Trending On Livewire: Weekend Edition - Saturday 19th October

It’s important to pay attention in markets.

While a stronger-than-expected jobs print this week cemented expectations that rates will stay higher for the rest of the year, you wouldn’t know it looking at the Australian share market, with the ASX 200 hitting a fresh all-time high. But there have been other signs that the animal spirits are alive and kicking.

The Dow Jones in the US crossed 43,000 for the first time. The Bank of America Fund Manager Survey showed cash levels for participating fundies dropped to the lowest level since February 2021. Back home, the ASX Small Ordinaries index has quietly delivered 21% over the past year, whilst listed fund managers have been on a tear – Pinnacle, GQG, Regal and Magellan are all up 60% plus in the last 12 months. Even much-maligned AMP is getting in on the act, jumping 17% yesterday on strong net cashflows.

All this adds to the China stimulus fueled rally in materials plays over recent weeks, whilst the other end of the barbel – the banks – have bounced back after some ‘rotation’ selling in late September.

It wasn’t so long ago that the narrative for investors concerned locking in yield and perhaps some security offered by private credit. And while those are still valid investment options that serve their purpose, the narrative appears to have shifted again.

Chris Conway, Managing Editor, Livewire Markets

A will to win: How Ausbil's Paul Xiradis built a $20 billion business

Paul Xiradis, or "X" as much of the street knows him, was pleasantly surprised when he got the call. After more than four and a half decades in investment management, and having built Ausbil from the ground up to the $20 billion funds management house it is today, X has been inducted into the Funds Management Hall of Fame. Given Ausbil's funds are truly some of the industry's top long-term outperformers, the recognition of X's "will to win", as Ausbil's co-head of equities John Grace put it, is well-deserved and arguably overdue. Here, we share Xiradis’ journey to the Hall and how he is seeing markets today.

Who is to blame for Australia's housing crisis? Neither the answer nor the solution is easy

.jpg)

The most important thing to remember about the Australian housing debate is how nuanced the conversation is. Everyone has their vested interests and it's impossible to get a purely objective view on the situation. So rather than attempt to play the blame game, a non-helpful and already overdone exercise, we've asked AMP's Diana Mousina and CoreLogic's Eliza Owen to discuss the factors that explain how we arrived at this point. And, just for some fun, we asked them what they would do if they became federal housing ministers for a day. I think you'll enjoy what they had to say.

Top 3 Wires this Week

.png)

Our Experts

Some of the best wires from our Contributors this week:

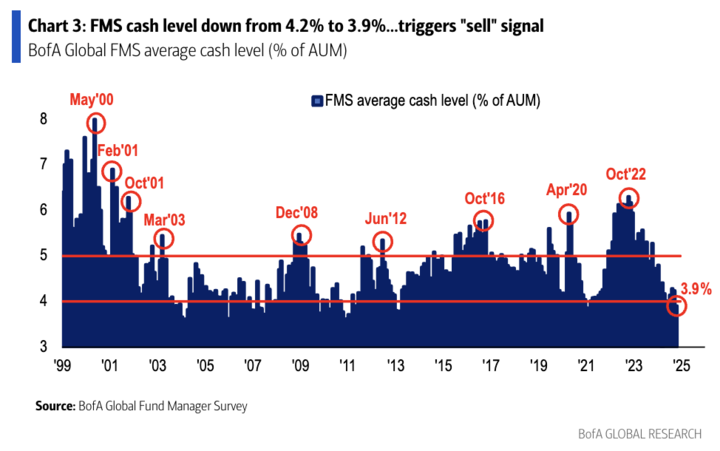

Chart of the Week: Fundies' cash levels drop, triggering a "sell" signal

This week's Bank of America Global Fund Manager Survey results were very revealing. Bullish sentiment is back in a big way, with the one-month change in this indicator surging by the most since June 2020. And when the bulls are in charge, the cash comes out to play. Stocks are being bought at the expense of bonds and cash levels are at their lowest since February 2021.

Equally interesting, a sub-4% cash level in this survey has traditionally been a contrarian sell signal. Will it be the case again this time? Not if the bulls can help it!

Hans Lee, Senior Editor, Livewire Markets

Weekly Poll

The Aussie market hit fresh all-time highs this week amid recent China stimulus and hope for rate cuts. As Livewire’s Carl Capolingua explains here, we’re also approaching a period of seasonal strength for the ASX.

Can Australian equities keep marching higher?

a) Yes, to infinity and beyond!

b) Yes, but the rally will stop short of 9000

c) No, this is as good as it gets, with all drivers priced in

d) The market shouldn’t even be here, earnings need to catch up

LAST WEEKS POLL RESULTS

We asked "Does Rio Tinto's $9.9 billion acquisition of Arcadium mark the bottom for lithium stocks?"

The poll results show that 55% of respondents believe Rio Tinto's $9.9 billion acquisition of Arcadium will mark the bottom for lithium stocks and lead to a rally, while 45% think there is still more decline to come for lithium prices and stocks.

How do you rate this Weekend's Trending On Livewire?

After selecting, you'll have the option to provide more detailed feedback in our quick survey.

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

5 topics

2 contributors mentioned