What's next for central banks and what will it mean for investors?

It seems that interest rates have been going up forever. The focus on interest rate announcements in Australia has become so intense that it seems everyone has come to know when it's “RBA day”! Fortunately, at least there will be fewer RBA meetings in the year ahead – which will be a relief for those who are now sick of hearing about them.

After years and years of low and falling rates, the drip feed of ever-higher rates has come as a bit of a shock to many. Many people like my mother who get income from bank deposits are happy, but it has been rough for mortgage holders and rough for investors.

The hit to investors was evident in the big falls in share markets in 2022 and surging bond yields. It was again evident into October 2023 on the back of worries about “sticky inflation” and “high for longer” interest rates with a roughly 10% correction in shares and bond yields at new cycle highs.

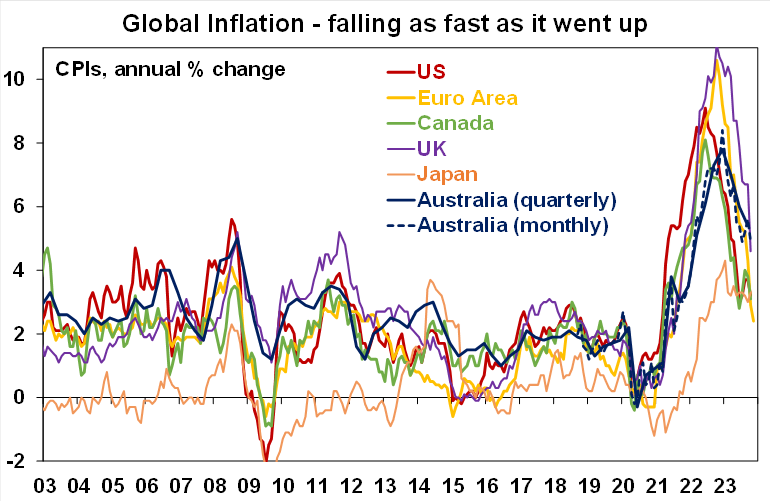

Through much of this period of rising interest rates, there has been much doubt that it will work to control inflation. But the evidence is now overwhelming that it is working. Disinflation has been one of the big themes of 2023. Inflation across major countries has fallen sharply from peaks of 8 to 11% in 2022 to around 2 to 5% now. Inflation almost seems to be going down as quickly as it went up. Of course, this is not to say that prices are all falling – just that they are going up far more slowly.

Inflation is likely to continue to fall as supply chain pressures have reversed, demand is cooling, and labour markets are easing with sharp falls in job vacancies.

This includes Australia. Sure, inflation is higher here but note that Australian inflation lagged the US by six months on the way up (partly because we reopened from the pandemic later than the US), peaked at a lower level six months later, and is just following the same lag on the way down. So there is no need for undue concern.

Our Inflation Indicator points to a further sharp fall. It’s looking like monthly Australian inflation will end in 2023 at three-point-something.

What’s more, while economic growth held up better than expected in 2023 growth now looks to be slowing under the weight of the biggest monetary tightening since the 1980s – with a high risk of recession in 2024. Real consumer spending is now stalling in Australia.

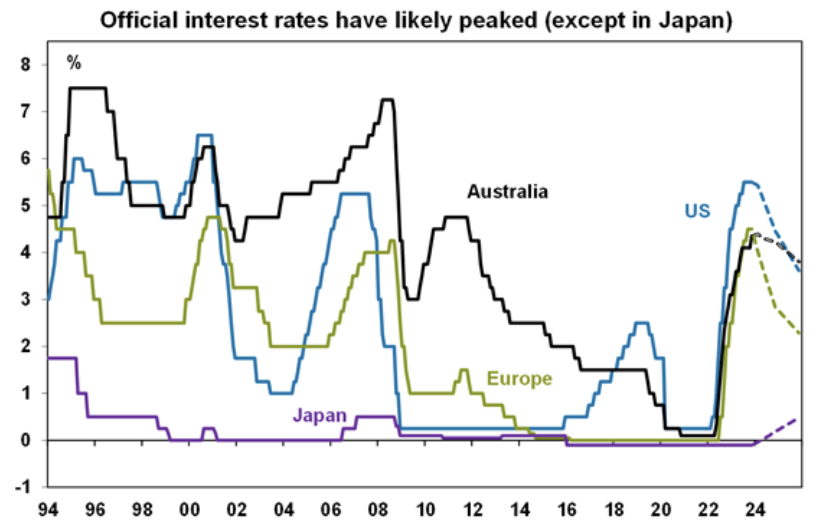

Falling inflation and weakening growth mean that central bank policy rates have likely now peaked with rate cuts coming into sight. This includes Australia, where there is still a high risk of another rate hike in February but it's likely to be headed off by news of lower inflation. Of course, Japan is an exception.

Dashed lines show market expectations. Source: Bloomberg, AMP

We expect the Federal Reserve and the European Central Bank (ECB) to start cutting in March or the June quarter. We also expect the RBA to follow with the start of rate cuts in the September quarter and the cash rate to fall to 3.6% by the end of 2024.

For investors, this means four big things. First, from a fundamental perspective inflation coming under control and interest rates falling will be good news as lower rates are positive for shares via stronger economic growth and profits and as they allow higher valuations.

This is particularly so for cyclical shares. So lower rates will be good news for longer-term investors and should support share markets on a 12-month horizon.

Secondly, short-term investors need to allow that shares often don’t respond positively to rate cuts at first because economic activity and profits may be falling initially, and monetary conditions will still be tight.

It may make sense for short-term investors to hold back a bit particularly if rates are being cut because of weaker conditions and let the dust settle before then seeking to take advantage of the positive impact of lower rates which often comes with a lag of several months.

Thirdly, with US rates looking like they will fall faster than rates in other major countries including Australia, it’s likely that the US Dollar has peaked and that the Australian Dollar has bottomed. This suggests that there is a case to consider hedging some international exposures and looking for investments that will benefit from a lower US Dollar like commodities that are priced in US dollars. Of course, if there is a recession, this may only come with a lag.

Finally, bear in mind that we have probably entered a more inflation-prone world than the one before the pandemic so don’t expect interest rates to fall back to their pandemic lows unless we have a deep and long recession which is unlikely.

The bottom line is that lower inflation and the likelihood of falling interest rates are good news for investors and should underpin a favourable 12-month outlook but there could be some rough patches initially given the elevated risk of recession.

4 topics