Two Chinese stocks to ride the tech recovery wave

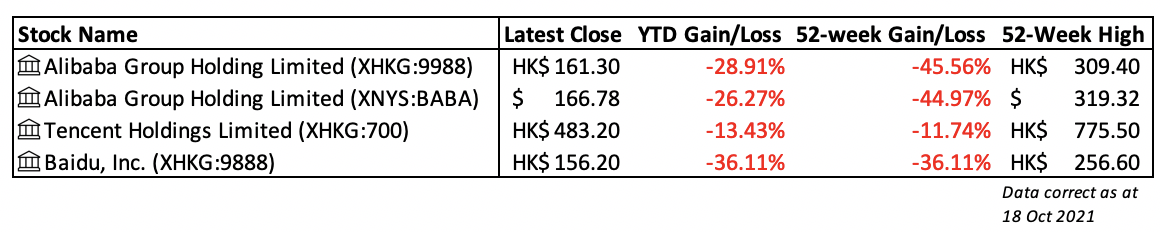

We have so far looked into the reasons driving a recent sell-off in Chinese tech, as well as what the future holds for the sector. Many stocks remain at heavy discounts on the year and significantly off their 52-week highs, induced by widespread panic in an uber-sentiment driven domestic market.

"China’s stock market has often been likened to a casino, dominated by unsophisticated retail investors gambling their wealth rather than looking for long-term sound investments....While the proportion of U.S. equities managed by institutional investors stood at 62% in 2019, 99.6% of total investors in China’s stock markets were retail investors." - Investopedia

As stockmarkets mature, they tend to become more efficient given the focus of sophisticated and professional investors on realising fundamental value. Does this imply that this recent drop presents an opening to secure quality assets at irrationally discounted prices? And which stocks present the most compelling opportunities?

In the final part of this collection, I reached out to the experts to unpack the Chinese tech names they are keeping a close eye on as well as their final lessons for prospective investors.

Guest contributors:

- Sunny Bangia - Antipodes Partners

- Andrew Macken - Montaka Global Investments

A conglomerate that remains under-appreciated

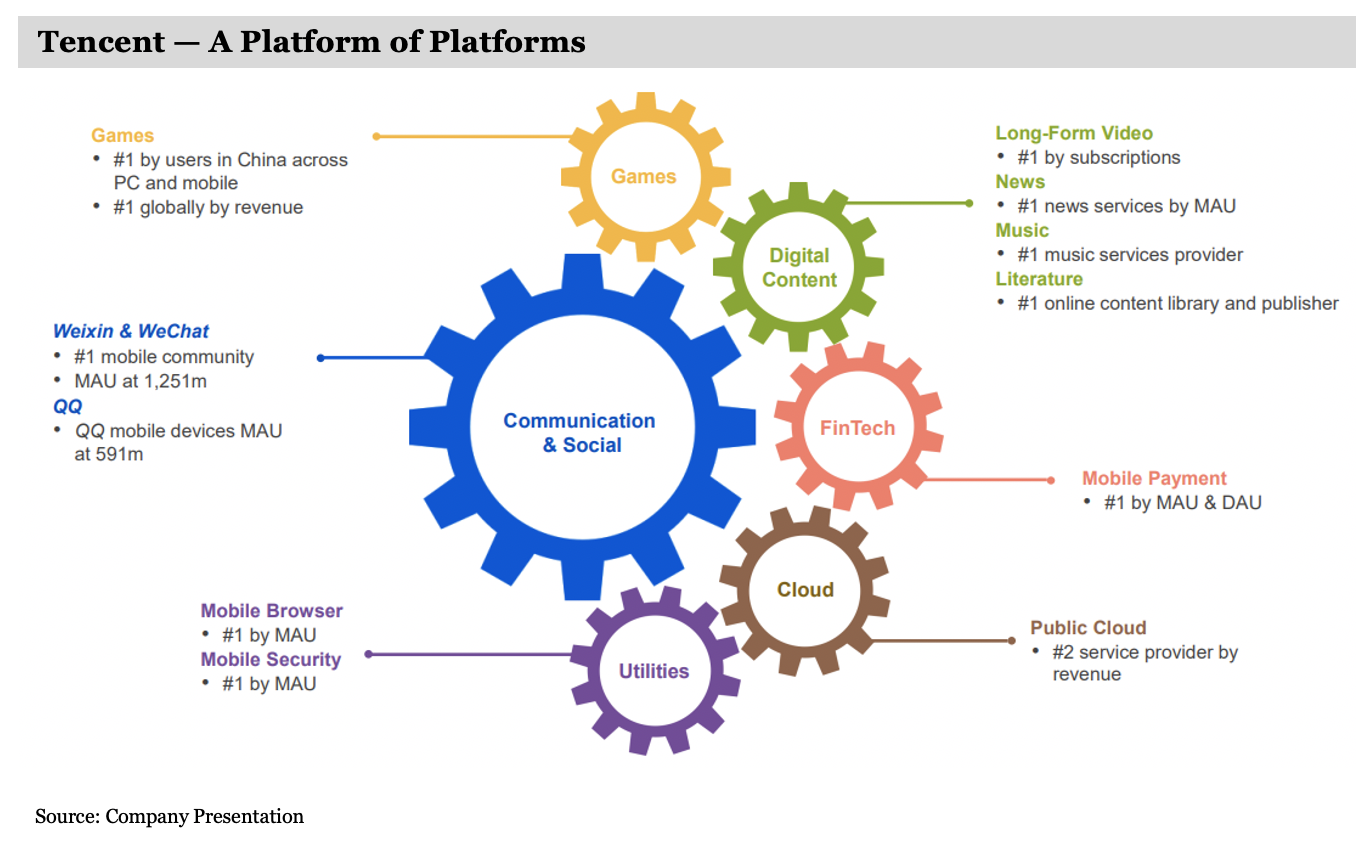

Andrew Macken - Montaka Global InvestmentsWe believe Tencent (XHKG:700) is particularly attractive at today’s stock price levels. As owner of China’s most important 1.2 billion member mobile community, Tencent represents a privileged platform upon which social communication (both personal and professional) takes place, as well as gaming, news, music, video, e-commerce and payments.

As owner of China’s second-largest cloud computing business, Tencent is also rapidly building out leading enterprise applications and platform-tools developers. These include: WeCom (resembling a mix between Salesforce and Shopify); Tencent Meetings (like Zoom) – which is already the most popular standalone cloud conferencing app in China; and Tencent Docs (like Google Docs and/or Microsoft Office). These are not monetised today and, instead, represent valuable future growth options for Tencent shareholders.

Tencent’s valuation today is striking. Many investors may not appreciate that the value of Tencent’s investee company portfolio now represents nearly 40% of the company’s entire value. Included in this portfolio are equity stakes in Meituan, JD.com, Sea, Pinduoduo, Kuaishou, Bilibili, Epic Games, Spotify, Warner Music Group, Snapchat, Afterpay, and hundreds of other tech businesses.

If one were to exclude these investee companies and examine only the ‘rump’ of Tencent, it can be acquired today at approximately 16x EBIT. This is extraordinarily cheap for such an advantaged business that dominates the digital markets of the world’s second-largest economy, in our view.

Tencent is a top holding in Montaka’s portfolio today.

Key lessons for investors

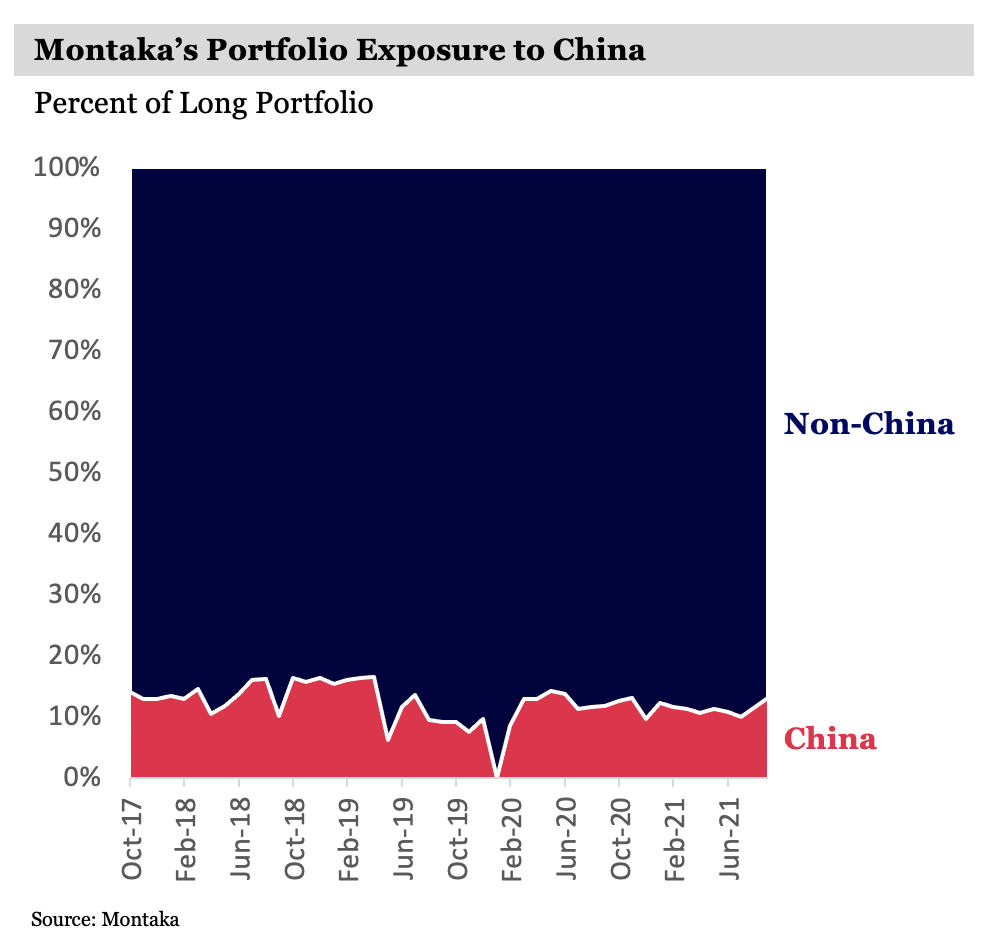

Ultimately, investors need to do what feels right for them. Upon weighing up the risks and opportunities, we believe it makes sense for Montaka to participate in the likely recovery of Chinese tech – but in a limited way.

For us, this means keeping Montaka’s portfolio’s exposure to China below 20%. At this level, it’s meaningful enough to contribute to Montaka’s long-term compounding, while also small enough to manage the unique risks foreign investors face when investing in China.

Montaka’s approach of ‘dipping our toe’ into the Chinese waters can be observed in the chart below, which shows Montaka’s long portfolio exposure to companies domiciled in China as a percentage of the total portfolio.

Additionally, we decided to steer clear of businesses perceived to be contributing to societal disharmony, including many of those which have been cracked down upon recently. Last year, for example, China cracked down on online gambling. This year, of course, it’s been the for-profit education sector, which was perceived to be exploiting young Chinese parents.

Ultimately, our limited and measured exposure to China also meant focusing on the China’s ‘blue chip’ technology businesses, such as Tencent and Alibaba. These are wildly popular, ubiquitous digital platforms that provide enormous convenience for the Chinese population, as well as enormous business opportunities for businesses, large and small.

While not immune to regulatory risk, as 2021 has demonstrated, their positive contribution to Chinese society is clearly strong, particularly in the areas of poverty reduction, improved social connectivity, and professional productivity.

The increasing data advantages of these businesses and privileged software economics in the context of the world’s leading digital economy makes these businesses compelling investment opportunities.

In framing potential Chinese investment candidates, investors must weigh up the risks of investing in China generally and the specific company risks associated with one’s contribution to China’s social objectives, on the one hand; against the size and degree of under-pricing of the opportunity, on the other. Of late, the degree of underpricing in valuations has been significant, in our view.

JD (XHKG:9618) is a leading e-commerce platform with a dominant share in electronics and appliances. It's predominantly a 1P business model – buying goods in bulk from suppliers and storing these goods in its own warehouses before selling to customers.

It’s a traditional retailer with an Amazon-like digital model, versus Alibaba whose platform is designed for buyers and sellers to meet. In this regard, JD is better positioned to weather tighter regulation.

The company already has a strong market share in higher-tier cities. Increasingly the next leg of growth will come from lower-tier cities as wealth increases – today, 70% of JD’s new orders are coming from these cities. We see earnings growing at 20% p.a, and JD has the infrastructure in place to support this growth and customer service.

JD’s core retail business is valued at just 7x free cash flow after CAPEX – very attractive given the company’s dominant market position and growth profile. It’s materially cheaper than offline Chinese retailers which also grow at a much slower rate.

Key lessons for investors

My biggest piece of advice would be to look for robust tech businesses that are actually improving the lives of consumers, not exploiting them. Whether this be providing a fairer way for rural agricultural producers to reach customers, increasing e-commerce penetration, or improving communication and payments, there are a number of very attractive businesses that fit the bill.

Active management is also very important when it comes to China, simply buying the index is fraught with danger during a very fluid social, economic and geopolitical period.

However, the biggest mistake in my view is ignoring China’s incredible domestic consumption growth. Despite the periods of volatility over the past decade, investors have made a lot of money from exposure to China, the next decade will be no different. Blips of volatility surrounding regulation such as this provide opportunity.

Bonus stock ideas

My colleague Mia Kwok also published a series of articles into the compelling case for overweight exposure to China. Her fundie guests recommended:

- Baidu

- Nari Technology

- Contemporary Amerpex Technology

You can find the complete contentions here:

Conclusion

Our fundies are all confident that the opportunities presented by China outweigh the pockets of volatility we are seeing. It is important to manage your risk in a stock market often likened to a casino, but if you focus on the companies with proven ability to execute, you can find names that are set to dominate as China's development continues to explode.

Check out the other parts of the series

Make sure you "FOLLOW" my profile to be notified of my future content.

If you enjoyed this wire, please click like and comment below the stocks you are looking to capitalise on.

3 topics

1 contributor mentioned