What is the "Great Rotation" and what could it mean for you?

You may have heard the term “The Great Rotation” being bandied about recently, particularly if you follow US markets and invest in US stocks.

This wire aims to unpack exactly what it is, why it has become relevant now, and what it could mean for Australian investors.

What is it?

While great rotations can occur across asset classes, i.e., from stocks to bonds, in this case, the “Great Rotation” refers to a rotation out of big US growth stocks (think The Magnificent Seven) and into small, cheap, and international stocks.

As most everyone would know, US large caps have been catching most of the bids over the past 12 months, with the all-time highs for the major US indices being powered by extremely narrow leadership.

That trade has become crowded, and it could be argued that share prices have departed from valuations in some instances. At some point, there was always going to be profit-taking or a softening of the AI hype that has powered those names.

It seems that last week, the market may have been given its trigger.

What happened last week?

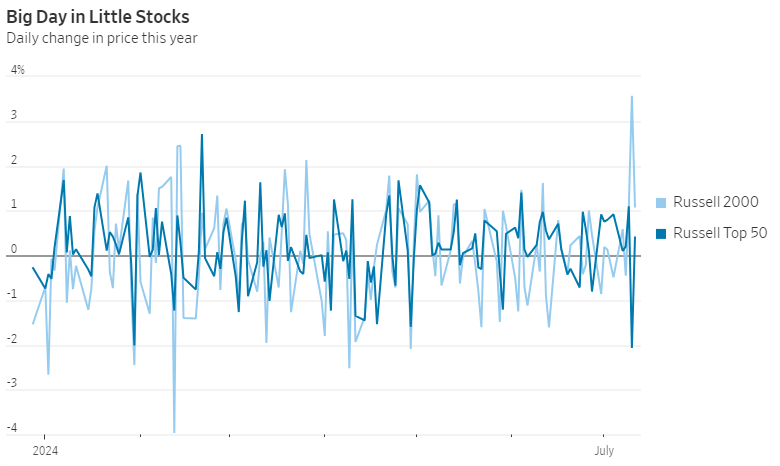

The market action in the US late last week saw a near-record swing from big to small stocks – that is, investors sold large caps to buy small caps. More specifically, stocks and segments of the market most sensitive to interest rates – i.e. consumer stocks - surged.

It has been reported that not only was the Russell 2000's outperformance versus the S&P 500 quite high, but it was also extremely rare (once in 45 years before Thursday) for the Russell 2000 to be up 3% or more while the S&P closed down—the last time that occurred was in October 2008.

The trigger was a surprisingly low June inflation number, which increased the probability that the US Federal Reserve will embark upon rate cuts, with the first one potentially in September.

Those rate cuts, in turn, would likely benefit some of the stock market's beaten-down corners, including small-cap companies that are often funded by debt.

Questions remain

While we saw some significant rotation last week, there are many questions that remain.

Was that simply a one-shot deal, with the market reacting to the inflation data, or was it the start of a bigger move? While it’s still too early to tell, we have seen some further evidence since – albeit modest – that the rotation is continuing.

The other big question is whether the rotation will come at the expense of the large-cap names, or will it be a matter of money moving off the sidelines into the small caps?

The upcoming earnings season in the US will play a big part in answering that question. If the mega-cap tech names deliver strong numbers, investors will have no reason to sell them down. If they don’t meet expectations, it could trigger money leaving those names and looking for a home elsewhere.

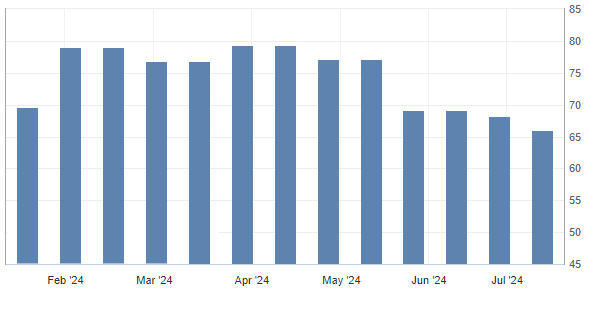

The other moving part in the US is the consumer. While last Thursday’s rotation saw money flow towards consumer stocks, the worry is that the consumer won’t play along.

That’s because recent data points to fading consumer resilience. If the economy falters, stocks and sectors sensitive to the economic cycle will be less likely to enjoy a sustained rotation.

What the fundies say

There has been plenty written on the Livewire platform alone about the potential for small-cap stocks to re-rate. My colleague Glenn Freeman, just last week, extracted the following comments from Spheria Asset Management Portfolio Manager Matthew Booker on small caps:

We think the economy is clearly showing signs of strain which is likely to lead to an easing of monetary policy. We believe investors will look forward at this point and seek more attractively priced investments with the potential for greater economic leverage.

Meanwhile, earlier in the year, I spoke with Munro Partners Qiao Ma, who had the following to say about the gap between large-cap and small-cap stocks:

"At some point, the gap has to narrow. That's just how markets work", says Ma.

Below are some of the other articles that have talked about a potential rotation recently:

.png)

What about Australia?

While the Australian market will, to an extent, likely follow the direction of US markets, there is an important caveat.

The Fed might be about to cut rates in the US, but there’s a strong case to be made that the next interest move in Australia will be higher. Those are two very divergent paths, that will have very different implications for stocks.

So, while we might see a significant rotation in the US, it could very well be far less pronounced in Australia.

The bottom line

The upcoming US reporting season could be a significant driver of any potential rotation. If the big boys hold up, any true rotation would likely be modest, and small cap strength would need to see money either coming off the sidelines or out of funds and into specific stocks.

As for an Australian rotation, it will likely be dependent on the path of interest rates primarily, followed by the results from the August reporting season.

4 topics