Weekly S&P500 ChartStorm - 27 March 2022

The Weekly S&P500 ChartStorm is a selection of 10 charts which I hand pick from around the web and post on Twitter. The purpose of this post is to add extra color and commentary around the charts.

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective...

1. Correction Drivers: status check as the rebound plays through...

-EPOL (geopolitics): rebound has stalled, relief rally constrained by uncertainty.

-LQD (credit/duration): bond yields surging, but credit spreads contained for now.

-ARKK (tech burst): bounce also seems to be stalling.

(p.s. also note: “roundnumberitis” at 4550?)

Source: @Callum_Thomas

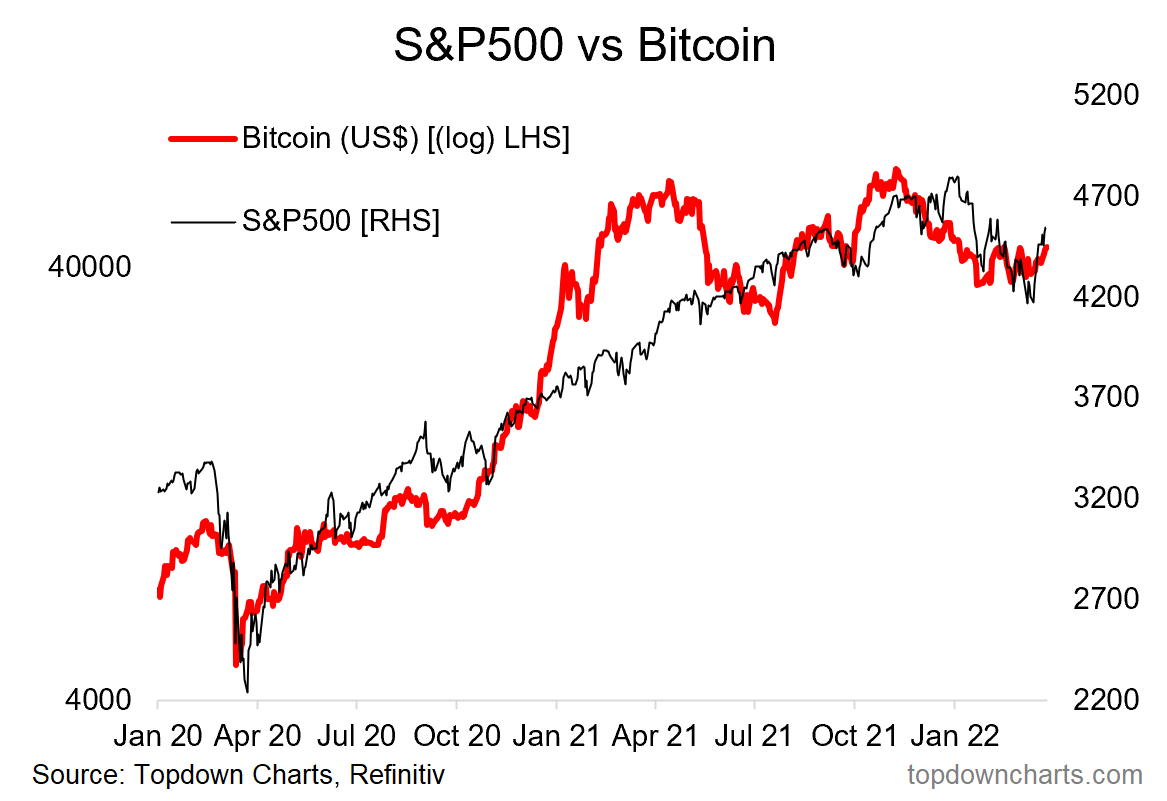

2. Bitcoin base = S&P500 based: If we think of Bitcoin as basically a barometer for the ebb and flow of risk appetite and liquidity, the apparent base in bitcoin (still needs to break out to the upside though) looks to be a positive sign for broader risk assets such as the S&P 500.

Source: @topdowncharts

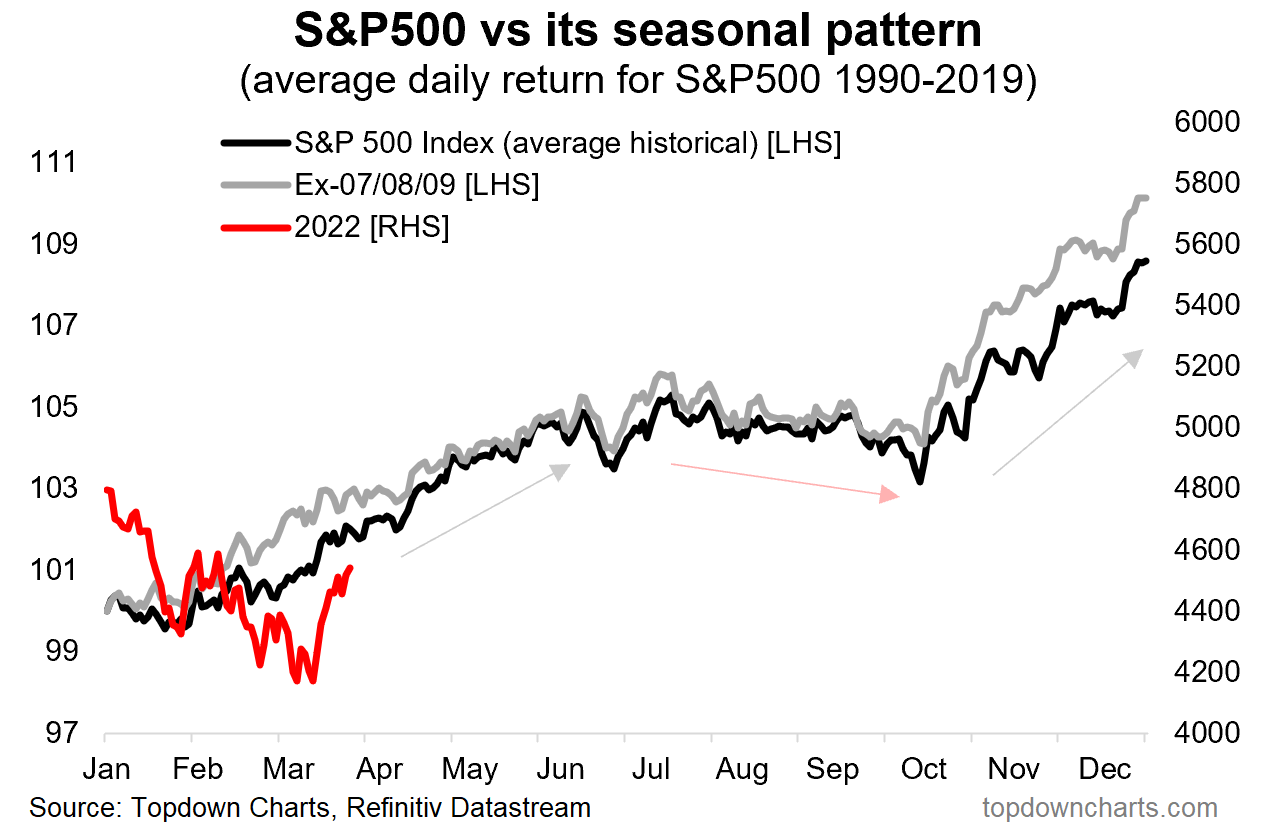

3. Seasonality: Yes it is different this time, it is always different, but worth noting that April is historically the best month (highest average monthly gain, and 74% of all Aprils in history were positive).

Source: @topdowncharts

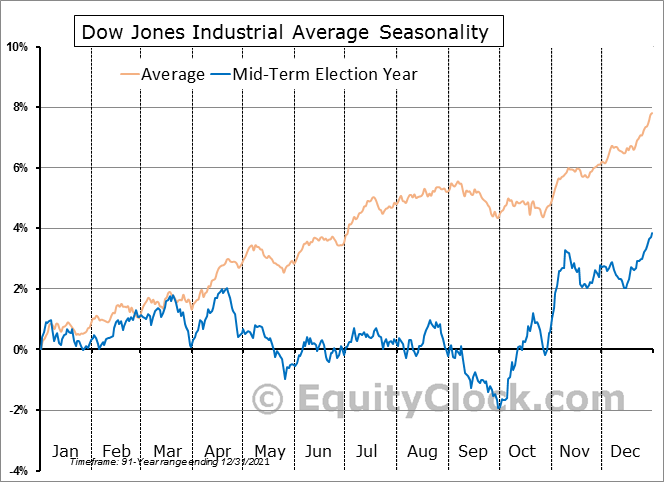

4. Seasonality “Yeah But”… But then again, mid-term election-year seasonality would suggest that any such April rally would be about it, short lived, followed by down-at-best through October.

Source: @EquityClock via @MikeZaccardi

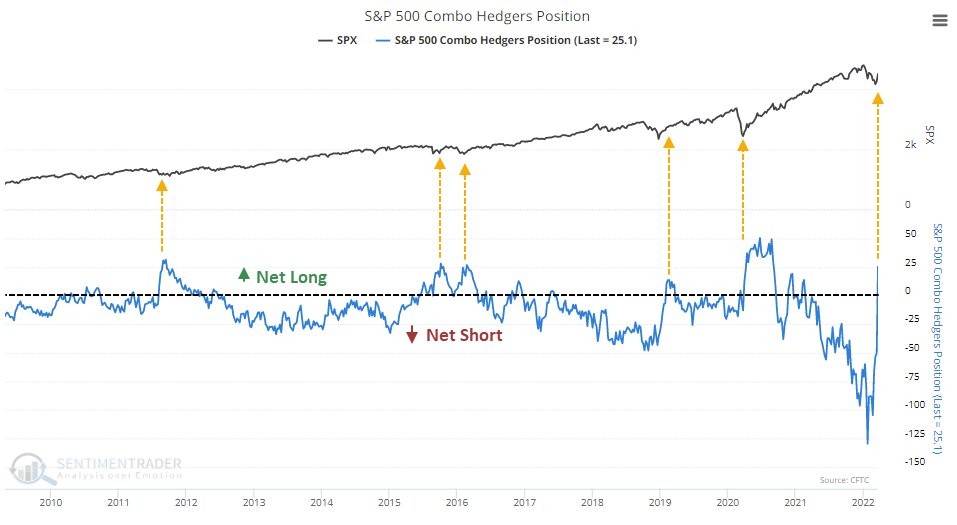

5. Hedgers... hedging FOMO risk: Massive pivot from record shorts to now sizable longs. Long live the dip buyers? ¯\_ (ツ)_/¯

Source: @sentimentrader

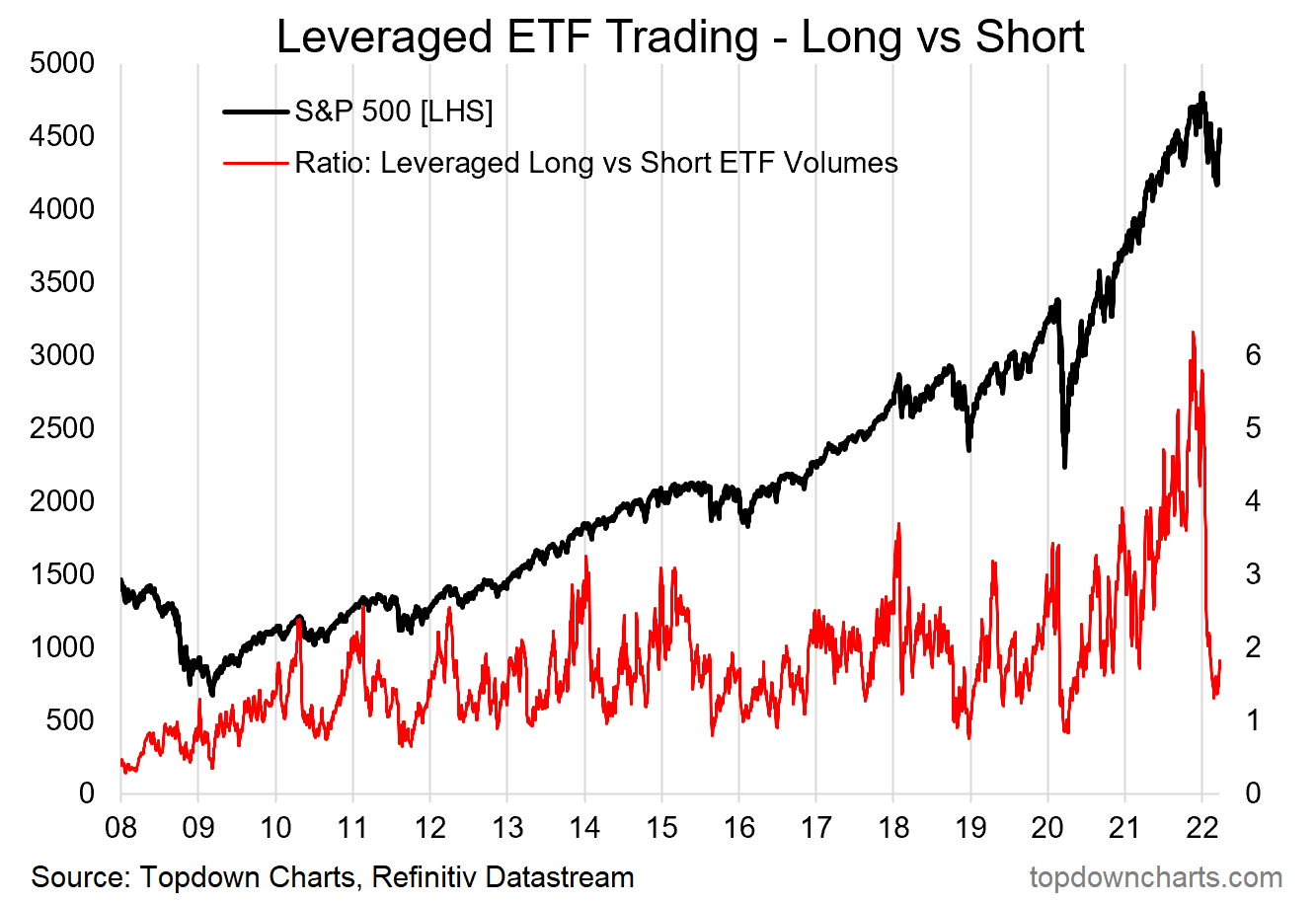

6. ETF Speculators: Similarly, trading in leveraged long vs short US equity ETFs has ticked up towards the long side after a hefty rinsing-out of previous speculative fervor.

(albeit n.b. this indicator’s track record in signaling bottoms has been early/false-dawny before... e.g. most notably recently in late-2018)

Source: @topdowncharts

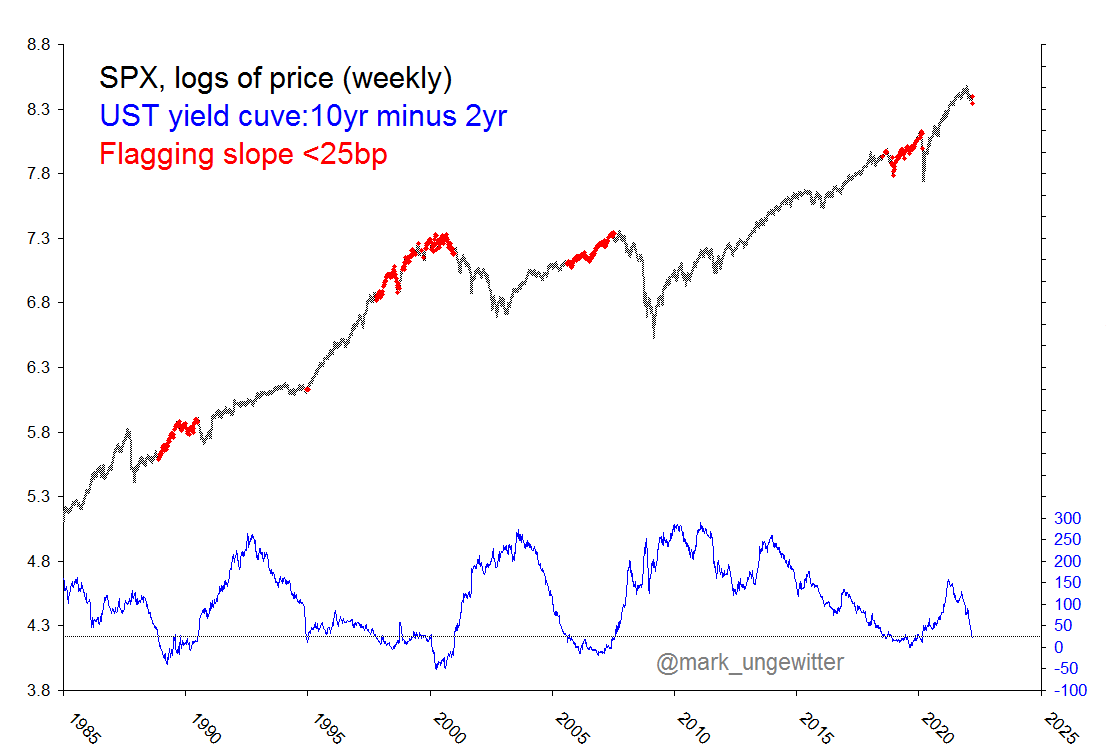

7. Yield Curve: A lot of talk on yield curves recently, as this chart seems to show, yield curve flattening/inversion (at least as measured by this version of the yield curve) is not so much an immediate issue... but basically presents a tell in terms of lateness-of-cycle. In other words, most of the time this was the kind of thing you saw later in the cycle, before a turn (but typically well in advance of the turn).

Source: @mark_ungewitter

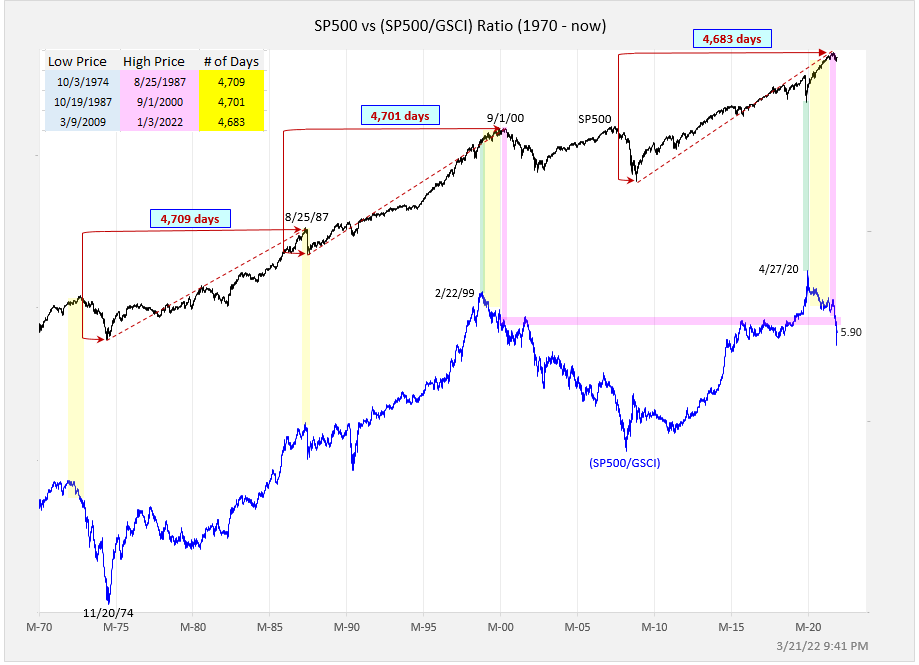

8. Stocks vs Commodities: Inflation is an equity killer.

Peaks in the S&P500 vs Commodities index ratio have served well in flagging major market tops for stocks. (inflation (where commodities are a key proxy/driver) places pressure on margins, consumers, and drives central bankers to tighten policy)

Source: @exposurerisk

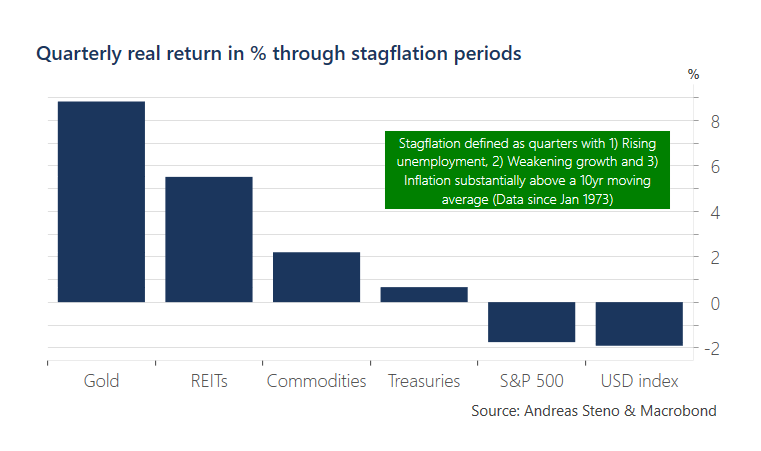

9. Living with Stagflation: So you've decided to move on with your life and just "live with stagflation". Here's what history says about where to allocate...

(n.b. past performance does not necessarily = future, etc)

Source: @AndreasSteno

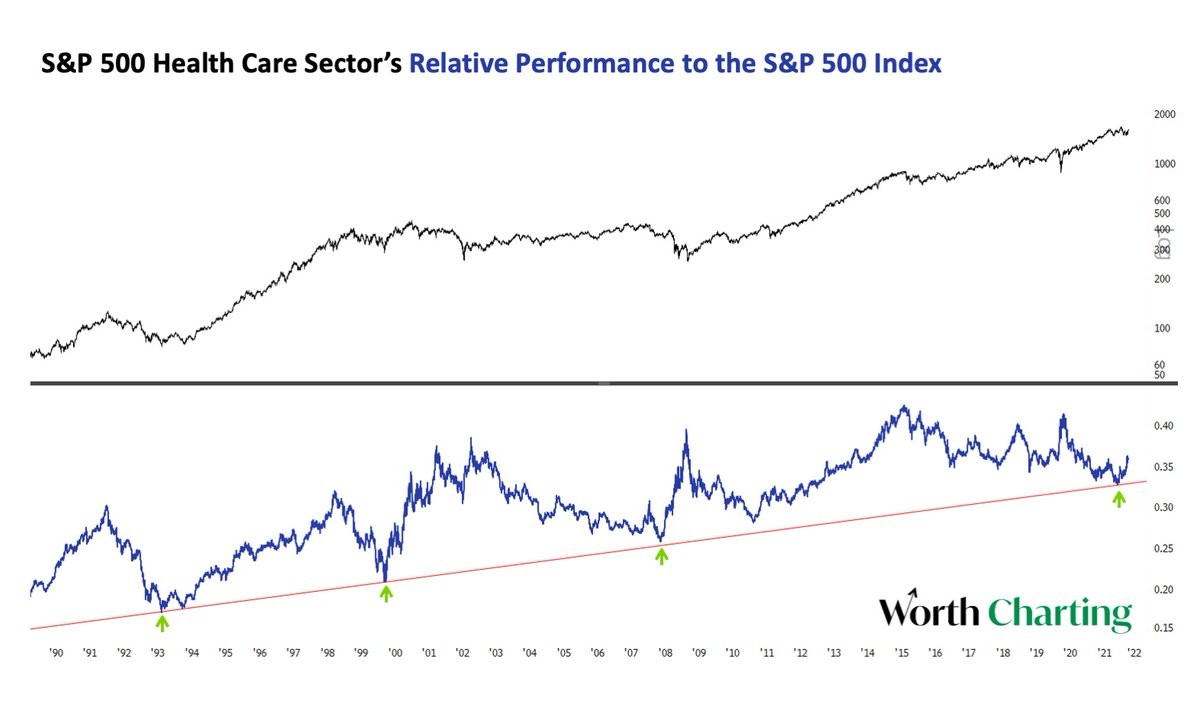

10. Healthy Healthcare: Healthcare relative performance price ratio is bouncing off its very-long-term trendline: fairly reliable signal for a run in healthcare.

n.b. healthier healthcare relative performance is often actually an unhealthy signal for the health of the broader market (being typically a defensive sector).

Source: @CarterBWorth

Thanks for reading! Any feedback, questions and views are welcome in the comment section below.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

4 topics