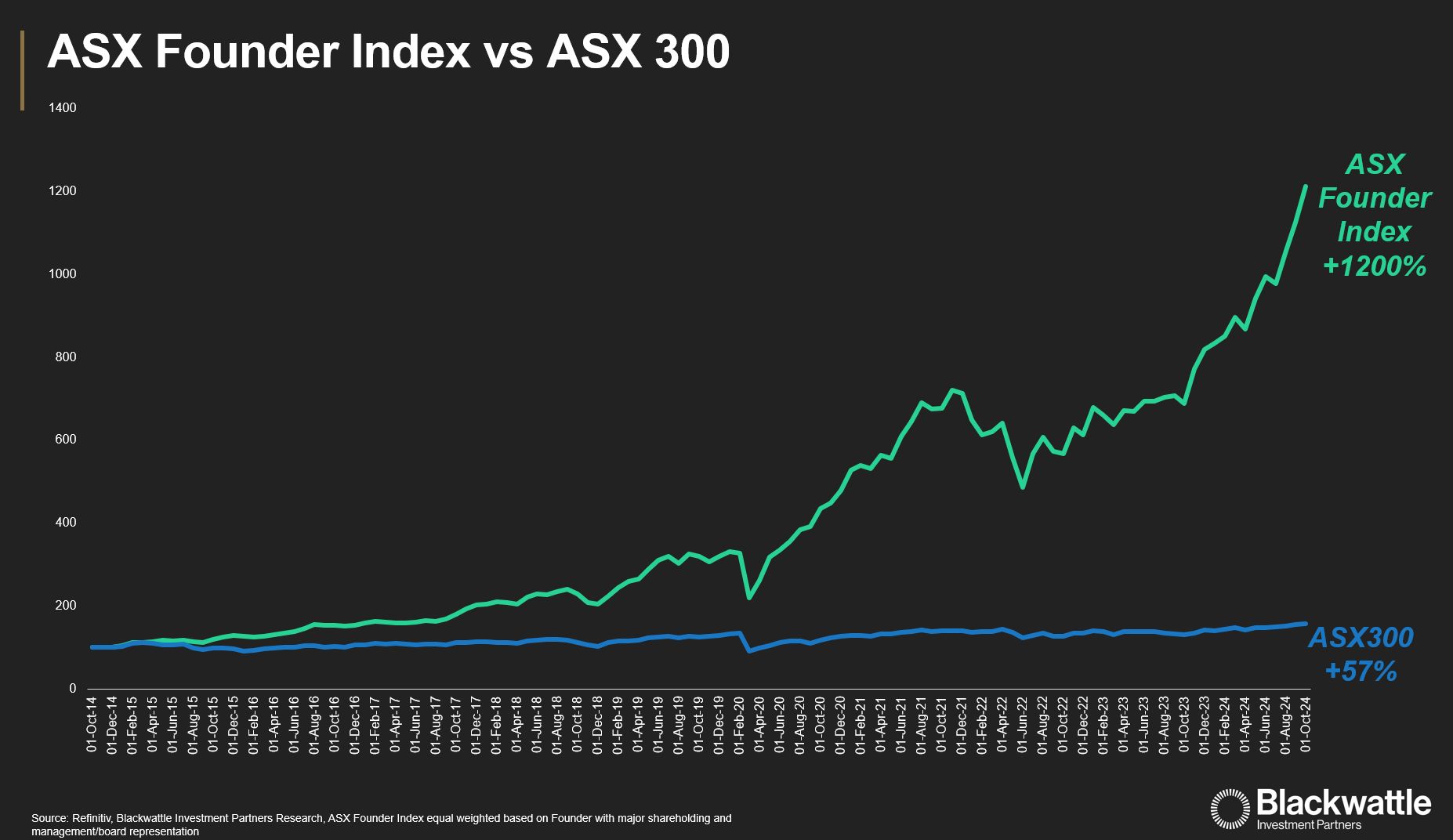

Chart of the Week: ASX Founder Index vs ASX 300

“While founder-led companies have historically performed well, poor governance is a significant red flag for future underperformance based on our experience.

Governance lapses - leading to poor workplace cultures, high staff turnover, excessive risk-taking, and poor capital allocation - can severely undermine a company’s long-term viability and durable competitive advantage,” David wrote.

David argues that founder CEOs must surround themselves with ‘aligned, capable management teams’ to advance their vision.

James Marlay, Editor & Co-Founder, Livewire Markets

Weekly Poll

How do you feel about investing in founder led stocks?

a) The returns are compelling and I’m aware of the risks

b) Avoid. The risks are too big

c) I wasn’t aware of the risks

d) I’m not convinced founder led stocks deliver better returns

LAST WEEKS POLL RESULTS

We asked "Can Australian equities keep marching higher?"

The poll results show that 42% believe the Australian equities rally will stop short of 9000, 28% think the market is overextended, 22% feel all gains are already priced in, and 8% foresee continuous growth.

How do you rate this Weekend's Trending On Livewire?

After selecting, you'll have the option to provide more detailed feedback in our quick survey.

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

5 topics

1 contributor mentioned