Jackson Hole Preview: Will a hawkish Powell trample markets?

Hawkish Fedspeak and a stronger-than-expected US economy has had some success in convincing markets that the ‘higher for longer’ narrative is here to stay and Powell will have the opportunity to finish the job on Friday with his Jackson Hole speech.

Since early April, the US 10-year yield has rallied almost 110 bps to a high of 4.34% on 22 August – A level not seen since November 2007. The resurgence in bond yields sets the MSCI index of global stocks on course for its worst month since last September.

Most analysts expect Powell to give a hawkish speech at Jackson Hole but the tone is expected to shift from ‘how high’ to ‘how long’.

Back in July, Powell said that the “real federal funds rate is now in meaningfully positive territory … I would say, monetary policy is restrictive, more so after today’s decision, meaning that it is putting forward pressure on economic activity and inflation.”

According to a Bloomberg survey, 82% of respondents expect the Fed chair to reinforce the message of a hawkish hold. In simple terms, this is expected to:

- Stocks weaken

- Bond yields tick up

- US dollar strengths

As for last year’s Jackson Hole, the S&P 500 fell 3.4% on 26 August and experienced a peak drawdown of 16.85% by 13 October. The key takeaways from last year’s include:

- Powell insisted that the Fed must “keep at it until the job is done”, and sees greater risks skewed toward stopping rate hikes prematurely

- Powell flagged that “reducing inflation is likely to require a sustained period of below-trend growth” with “some softening of labor market conditions”

- Short-term rates spiked immediately on the hawkish message

The playing field is a lot different this time round as US inflation returns to the 3.0% level from a peak of 9.1% in June 2022. However, a re-acceleration in inflation remains a material risk as beneficial base effects begin to roll off.

What analysts are saying

ANZ Economics: "ECB President Lagarde will address the Jackson Hole Symposium on Friday which she is expected to reiterate the ECB is unwaveringly committed to setting appropriate policy to achieve its inflation mandate."

This could prove to be a tricky one for Lagarde after Germany's manufacturing and services PMI contracted at the fastest pace in more than three years in August. The HCOB Manufacturing PMI by S&P Global fell to 44.7 from July’s 48.5, marking the lowest level Since May 2020.

Yardeni Research: "If Powell wants to calm the bond market down, he should acknowledge that inflation has moderated significantly and say that if it continues to do so, the Fed will probably lower interest rates next year."

Yardeni Research says that the end to the bond market's woes will start with any signal of rate cuts. Contrary to those hopes, rate cuts have been completely priced out of early 2024. As it stands:

- The first cut is expected to take place in June 2024

- Three months ago, futures were pricing in up to four rate cuts in 2023

- The odds of an additional 25 bp hike this year sit at 44%

Mizuho Bank: "Heading into Jackson Hole later this week, Fed Chair Powell's comments on policy could continue to underpin, if not boost, real US Treasury yields."

What the data tells us

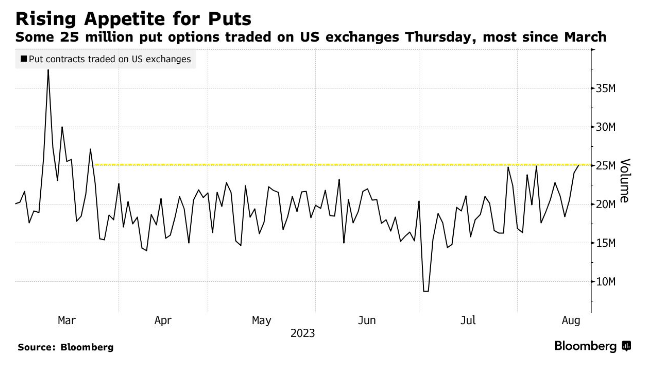

Approximately 25 million put options were traded on US exchanges last Thursday, the highest amount since March. Markets are clearly bracing for something big.

At the same time, CBOE put-to-call ratios have spiked to levels not seen since January, according to Bank of America. Are markets trying to hedge for a major pullback or is this a short squeeze that’ll stock stocks higher?

.png)

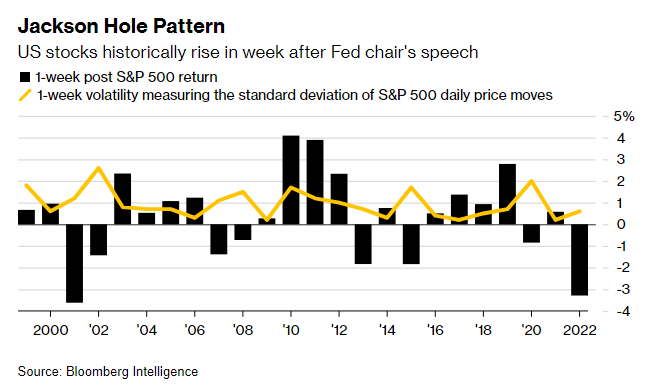

Historically speaking, the S&P 500 has gained an average 0.4% in the week following the Fed Chair’s speech at Jackson Hole, according to Bloomberg.

.png)

That said, all the outliers have occurred during troubled years such as the Dotcom bubble, Global Financial Crisis and onset of the pandemic. Is 2023 also a troubled year?

A version of this piece appeared in The Morning Wrap on Thursday 24 August. Thank you Hans Lee for compiling the analyst views.

3 topics

1 contributor mentioned