Trending On Livewire: Weekend Edition - Saturday 12th October

Staying with the commodity theme, China will hold a briefing over the weekend in which the finance ministry is expected to pump a further three trillion yuan (US$425 billion) into the economy. If the Rio deal doesn’t keep things moving, that should.

Chris Conway, Managing Editor, Livewire Markets

Meet Armina Rosenberg: Mike Cannon-Brookes' former PM harnessing AI to outperform the market

In a world where artificial intelligence dominates headlines, few fund managers have harnessed it as boldly as Armina Rosenberg. For those who don't know her, "Arms" made a name for herself at Grok Ventures, the family office of Mike Cannon-Brookes.

Now, she's paving a new path at AI-backed Minotaur Capital, alongside Perpetual alumnus Thomas Rice. The duo have developed Taurient, a software system that uses large language models for everything from idea generation to portfolio construction.

In this episode, she outlines how you can use AI to level up your own investment strategy, as well as a few stock ideas to get you started.

.png)

Forget the white-knuckle ride, there’s plenty of opportunity beyond banks and miners

Long-term holders of the banks would have enjoyed the rally over the past 12 months, but you’d be hard-pressed to find anyone willing to say with a straight face that the rally has been a hallmark of an efficient market. Investors who have watched CBA rocket from $100 to $145 have been white knuckling it, knowing full well that the party could end abruptly. Hardly the stuff of sound, sleep-at-night investing.

Here, Yarra Capital Management’s Dion Hershan unpacks the opportunity beyond the banks and the other end of the Aussie market barbel, the miners. Turns out there are plenty of great companies beyond the ASX 20. For good measure, Hershan shares three he likes.

Top 3 Wires this Week

Our Experts

Some of the best wires from our Contributors this week:

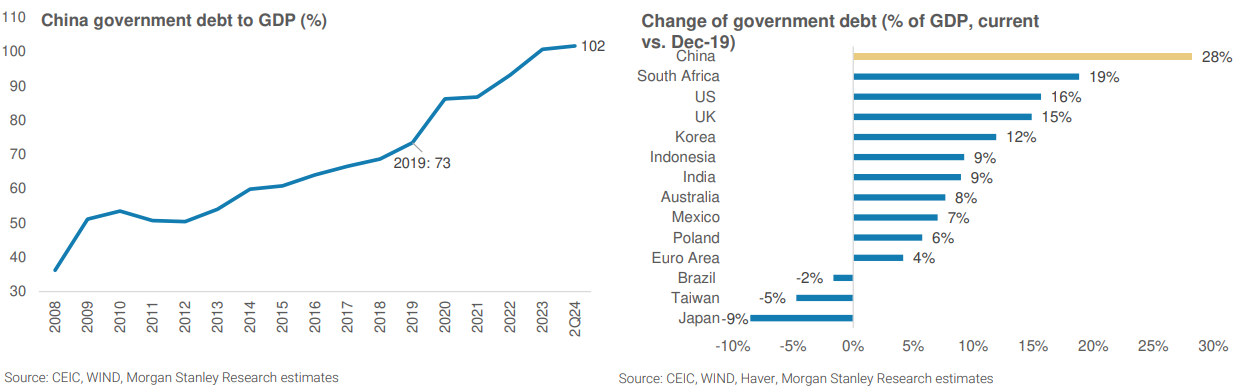

Chart of the Week: Chinese government debt to GDP and its rise from 2019

As noted in the intro, China is expected to deliver more stimulus at the weekend. While that market might cheer, Morgan Stanley’s views on what needs to be done to satisfy the market’s now bulging expectations is substantially greater. In a research note released this week titled “The Viewpoint: China: Why the Hesitancy to Enact Forceful Fiscal Easing?”, the broker suggests Beijing will have to stump up as much as RMB10 trillion (A$2.1 trillion) to support consumption and clear the country’s massive property inventory overhang.

Morgan Stanley warns that whilst this amount is likely the order of magnitude required to solve China’s economic problems, what will actually be delivered may only be a fraction of this. “But policymakers appear hesitant to enact forceful fiscal easing”, the broker notes, and ultimately the scale of the stimulus Beijing delivers will likely be “constrained by high public debt ratios and declining revenues”.

Carl Capolingua, Content Editor, Livewire Markets

Weekly Poll

Earlier this week, Rio Tinto (ASX: RIO) announced that it would buy lithium producer Arcadium, for $9.9 billion in an all-cash deal.

In a conversation with Livewire, Katana Asset Management's Romano Sala Tenna suggested the deal could seal the bottom for lithium stocks.

Does Rio Tinto's $9.9 billion acquisition of Arcadium mark the bottom for lithium stocks?

a) Yes, lithium and lithium stocks will rally from here

b) No, there is more pain to come for lithium prices and stocks

LAST WEEKS POLL RESULTS

We asked "Is the AI movement over-hyped or is it a generational game changer?"

The poll shows that 59.78% believe AI is over-hyped, while 40.22% see it as a generational game changer. The majority are skeptical of AI's current potential, though a significant portion still views it as transformative.

How do you rate this Weekend's Trending On Livewire?

After selecting, you'll have the option to provide more detailed feedback in our quick survey.

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

5 topics

3 contributors mentioned